Question: please answer both or i will down vote Question 30 Contributions to a Roth IRA are: Income tax deductible to the employee if the Roth

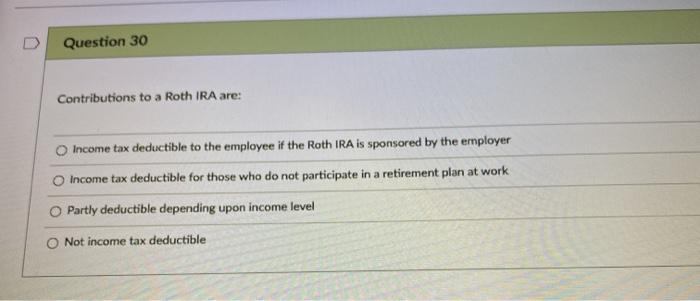

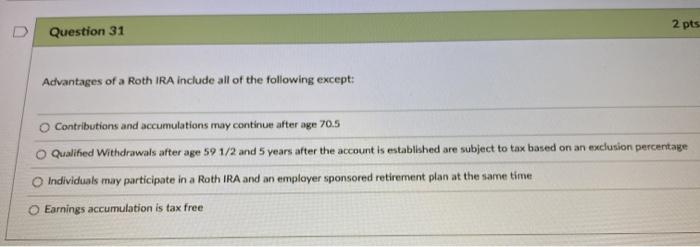

Question 30 Contributions to a Roth IRA are: Income tax deductible to the employee if the Roth IRA is sponsored by the employer Income tax deductible for those who do not participate in a retirement plan at work Partly deductible depending upon income level Not income tax deductible D 2 pts Question 31 Advantages of a Roth IRA include all of the following except: Contributions and accumulations may continue after age 70.5 O Qualified Withdrawals after age 59 1/2 and 5 years after the account is established are subject to tax based on an exclusion percentage Individuals may participate in a Roth IRA and an employer sponsored retirement plan at the same time Earnings accumulation is tax free

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts