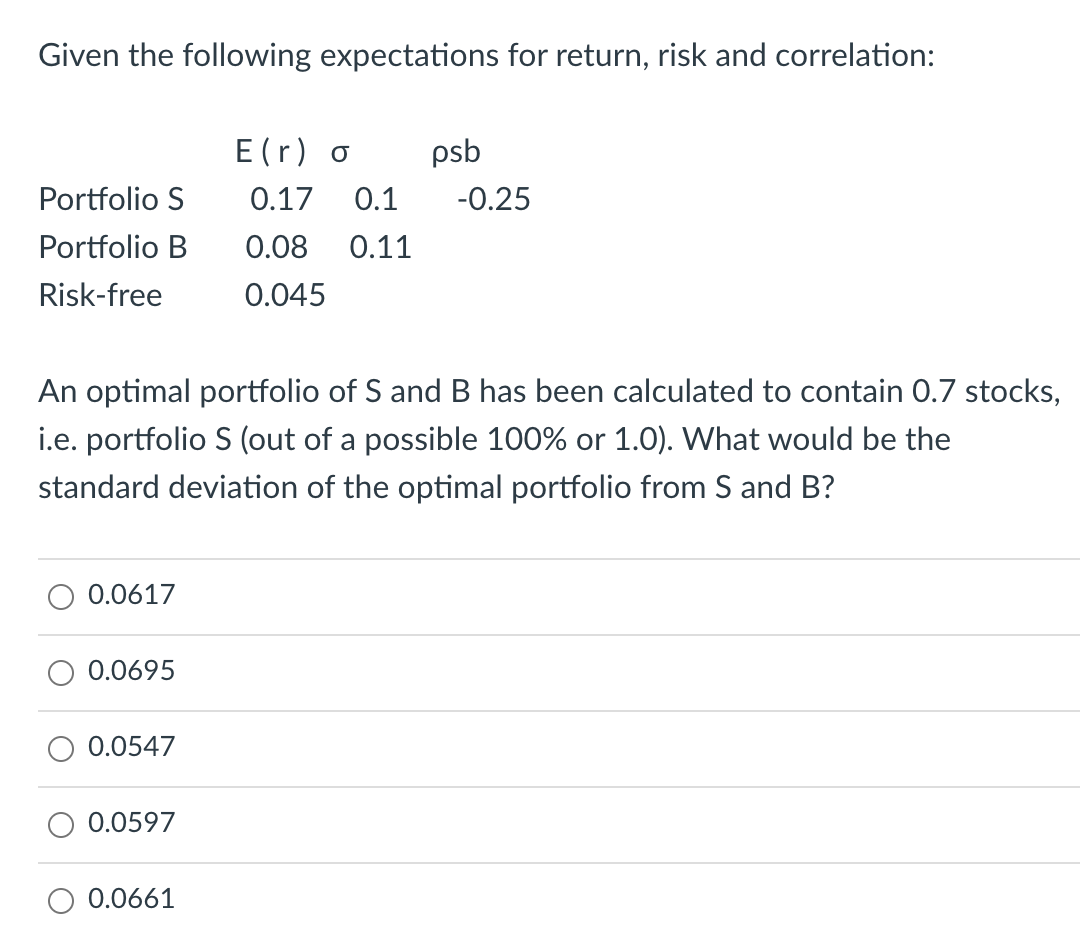

Question: Given the following expectations for return, risk and correlation: psb -0.25 Portfolio S Portfolio B E(r) o 0.17 0.1 0.08 0.11 0.045 Risk-free An optimal

Given the following expectations for return, risk and correlation: psb -0.25 Portfolio S Portfolio B E(r) o 0.17 0.1 0.08 0.11 0.045 Risk-free An optimal portfolio of S and B has been calculated to contain 0.7 stocks, i.e. portfolio S (out of a possible 100% or 1.0). What would be the standard deviation of the optimal portfolio from S and B? 0.0617 0.0695 0.0547 0.0597 O 0.0661

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts