Question: please answer both questions eBook a. You plan to make five deposits of $1,000 each, one every 6 months, with the first payment being made

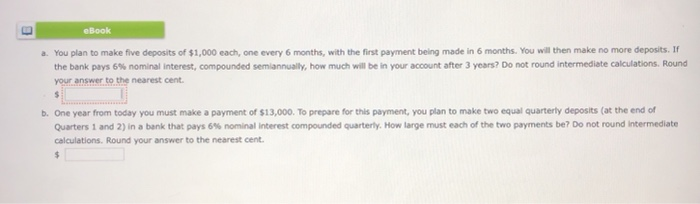

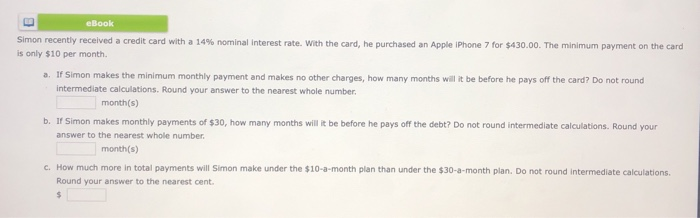

eBook a. You plan to make five deposits of $1,000 each, one every 6 months, with the first payment being made in 6 months. You will then make no more deposits. If the bank pays 6% nominal Interest, compounded semiannually, how much will be in your account after 3 years? Do not round intermediate calculations. Round your answer to the nearest cent. $ b. One year from today you must make a payment of $13,000. To prepare for this payment, you plan to make two equal quarterly deposits (at the end of Quarters 1 and 2) In a bank that pays 6% nominal interest compounded quarterly. How large must each of the two payments be? Do not round Intermediate calculations. Round your answer to the nearest cent. $ eBook Simon recently received a credit card with a 14% nominal Interest rate. With the card, he purchased an Apple iPhone 7 for $430.00. The minimum payment on the card is only $10 per month a. If Simon makes the minimum monthly payment and makes no other charges, how many months will it be before he pays off the card? Do not round intermediate calculations. Round your answer to the nearest whole number, month(s) b. If Simon makes monthly payments of $30, how many months will it be before he pays off the debt? Do not round intermediate calculations. Round your answer to the nearest whole number month(s) C. How much more in total payments will Simon make under the $10-3-month plan than under the $30-a-month plan. Do not round Intermediate calculations. Round your answer to the nearest cent. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts