Question: please answer fully and completely for a guaranteed thumbs up. please do it in a timely manner as well! let me know if any more

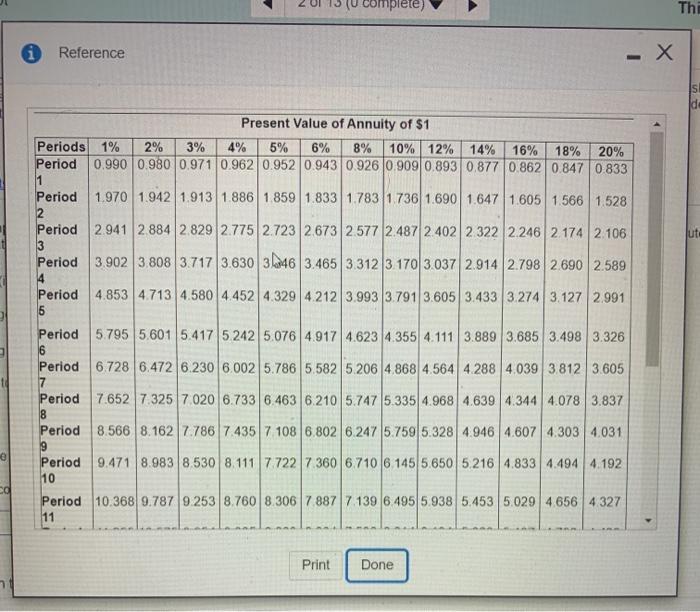

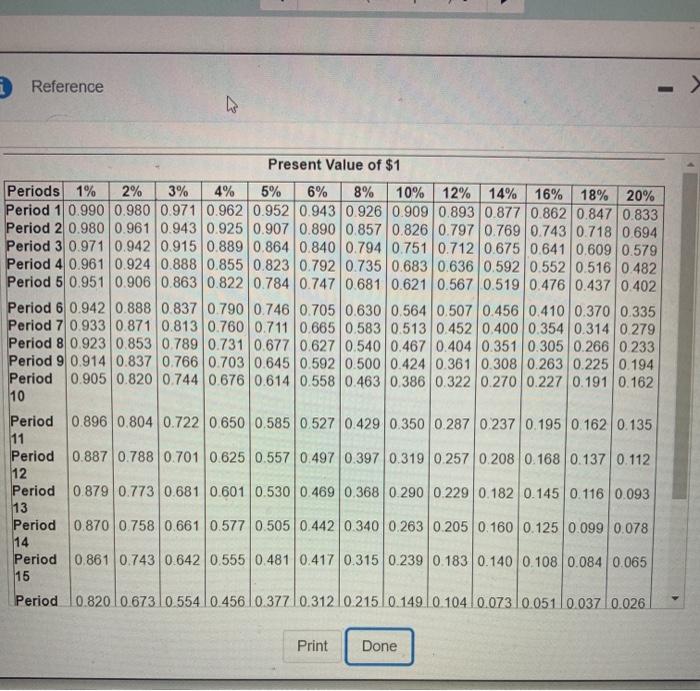

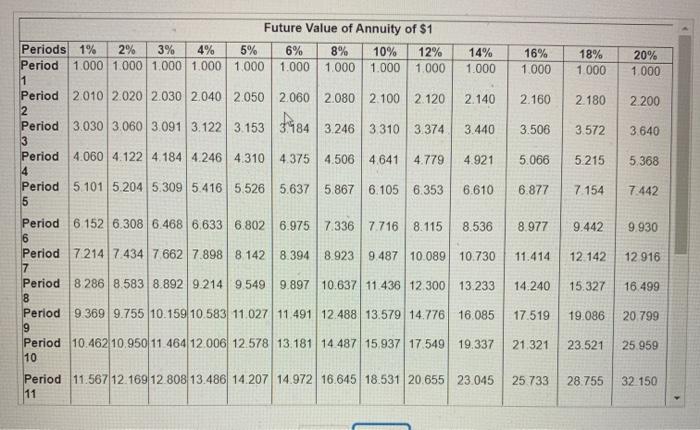

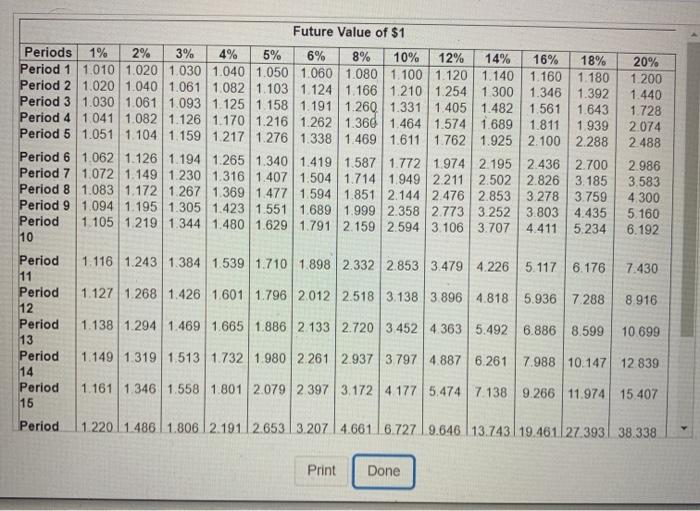

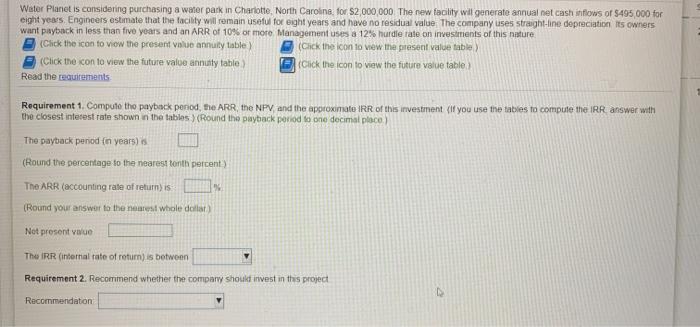

complete) Thi Reference . ut: 5 Present Value of Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 18% 20% Period 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 11 Period 1.970 1.942 1.913 1886 1859 1.833 1.783 1736 1.690 1.647 1.605 1.566 1.528 2 Period 2.941 2.884 2.829 2.775 2.723 2.673 2.577 2.487 2.402 2 322 2.246 2 174 2.106 3 Period 3.902 3 808 3.717 3.630 3646 3.465 3 312 3.170 3.037 2.914 2.798 2690 2.589 4 Period 4.853 4.713 4.580 4.452 4.329 4.212 3.993 3.791 3.605 3.433 3.274 3.127 2.991 5 Period 5.795 5.601 5.417 5.242 5.076 4.917 4.623 4.355 4.111 3.8893.685 3.498 3.326 6 Period 6728 6.472 6.230 6.002 5.786 5,582 5.206 4.868 4.564 4.288 4.039 3 812 3.605 7 Period 7.652 7.325 7020 6.733 6.463 6.210 5.747 5.335 4.968 4.639 4.344 4.078 3.837 8 Period 8.566 8.162 7.786 7.435 7 108 6.802 6 247 5.759 5.328 4.946 4.6074.303 4.031 9 Period 9.471 8.9838 530 8.1117 722 7.360 6.710 6 145 5.650 5.216 4.833 4.494 4.192 10 Period 10.368 9.787 9.253 8.760 8.30678877 139 6 495 5.938 5.453 5.029 4.656 4327 11 ed Print Done Reference Present Value of $1 Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.9520.943 0.926 0.9090.893 0.877 0.862 0.847 0.833 Period 2 0.980 0.961 0.943 0.925 0.907 0.890 0.8570.826 0.797 0.769 0.743 0.7180 694 Period 30.971 0.942 0.915 0.8890.864 0.840 0.794 0.751 0.712 0.675 0.641 0.609 0.579 Period 4 0.961 0.924 0.888 0.855 0.823 0.792 0.735 0.683 0.636 0.592 0.552 0.516 0.482 Period 5 0.951 0.906 0.863 0.822 0.784 0.747 0.681 0.621 0.567 0.519 0.476 0.437 0.402 Period 6 0.942 0.888 0.837 0.790 0.746 0.705 0.630 0.564 0.507 0.456 0.410 0.370 0.335 Period 7 0.933 0.871 0.813 0.760 0.7110.665 0.583 0.513 0.452 0.400 0.354 0.314 0 279 Period 8 0.923 0.853 0.789 0.731 0.677 0.627 0.540 0.467 0.404 0.351 0.305 0.266 0.233 Period 9 0.9140.837 0.766 0.703 0.645 0.5920.500 0.424 0.361 0.308 0.263 0.225 0.194 Period 0.905 0.820 0.744 0.676 0.614 0.558 0.463 0.386 0.322 0.270 0.227 0.1910.162 10 Period 0.896 0.804 0.722 0.650 0.585 0.527 0.429 0.350 0.2870.237 0.1950.162 0.135 11 Period 0.887 0.788 0.701 0.625 0.5570.497 0.397 0.319 0.257 0.208 0.168 0.137 0.112 12 Period 0.879 0.773 0.681 0.601 0.530 0.469 0.368 0.290 0.229 0.182 0.145 0.116 0.093 13 Period 0.870 0.758 0.661 0.5770.505 0.442 0 340 0.263 0.205 0 160 0.125 0.099 0.078 14 Period 0.861 0.743 0.642 0.555 0.481 0.417 0.315 0.239 0.183 0.140 0.108 0.084 0.065 15 Period 10.820 10.67310.554 10.456 10.377/0.31210.215 0.149.10.10410.073 10.051 0.037 0.026 Print Done 10% 16% 1.000 18% 1.000 20% 1.000 2.160 2.180 2.200 $184 3.246 3310 3.374 3.506 3.572 3.640 5.066 5215 5.368 Future Value of Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 8% 12% 14% Period 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 11 Period 2010 2020 2030 2040 2050 2060 2.080 2.100 2.120 2.140 2 Period 3.030 3.060 3.091 3.122 3.153 3.440 3 Period 4.060 4.122 4 1844.246 4310 4.375 4.506 4.641 4.779 4.921 4 Period 5101 5.204 5.309 5.416 5.526 5.6375.867 6.105 6.353 6.610 5 Period 6.152 6.308 6.468 6.633 6.802 6.975 7.336 7.716 8.115 8.536 6 Period 72147 434 7 662 7.898 8 142 8.394 8.923 9.487 10.089 10.730 7 Period 8 286 8.583 8.8929.214 9.549 9.897 10.637 11.436 12 300 13.233 8 Period 9.369 9.755 10.159 10.583 11.027 11 491 12.488 13.579 14.776 16.085 9 Period 10.462 10.950 11 464 12.006 12 578 13.181 14 487 15 937 17 549 19.337 10 6.877 7.154 7.442 8.977 9.442 9.930 11.414 12 142 12 916 14.240 15.327 16.499 17.519 19.086 20 799 21.321 23.521 25.959 Period 11.567 12. 169 12 808 13.486 14.207 14.972 16.645 18.531 20.655 23.045 11 25.733 28.755 32 150 Water Planet is considering purchasing a water park in Charlotte, North Carolina, for $2 000 000 The new facility will generate annual net cash inflows or $495.000 for eight years. Engineers estimate that the facility will remain useful for oight years and have no residual value The company uses straight line depreciation its owners want payback in less than five years and an ARR of 10% or more Management uses a 12% hurdle rate on investments of this nature (Click the icon to view the present value annuity table> (Click the icon to view the present value table (Click the icon to view the future value annuity table> (Click the icon to view the future value table Read the requirements Requirement 1. Compute tho payback period, the ARR, the NPV and the approximate IRR of this investment (If you use the tables to compute the IRR answer with the closest interest rate shown in the tables Round the payback period to one decimal place) The payback period in years) 's (Round the percentage to the nearest tonth percent The ARR (accounting rate of return) is (Round your answer to the nearest Whole della Not present value The IRR (internal tate of return) is between Requirement 2. Recommend whether the company should invest in this project Recommendaton

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts