Question: Please answer each question in more than 200 words, please. CLOSING CASE Citigroup: The Opportunities and Risks of Diversification In 2015, Citigroup was a $70.1-billion,

Please answer each question in more than 200 words, please.

Please answer each question in more than 200 words, please.

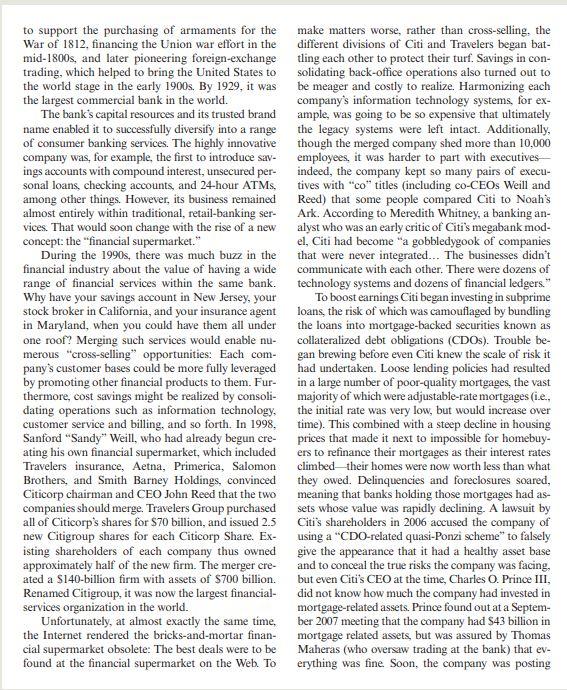

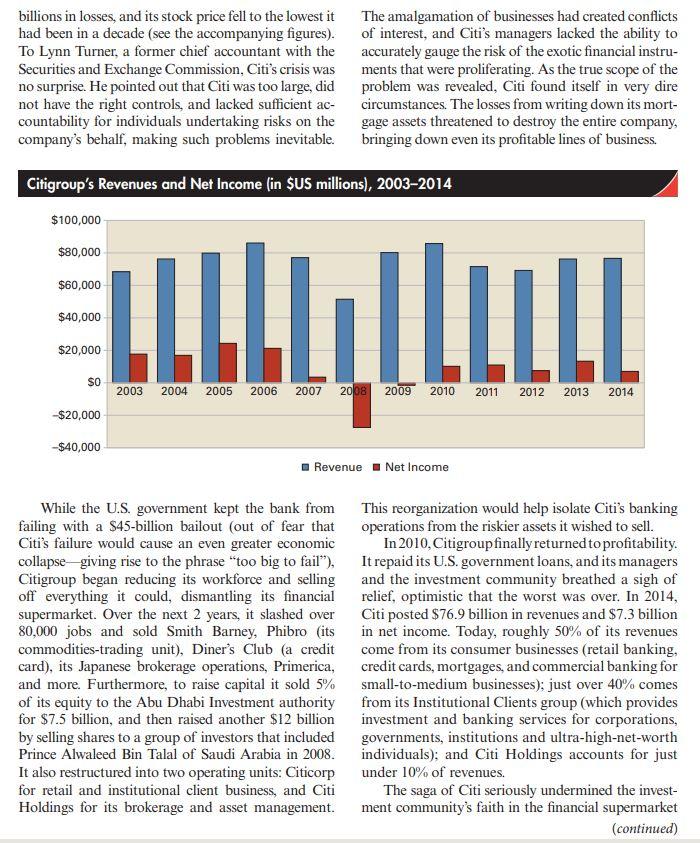

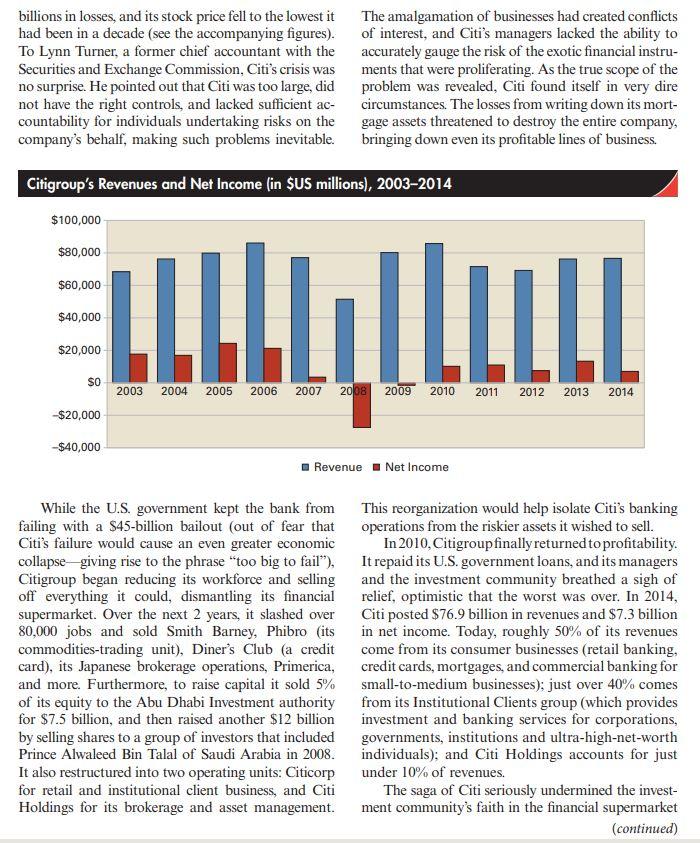

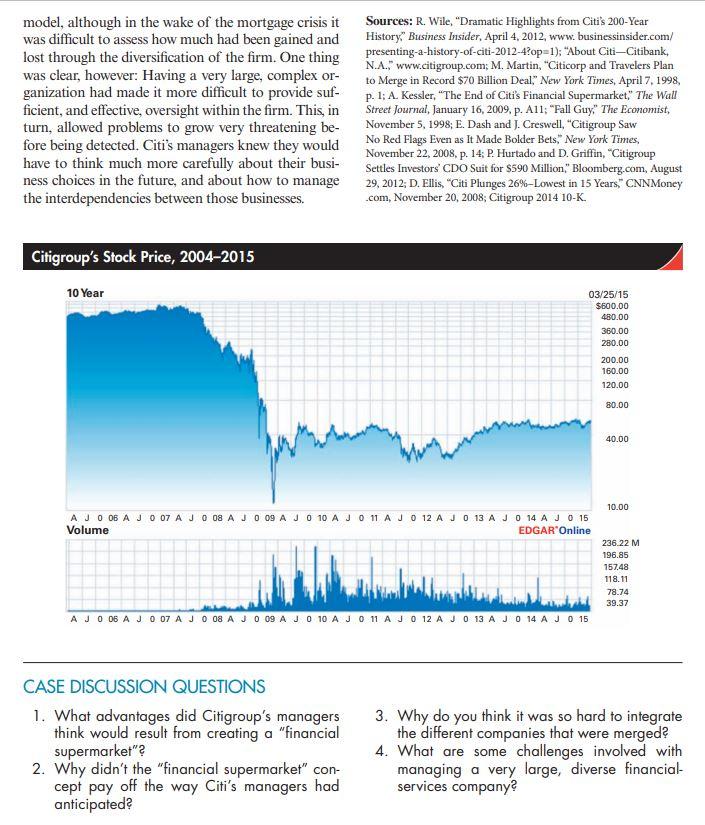

CLOSING CASE Citigroup: The Opportunities and Risks of Diversification In 2015, Citigroup was a $70.1-billion, diversified financial-services firm known around the world. However, its history had not always been smooth. From the late 1990s through 2010, the company's diversification moves, and its role in the mort- gage crisis, combined to bring the company to its knees, raising fears that the venerable bank-one of the oldest and largest in the United States would not survive. Citigroup traces its history all the way back to 1812, when it was formed by a group of merchants in response to the abolishment of the First Bank of the United States (the First Bank's charter had been permitted to lapse due to Thomas Jefferson's arguments about the dangers of centralized control of the economy). The merchants, led by Alexander Hamilton, created the City Bank of New York in 1812, which they hoped would be large enough to replicate the scale advantages that had been offered by the First Bank. The bank played some key roles in the rise of the United States as a global power, including lending money (continued) to support the purchasing of armaments for the make matters worse, rather than cross-selling, the War of 1812, financing the Union war effort in the different divisions of Citi and Travelers began bat- mid-1800s, and later pioneering foreign-exchange ting each other to protect their turf. Savings in con- trading, which helped to bring the United States to solidating back-office operations also turned out to the world stage in the early 1900s. By 1929, it was be meager and costly to realize. Harmonizing each the largest commercial bank in the world. company's information technology systems, for ex- The bank's capital resources and its trusted brand ample, was going to be so expensive that ultimately name enabled it to successfully diversify into a range the legacy systems were left intact. Additionally, of consumer banking services. The highly innovative though the merged company shed more than 10,000 company was, for example, the first to introduce sav- employees, it was harder to part with executives ings accounts with compound interest, unsecured per- indeed, the company kept so many pairs of execu- sonal loans, checking accounts, and 24-hour ATMs, tives with "co" titles (including co-CEOs Weill and among other things. However , its business remained Reed) that some people compared Citi to Noah's almost entirely within traditional, retail-banking ser- Ark. According to Meredith Whitney, a banking an- vices. That would soon change with the rise of a new alyst who was an early critic of Citi's megabank mod- concept: the "financial supermarket." el, Citi had become "a gobbledygook of companies During the 1990s, there was much buzz in the that were never integrated... The businesses didn't financial industry about the value of having a wide communicate with each other. There were dozens of range of financial services within the same bank. technology systems and dozens of financial ledgers." Why have your savings account in New Jersey, your To boost earnings Citi began investing in subprime stock broker in California, and your insurance agent loans, the risk of which was camouflaged by bundling in Maryland, when you could have them all under the loans into mortgage-backed securities known as one roof? Merging such services would enable nu- collateralized debt obligations (CDOs). Trouble be- merous "cross-selling" opportunities: Each com- gan brewing before even Citi knew the scale of risk it pany's customer bases could be more fully leveraged had undertaken. Loose lending policies had resulted by promoting other financial products to them. Fur- in a large number of poor-quality mortgages, the vast thermore, cost savings might be realized by consoli- majority of which were adjustable-rate mortgages (i.e., dating operations such as information technology, the initial rate was very low, but would increase over customer service and billing, and so forth. In 1998, time). This combined with a steep decline in housing Sanford "Sandy" Weill, who had already begun cre- prices that made it next to impossible for homebuy- ating his own financial supermarket, which included ers to refinance their mortgages as their interest rates Travelers insurance, Aetna, Primerica, Salomon climbed their homes were now worth less than what Brothers, and Smith Barney Holdings, convinced they owed. Delinquencies and foreclosures soared, Citicorp chairman and CEO John Reed that the two meaning that banks holding those mortgages had as- companies should merge. Travelers Group purchased sets whose value was rapidly declining. A lawsuit by all of Citicorp's shares for $70 billion, and issued 2.5 Citi's shareholders in 2006 accused the company of new Citigroup shares for each Citicorp Share. Ex- using a "CDO-related quasi-Ponzi scheme" to falsely isting shareholders of each company thus owned give the appearance that it had a healthy asset base approximately half of the new firm. The merger cre- and to conceal the true risks the company was facing, ated a $140-billion firm with assets of $700 billion. but even Citi's CEO at the time, Charles O. Prince III, Renamed Citigroup, it was now the largest financial- did not know how much the company had invested in services organization in the world. mortgage-related assets. Prince found out at a Septem- Unfortunately, at almost exactly the same time, ber 2007 meeting that the company had $43 billion in the Internet rendered the bricks-and-mortar finan- mortgage related assets, but was assured by Thomas cial supermarket obsolete: The best deals were to be Maheras (who oversaw trading at the bank) that ev- found at the financial supermarket on the Web. To erything was fine. Soon, the company was posting billions in losses, and its stock price fell to the lowest it had been in a decade (see the accompanying figures). To Lynn Turner, a former chief accountant with the Securities and Exchange Commission, Citi's crisis was no surprise. He pointed out that Citi was too large, did not have the right controls, and lacked sufficient ac- countability for individuals undertaking risks on the company's behalf, making such problems inevitable. The amalgamation of businesses had created conflicts of interest, and Citi's managers lacked the ability to accurately gauge the risk of the exotic financial instru- ments that were proliferating. As the true scope of the problem was revealed, Citi found itself in very dire circumstances. The losses from writing down its mort- gage assets threatened to destroy the entire company, bringing down even its profitable lines of business. Citigroup's Revenues and Net Income (in $US millions), 2003-2014 $100,000 $80,000 $60,000 $40,000 LulllLLL $20,000 SO 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 $20,000 -$40,000 Revenue Net Income While the U.S. government kept the bank from failing with a $45-billion bailout (out of fear that Citi's failure would cause an even greater economic collapse giving rise to the phrase "too big to fail"), Citigroup began reducing its workforce and selling off everything it could, dismantling its financial supermarket. Over the next 2 years, it slashed over 80,000 jobs and sold Smith Barney, Phibro (its commodities-trading unit), Diners Club (a credit card), its Japanese brokerage operations, Primerica, and more. Furthermore, to raise capital it sold 5% of its equity to the Abu Dhabi Investment authority for $7.5 billion, and then raised another $12 billion by selling shares to a group of investors that included Prince Alwaleed Bin Talal of Saudi Arabia in 2008. It also restructured into two operating units: Citicorp for retail and institutional client business, and Citi Holdings for its brokerage and asset management. This reorganization would help isolate Citi's banking operations from the riskier assets it wished to sell. In 2010, Citigroupfinally returned to profitability. It repaid its U.S. government loans, and its managers and the investment community breathed a sigh of relief, optimistic that the worst was over. In 2014, Citi posted $76.9 billion in revenues and $7.3 billion in net income. Today, roughly 50% of its revenues come from its consumer businesses (retail banking, credit cards, mortgages, and commercial banking for small-to-medium businesses); just over 40% comes from its Institutional Clients group (which provides investment and banking services for corporations, governments, institutions and ultra-high-net-worth individuals): and Citi Holdings accounts for just under 10% of revenues. The saga of Citi seriously undermined the invest- ment community's faith in the financial supermarket (continued) model, although in the wake of the mortgage crisis it was difficult to assess how much had been gained and lost through the diversification of the firm. One thing was clear, however: Having a very large, complex or- ganization had made it more difficult to provide suf- ficient, and effective, oversight within the firm. This, in turn, allowed problems to grow very threatening be- fore being detected. Citi's managers knew they would have to think much more carefully about their busi- ness choices in the future, and about how to manage the interdependencies between those businesses. Sources: R. Wile, "Dramatic Highlights from Citi's 200-Year History Business Insider, April 4, 2012, www.businessinsider.com/ presenting-a-history-of-citi-2012-4?op=1); "About Citi-Citibank, N.A. www.citigroup.com; M. Martin, "Citicorp and Travelers Plan to Merge in Record $70 Billion Deal New York Times, April 7, 1998, p. 1; A. Kessler, "The End of Citi's Financial Supermarket," The Wall Street Journal, January 16, 2009, p. A11; "Fall Guy" The Economist, November 5, 1998; E. Dash and J. Creswell, "Citigroup Saw No Red Flags Even as It Made Bolder Bets." New York Times, November 22, 2008, p. 14, P. Hurtado and D. Griffin, "Citigroup Settles Investors' CDO Suit for $590 Million" Bloomberg.com, August 29, 2012, D. Ellis, "Citi Plunges 26%-Lowest in 15 Years, CNNMoney .com, November 20, 2008; Citigroup 2014 10-K. Citigroup's Stock Price, 2004-2015 10 Year 03/25/15 $600.00 480.00 360.00 280.00 200.00 160.00 120.00 80.00 40.00 10.00 AJO 06 A J O 07 AJ O 08 AJ O 09 A J O 10 A JOLA J O 12 A J O 13 A J O 14 A JO 15 Volume EDGAR'Online 236.22 M 196.85 157.48 118.11 78.74 39.37 A JO 06 A J O 07 A JO 08 A J O 09 A JO 10 A JO 11 A J O 12 A JO 13 A JO 14 AJ O 15 CASE DISCUSSION QUESTIONS 1. What advantages did Citigroup's managers think would result from creating a "financial supermarket"? 2. Why didn't the "financial supermarket" con- cept pay off the way Citi's managers had anticipated? 3. Why do you think it was so hard to integrate the different companies that were merged? 4. What are some challenges involved with managing a very large, diverse financial services company

Please answer each question in more than 200 words, please.

Please answer each question in more than 200 words, please.