Question: please answer fully and completely for a guaranteed thumbs up. please do it in a timely manner as well! let me know if more info

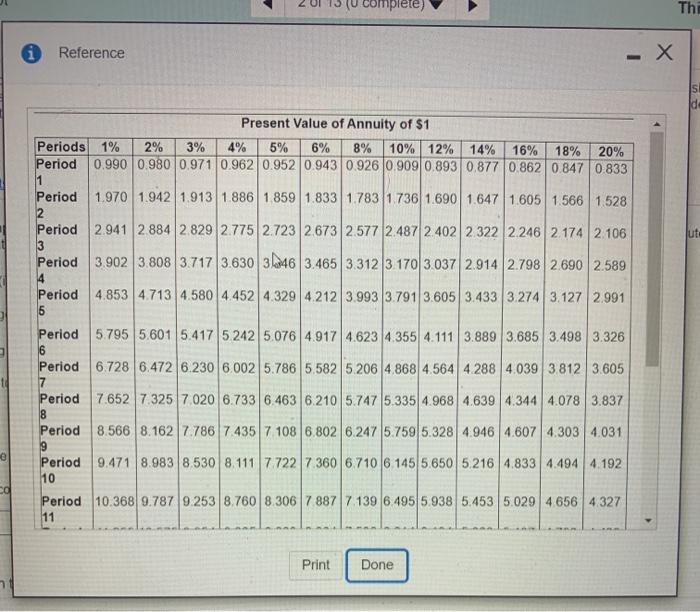

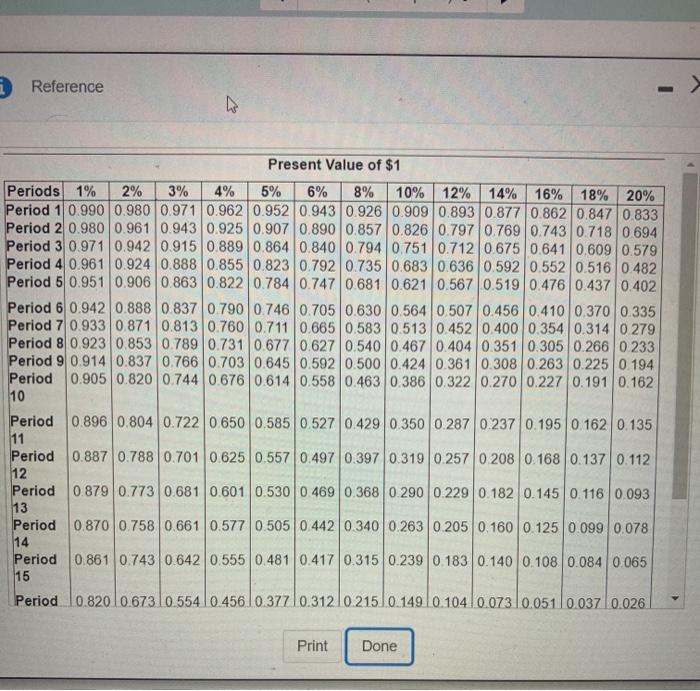

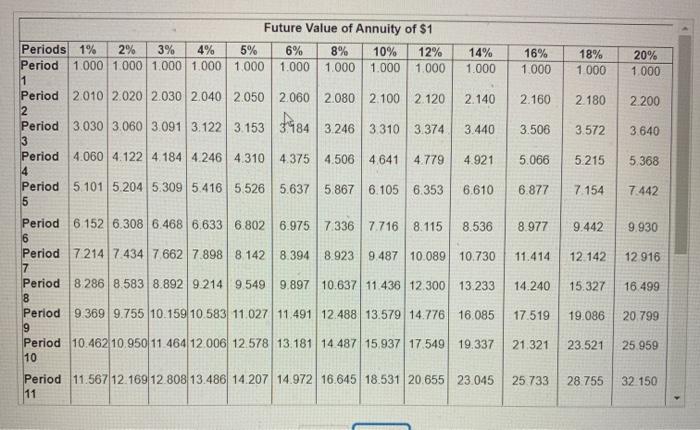

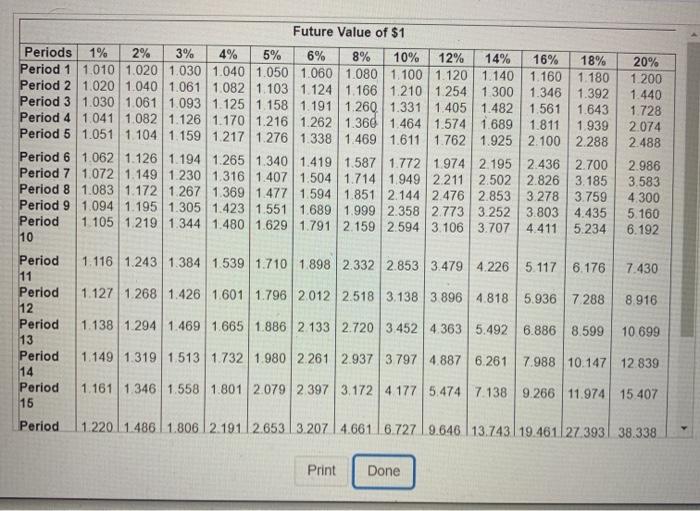

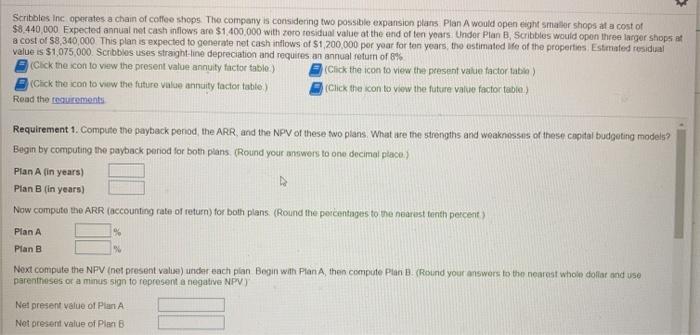

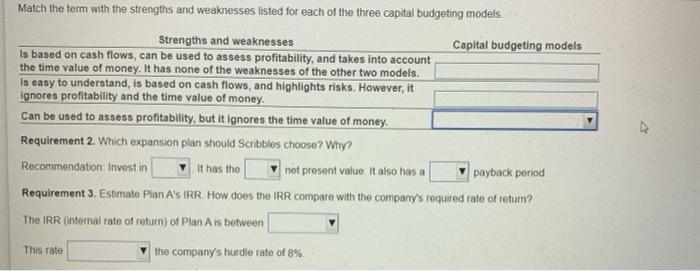

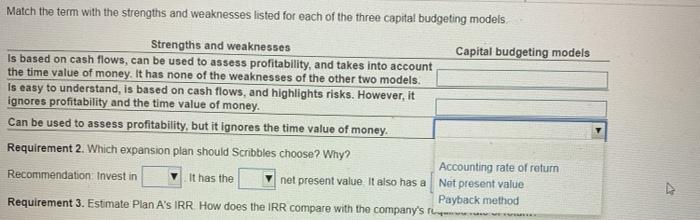

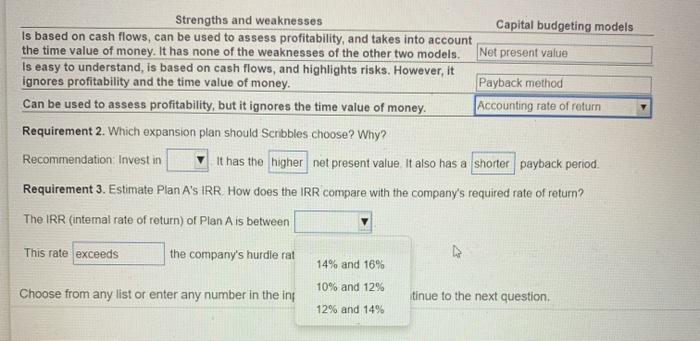

complete) Thi Reference . ut: 6 Present Value of Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 18% 20% Period 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 1 Period 1.970 1.942 1.913 1886 1859 1.833 1.783 1736 1.690 1.647 1.605 1.566 1.528 2 Period 2.941 2.884 2.829 2.775 2.723 2.673 2.577 2.487 2.402 2 322 2.246 2174 2106 3 Period 3.902 3.808 3.717 3.630 3|046 3.465 3.312 3.170 3.037 2.914 2.798 2.690 2.589 4 Period 4.853 4.713 4.580 4.452 4.329 4.212 3.993 3.791 3.605 3.433 3.274 3.127 2.991 5 Period 5.795 5.601 5.417 5.242 5.076 4.917 4.623 4.355 4.111 3.8893.685 3.498 3.326 6 Period 6728 6.472 6.230 6.002 5.786 5,582 5.206 4.868 4.564 4.288 4.039 3 812 3.605 7 Period 7.652 7.325 7020 6.733 6.463 6.210 5.747 5.335 4.968 4.639 4.344 4.078 3.837 8 Period 8.566 8.162 7.786 7435 7 108 6.802 6 247 5.759 5.328 4.946 4.607 4.303 4.031 9 Period 9.471 8.983 8 530 8. 1117 722 73606 710 6 145 5.650 5 216 4.833 4.494 4. 192 10 Period 10.368 9.787 9.253 8.760 8.306 7 887 7.139 6.495 5.938 5.453 5.029 4656 4.327 11 Print Done Reference 8% Present Value of $1 Periods 1% 2% 3% 4% 5% 6% 10% 12% 14% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 Period 2 0.980 0.961 0.943 0.925 0.907 0.890 0.8570.826 0.797 0.769 0.743 0.7180.694 Period 30.971 0.942 0.915 0.8890.864 0.840 0.794 0.751 0.712 0.675 0.641 0.609 0.579 Period 4 0.961 0.924 0.888 0.855 0.823 0.792 0.735 0.683 0.636 0.592 0.552 0.516 0.482 Period 5 0.951 0.906 0.863 0.822 0.784 0.747 0.681 0.6210.567 0.519 0.476 0.437 0.402 Period 6 0.942 0.888 0.837 0.790 0.746 0.705 0.630 0.564 0.507 0.456 0.410 0.370 0.335 Period 7 0.933 0.871 0.813 0.760 0.711 0.665 0.583 0.513 0.452 0.400 0.354 0.314 0279 Period 8 0.923 0.853 0.789 0.731 0.677 0.627 0.540 0.467 0.404 0.351 0.305 0.266 0233 Period 9 0.9140.837 0.766 0.703 0.6450.5920.500 0.424 0.361 0.308 0.263 0.225 0.194 Period 0.905 0.820 0.744 0.676 0.614 0.558 0.463 0.386 0.322 0.270 0.227 0.191 0.162 10 Period 0.896 0.8040.722 0.650 0.585 0.527 0.429 0.350 0.287 0.237 0.1950.162 0.135 11 Period 0.887 0.788 0.701 0.625 0.557 0.497 0.397 0.319 0.257 0.208 0.168 0.137 0.112 12 Period 0.879 0.773 0.681 0.601 0.530 0.469 0.368 0.290 0.229 0.182 0.145 0.116 0.093 13 Period 0.870 0.758 0.661 0.577 0.505 0.442 0 340 0.263 0.205 0.160 0.125 0.099 0.078 14 Period 0.861 0.743 0.642 0.555 0.481 0.417 0.315 0.239 0.183 0.140 0.108 0.084 0.065 15 Period 10.820 10.673 10.554 10.456 10.377/0.31210.2151 0.149.10.10410.073 10.051 0.037 0.026 Print Done 10% 16% 1.000 18% 1.000 20% 1.000 2.160 2.180 2.200 $484 3.246 3 310 3.374 3.506 3.572 3.640 5.066 5 215 5.368 6.877 7.154 7.442 Future Value of Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 8% 12% 14% Period 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 11 Period 2010 2020 2030 2040 2050 2060 2.080 2.100 2.120 2.140 2 Period 3.030 3.060 3.091 3.122 3.153 3.440 3 Period 4.060 4.122 4 1844.246 4.310 4.375 4.506 4.641 4.779 4.921 4 Period 5 101 5.204 5.309 5.416 5.526 5.6375.867 6.105 6.353 6.610 5 Period 6.152 6.308 6.468 6.633 6.802 6.975 73367.716 8.115 8.536 6 Period 7214 7 434 7 662 7.898 8 142 8.394 8.923 9.487 10.089 10.730 7 Period 8 286 8.583 8.8929.214 9.549 9.897 10.637 11.436 12.300 13.233 8 Period 9.369 9.755 10.159 10.583 11.027 11.491 12.488 13.579 14.776 16.085 9 Period 10.462 10.950 11 464 12.006 12.578 13.181 14 487 15 937 17 549 19.337 10 Period 11.567 12. 169 12 808 13.486 14.207 14.972 16.645 18.531 20.655 23.045 11 8.977 9.442 9.930 11.414 12 142 12 916 14.240 15.327 16 499 17.519 19.086 20.799 21 321 23.521 25.959 25.733 28 755 32 150 8% Future Value of $1 Periods 1% 2% 3% 4% 5% 6% 10% 12% 14% 16% 18% Period 11.010 1.020 1.030 1.040 1.050 1.060 1.080 1.100 1.120 1.140 1.160 1.180 Period 2 1.020 1.040 1.061 1.0821 103 1.124 1.166 1.210 1.254 1 300 1.346 1.392 Period 31.030 1.061 1.093 1.125 1 158 1.191 1.260 1.331 1.405 1.482 1.561 1.643 Period 4 1.041 1.082 1.126 1.170 1.216 1.262 1.360 | 1.464 1.574 1689 1.811 1.939 Period 5 1.051 1 104 1.159 1.2171276 1.338 1.469 1.611 1.762 1.925 2.100 2.288 Period 6 1.062 1.126 1.194 1.265 1.340 1.419 1.587 1.772 1.9742.195 2.436 2.700 Period 7 1.072 1.149 1.230 1.316 1.407 1.504 1.7141.949 22112.502 2.826 3.185 Period 8 1.083 1.172 1.267 1.369 1.4771.594 1.851 2.144 2.476 2.853 3.278 3.759 Period 9 1.094 1.195 1.305 1.423 1.551 1.689 1.999 2.358 2.773 3.252 3.803 4.435 Period 1.105 1.219 1.344 1.480 1.629 1.791 2.159 2.594 3.106 3.707 4.411 5.234 10 20% 1.200 1.440 1.728 2.074 2.488 2.986 3.583 4.300 5.160 6.192 1.116 1.243 1.384 1.539 1.710 1.898 2.332 2.853 3.479 4.226 5.117 6.176 7.430 1.127 1268 1.426 1.601 1.796 2012 2.518 3.138 3 896 4.818 5.9367288 8.916 Period 11 Period 12 Period 13 Period 14 Period 16 1.138 1.2941.469 1.665 1.886 2 133 2.720 3.452 4.363 5.492 6.886 8.599 10 699 1.149 1.319 1.5131732 1.980 2.261 2.9373797 4.887 6.2617.988 10.147 12 839 1.1611 346 1.558 1.801 2.079 2 397 3.1724 177 5.4747 138 9.266 11.974 15.407 Period 1.220 11.486 1.806 12.191 1 2.653 3.207 14.661.1 6.727 9.646 13.743 19.461127 393 38.338 Print Done Scribbles Inc operates a chain of coffee shops. The company is considering two possible expansion plans Plan A would open eight smaller shops at a cost of $8.440,000 Expected annual net cash inflows are $1.400.000 with zero residual value at the end of ten years. Under Plan B, Scribbles would open three larger shops at cost of $8.340,000 This plan is expected to generate net cash inflows of $1,200,000 por your for ten years, the estimated Ife of the properties Estimated residual value is $1,075,000. Scrbbles uses straight-line depreciation and requires an annual return of 8% Click the .con to view the present value annuity factor tabla) (Click the icon to view the present value factor tati) Click the icon to www the future value annuity factor table (Click the icon to view the future value factor table Read the requirements Requirement 1. Compute the payback penod the ARR, and the NPV of these two plans. What are the strengths and weaknesses of these capital budgeting models Begin by computing the payback period for both plans. (Round your answers to one decimal place) Plan A (in years) Plan B (in years) Now compute the ARR (accounting rate of return) for both plans (Round the percentages to the nearest tenth percent Plan A % Plan B Next compute the NPV (net present value) under each plan Begin with Plan A then compute Plan (Round your answers to the nearest whole doflar and use parentheses or a minus sign to represent a negative NPV) Nel present value of Plan A Not present value of Plan B Match the term with the strengths and weaknesses listed for each of the three capital budgeting models. Strengths and weaknesses Capital budgeting models Is based on cash flows, can be used to assess profitability, and takes into account the time value of money. It has none of the weaknesses of the other two models. In easy to understand, is based on cash flows, and highlights risks. However, it ignores profitability and the time value of money. Can be used to assess profitability, but it ignores the time value of money. Requirement 2. Which expansion plan should Scribbles choose? Why? Recommendation Invest in It has the not present value it also has a payback period Requirement 3. Estimate Plan A's IRR How does the IRR compare with the company's required rate of return? The IRR internal rate of return) of Plan Ais between A This rate the company's hurdle rate of 8% Match the term with the strengths and weaknesses listed for each of the three capital budgeting models Strengths and weaknesses Capital budgeting models Is based on cash flows, can be used to assess profitability, and takes into account the time value of money. It has none of the weaknesses of the other two models. Is easy to understand, is based on cash flows, and highlights risks. However, it ignores profitability and the time value of money. Can be used to assess profitability, but it ignores the time value of money. Requirement 2. Which expansion plan should Scribbles choose? Why? Accounting rate of return Recommendation Invest in It has the net present value It also has a Net present value Payback method Requirement 3. Estimate Plan A's IRR How does the IRR compare with the company's the Strengths and weaknesses Capital budgeting models Is based on cash flows, can be used to assess profitability, and takes into account the time value of money. It has none of the weaknesses of the other two models. Net present value Is easy to understand, is based on cash flows, and highlights risks. However, it ignores profitability and the time value of money. Payback method Can be used to assess profitability, but it ignores the time value of money. Accounting rate of return Requirement 2. Which expansion plan should Scribbles choose? Why? Recommendation: Invest in It has the higher net present value It also has a shorter payback period. Requirement 3. Estimate Plan A's IRR How does the IRR compare with the company's required rate of return? The IRR (internal rate of return) of Plan A is between This rate exceeds the company's hurdle rat 14% and 16% 10% and 12% Choose from any list or enter any number in the in tinue to the next question. 12% and 14%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts