Question: please answer fast, will leave good rate. Question 2 (2 points) In 2012, Fiona had earned income of $112,000 and had no pension adjustments. The

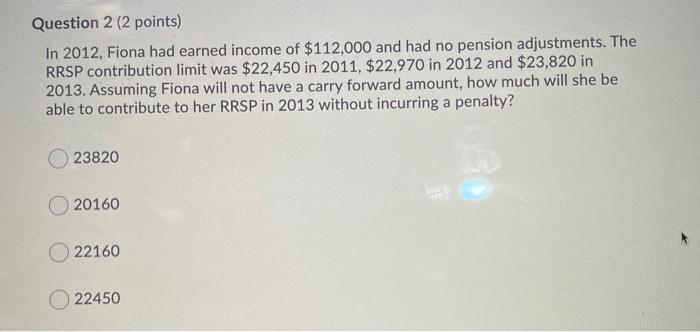

Question 2 (2 points) In 2012, Fiona had earned income of $112,000 and had no pension adjustments. The RRSP contribution limit was $22,450 in 2011, $22,970 in 2012 and $23,820 in 2013. Assuming Fiona will not have a carry forward amount, how much will she be able to contribute to her RRSP in 2013 without incurring a penalty? 23820 20160 22160 22450

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts