Question: please answer C...the correlation is? using the data in the following table. , estimate the: a. Average return and volatility for each stock. b. Covariance

please answer C...the correlation is?

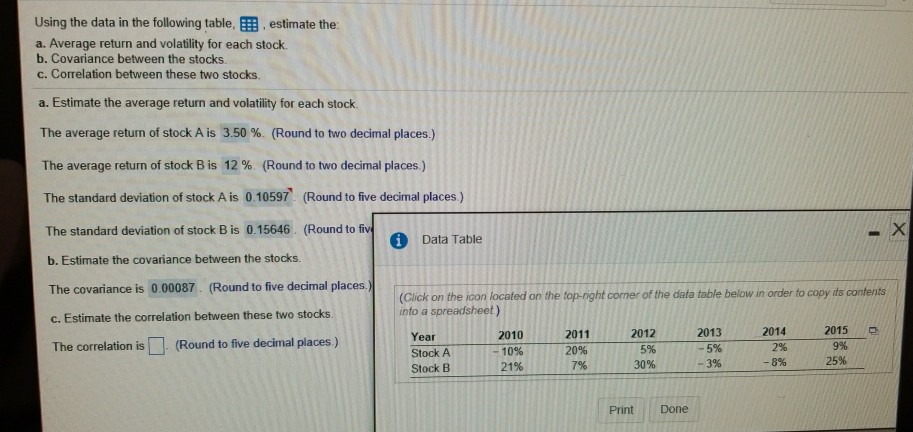

using the data in the following table. , estimate the: a. Average return and volatility for each stock. b. Covariance between the stocks. c. Correlation between these two stocks. a. Estimate the average return and volatility for each stock The average return of stock A is 3.50 % (Round to two decimal places.) The average return of stock B is 12 % (Round to two decimal places.) The standard deviation of stock A is 0.10597 (Round to five decimal places) The standard deviation of stock B is 0.15646 (Round to fiv Data Table b. Estimate the covariance between the stocks The covariance is 0.00087 (Round to five decimal places (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet) c. Estimate the correlation between these two stocks The correlation is (Round to five decimal places ) 2012 5% 30% 20132014 2015 9% 2011 Year Stock A Stock B 2010 -10% 21% 20% 7% -5% 3% 296 896 25% . Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts