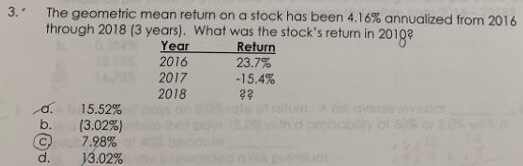

Question: please answer both & show work. The geometric mean return on a stock has been 4.16% annualized from 2016 through 2018 (3 years). What was

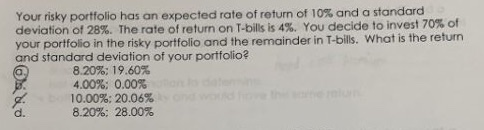

The geometric mean return on a stock has been 4.16% annualized from 2016 through 2018 (3 years). What was the stock's return in 20198 Year Return 2016 23.7% 2017 -15.4% 2018 15.52% (3.02%) 7.98% Your risky portfolio has an expected rate of return of 10% and a standard 3%. The rate of return on T-bills is 4%. You decide to invest 70% of your portfolio in the risky portfolio and the remainder in T-bills. What is the return and standard deviation of your portfolio 8.20%: 19.60% 4.00% 0.00% 10.00%: 20.06% 8.20%: 28.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts