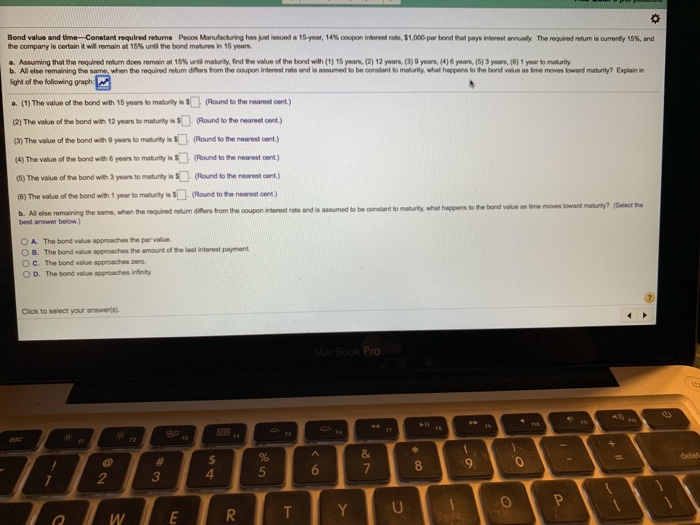

Question: Please answer each part, Ill give back positive feedback, thank you!! Bond value and time-constant required returns Pecos Mand dring has kat ssued a 15-year,

Please answer each part, Ill give back positive feedback, thank you!!

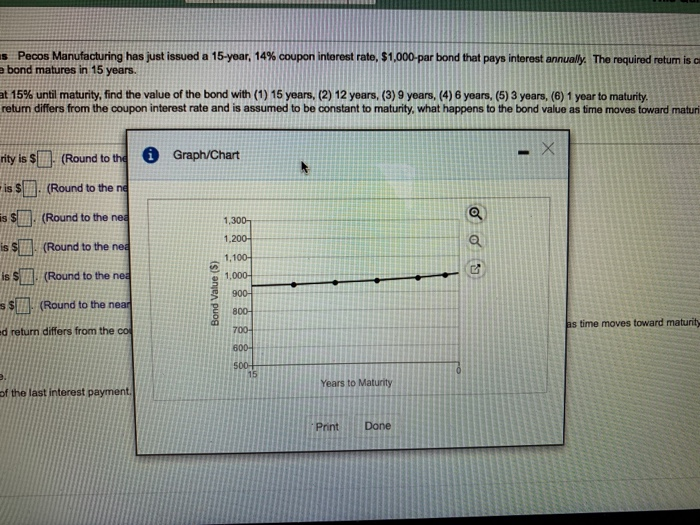

Please answer each part, Ill give back positive feedback, thank you!! Bond value and time-constant required returns Pecos Mand dring has kat ssued a 15-year, 14% oopon iterest rah, S 00 par band hat pays nmes' rnaly The newedreumis urver ss, and company is certain it wil remain at 15% urta the bond mahm h15 years a. Assuring that the roomd ream does rermain at 15%urt1 maaity, frd te wueofthe bond wit' (1) 15 s,(2) 12 year. C )9yws/4) 6 years, (51 3 years. (6) 1 tomdrity b. All else remaining e same when the required reum differs from the coupon interest rate and is assurmed to be constant to maburity, what happens to the bond value as time moves towand maturity? Explain in ight of the following graph (1) The value of the bond with 15 years to maturity is (Round to the nearest cent (2) The value of the bond with 12 years to maturity in Round to the nearest cent (3) The value of the bond with 9 yoars to maturity is $(Round to the rearest cent) (4) The value of the bond with 6 years to maturity lis S(Round to the nearest oent) (5) The value of the bond with 3 years to maturity is S(Rlound to the nearest ont (6) The value of the bond with 1 year to maturity is Round to the nearest cont b. All else remaining the same, when the required netum difers from the coupon intenest rate andi is assumed to be constant to maturity, what happens to the bond value as time moves toward maturity? (Select he best answer below.) O A. The bond value approaches the par value O B. The bond value approaches the amount of the last interest payment O C. The bond value approaches zero O D. The bond value approaches infinity Cick to select your answers). 2 3 4 s Pecos Manufacturing has jst issued a 15-year, 14% coupon interest rate, $1,000-par bond that pays interest annua e The required e bond matures in 15 years. tum at 15% until maturity, find the value of the bond with (1) 15 years, (2) 12 years, (3) 9 years (4) 6 years (5) 3 years (6) 1 year to maturity. return differs from the coupon interest rate and is assumed to be constant to maturity, what happens to the bond value as time moves toward maturi rity is $(Round to th issD(Round to the n O Graph/Chart (Round to the ne 1,3001 1,200 1.100 s Round to the nea is SA (Round to the nea Round to the nea d return differs from the co as time moves toward maturity 15 Years to Maturity of the last interest payment Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts