Question: please answer both questions asap and show work not using excel Question 3: As an independent public company, the Bauxite Division will have the same

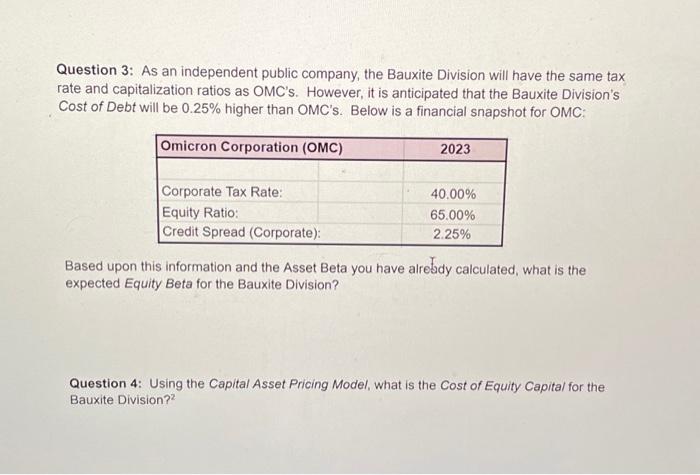

Question 3: As an independent public company, the Bauxite Division will have the same tax rate and capitalization ratios as OMC's. However, it is anticipated that the Bauxite Division's Cost of Debt will be 0.25% higher than OMC's. Below is a financial snapshot for OMC: Based upon this information and the Asset Beta you have alrebdy calculated, what is the expected Equity Beta for the Bauxite Division? Question 4: Using the Capital Asset Pricing Model, what is the Cost of Equity Capital for the Bauxite Division

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts