Question: Please answer both multiple choice questions and show your work, thanks! 7. International capital budgeting One of the important components of multinational capital budgeting is

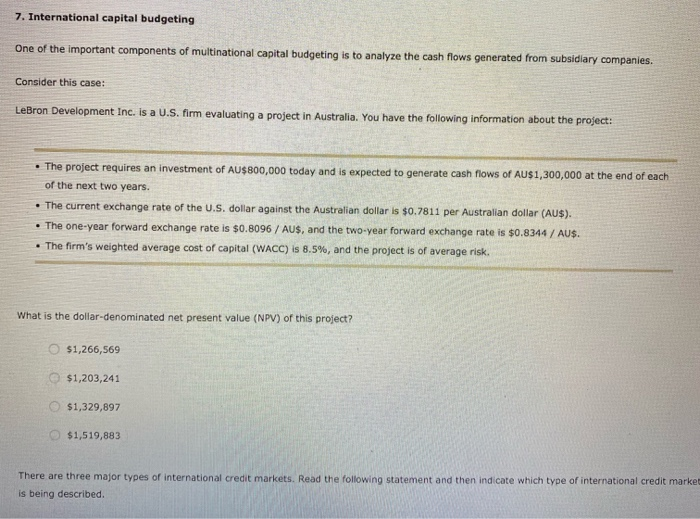

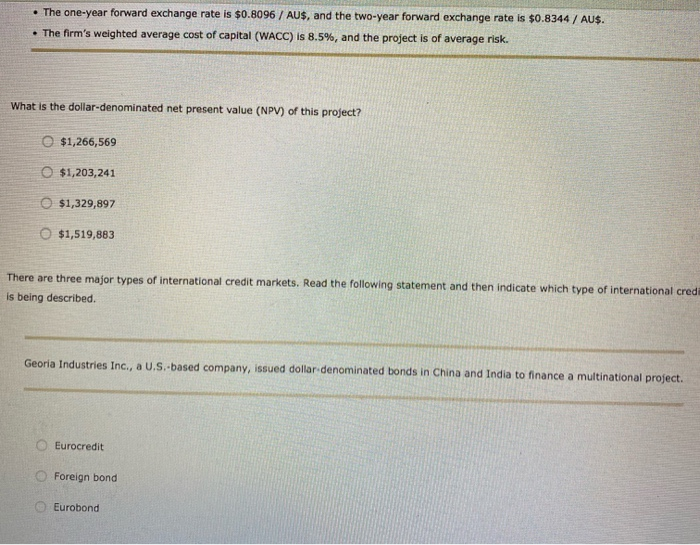

7. International capital budgeting One of the important components of multinational capital budgeting is to analyze the cash flows generated from subsidiary companies. Consider this case: LeBron Development Inc. is a U.S. firm evaluating a project in Australia. You have the following information about the project: The project requires an investment of AU$800,000 today and is expected to generate cash flows of AU$ 1,300,000 at the end of each of the next two years. The current exchange rate of the U.S. dollar against the Australian dollar is $0.7811 per Australian dollar (AUS). The one-year forward exchange rate is $0.8096 / AUS, and the two-year forward exchange rate is $0.8344 / AU$. The firm's weighted average cost of capital (WACC) is 8.5%, and the project is of average risk What is the dollar-denominated net present value (NPV) of this project? $1,266,569 $1,203,241 $1,329,897 $1,519,883 There are three major types of international credit markets. Read the following statement and then indicate which type of international credit marke is being described. The one-year forward exchange rate is $0.8096 / AU$, and the two-year forward exchange rate is $0.8344 / AUS. . The firm's weighted average cost of capital (WACC) is 8.5%, and the project is of average risk. What is the dollar-denominated net present value (NPV) of this project? $1,266,569 $1,203,241 $1,329,897 O $1,519,883 There are three major types of international credit markets. Read the following statement and then indicate which type of international cred is being described. Georia Industries Inc., a U.S.-based company, issued dollar denominated bonds in China and India to finance a multinational project. Eurocredit Foreign bond Eurobond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts