Question: please answer both on 59 When are the fees for managed fee-based accounts tax-deductible ? ad out of Select one: a. When they include investment

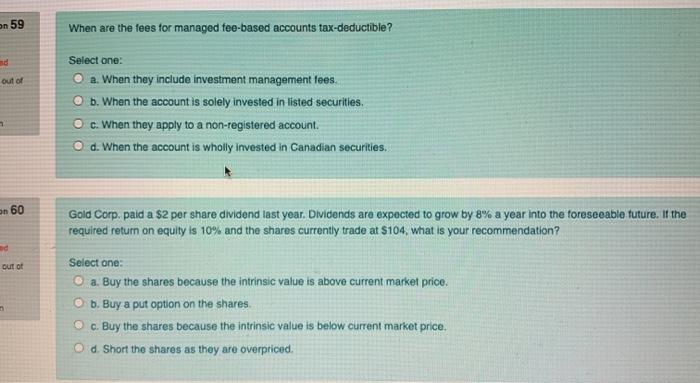

on 59 When are the fees for managed fee-based accounts tax-deductible ? ad out of Select one: a. When they include investment management fees. b. When the account is solely invested in listed securities. O c. When they apply to a non-registered account. Od. When the account is wholly invested in Canadian securities. en 60 Gold Corp. paid a $2 per share dividend last year. Dividends are expected to grow by 8% a year into the foreseeable future. If the required return on equity is 10% and the shares currently trade at $104, what is your recommendation? out of Select one: a. Buy the shares because the intrinsic value is above current market price. b. Buy a put option on the shares c. Buy the shares because the intrinsic value is below current market price. O d. Short the shares as they are overpriced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts