Please answer.

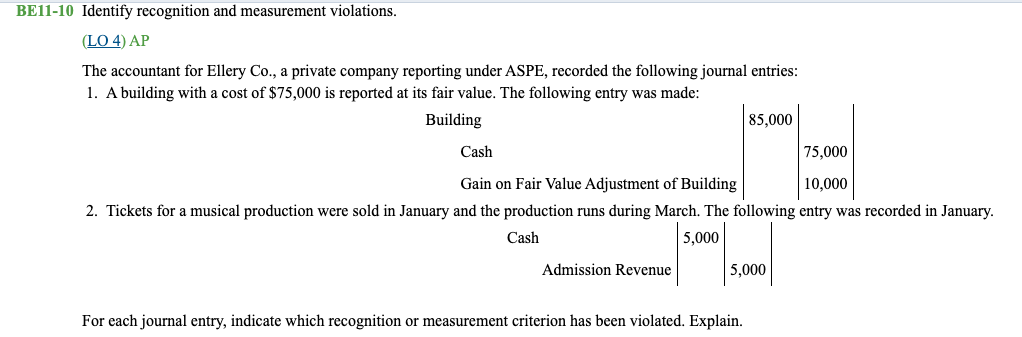

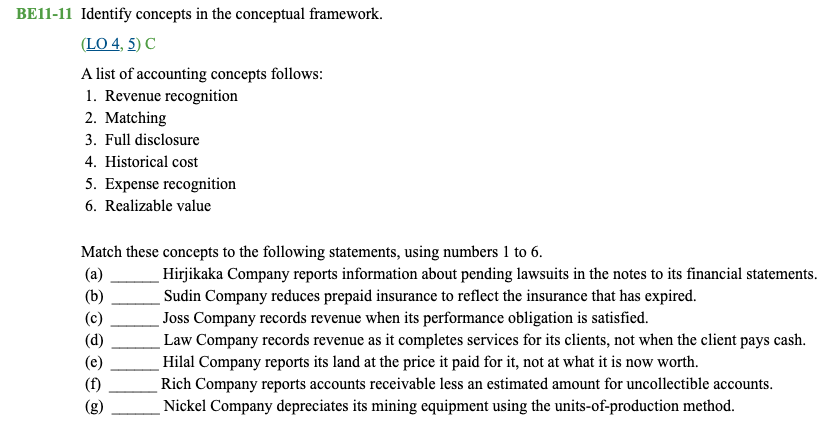

BE11-8 Determine revenue recognition using five-step model-contract-based approach. (LO 4) AP Flin Flon Company enters into a contract on April 3, 2017, with Thompson Industries to supply 5,000 microprocessors at a price of $7 each. The microprocessors cost Flin Flon $3 each. The microprocessors will be delivered to Thompson on June 3, 2017. Flin Flon has a three-month return policy and estimates that 5% of the goods will be returned. Flin Flon is confident that Thompson will pay any amounts owing. The goods are delivered on June 3, 2017, and Thompson pays the amount owing on July 3, 2017. Using the revenue recognition model for the contract-based approach, identify the contract, the performance obligation(s), and the transaction price. On what date will Flin Flon recognize revenue? How much revenue will be recognized on this date? BE11-9 Calculate expense. (LO 4) AP Courtney Company reported total operating expenses of $55,000 on its adjusted trial balance for the year ended November 30, 2017. After the preliminary statements were prepared, the accountant became aware of the following situations: 1. The physical inventory count revealed that merchandise inventory costing $4,000 was damaged and needed to be scrapped. 2. Sales staff were owed $2,500 of sales commissions relating to November sales. The sales commissions were paid in December. Calculate the total operating expenses that should be reported in the November 30, 2017, income statement.BE11-10 Identify recognition and measurement violations. (LO 4) AP The accountant for Ellery Co., a private company reporting under ASPE, recorded the following journal entries: 1. A building with a cost of $75,000 is reported at its fair value. The following entry was made: Building 85,000 Cash 75,000 Gain on Fair Value Adjustment of Building 10,000 2. Tickets for a musical production were sold in January and the production runs during March. The following entry was recorded in January. Cash 5,000 Admission Revenue 5,000 For each journal entry, indicate which recognition or measurement criterion has been violated. Explain.BE11-11 Identify concepts in the conceptual framework. (LO 4, 5) C A list of accounting concepts follows: 1. Revenue recognition 2. Matching 3. Full disclosure 4. Historical cost 5. Expense recognition 6. Realizable value Match these concepts to the following statements, using numbers 1 to 6. (a) Hirjikaka Company reports information about pending lawsuits in the notes to its financial statements. (b) Sudin Company reduces prepaid insurance to reflect the insurance that has expired. Joss Company records revenue when its performance obligation is satisfied. Law Company records revenue as it completes services for its clients, not when the client pays cash. Hilal Company reports its land at the price it paid for it, not at what it is now worth. Rich Company reports accounts receivable less an estimated amount for uncollectible accounts. Nickel Company depreciates its mining equipment using the units-of-production method