Question: PLEASE ANSWER HIGHLIGHTED QUESTIONS 4 & 6 ONLY. PLEASE SHOW ALL CALCULATIONS AND FORMULAS IF ANY. YOU CAN USE EXCEL. I WILL GIVE IT A

PLEASE ANSWER HIGHLIGHTED QUESTIONS 4 & 6 ONLY. PLEASE SHOW ALL CALCULATIONS AND FORMULAS IF ANY. YOU CAN USE EXCEL. I WILL GIVE IT A THUMBS UP. THANK YOU!!!!

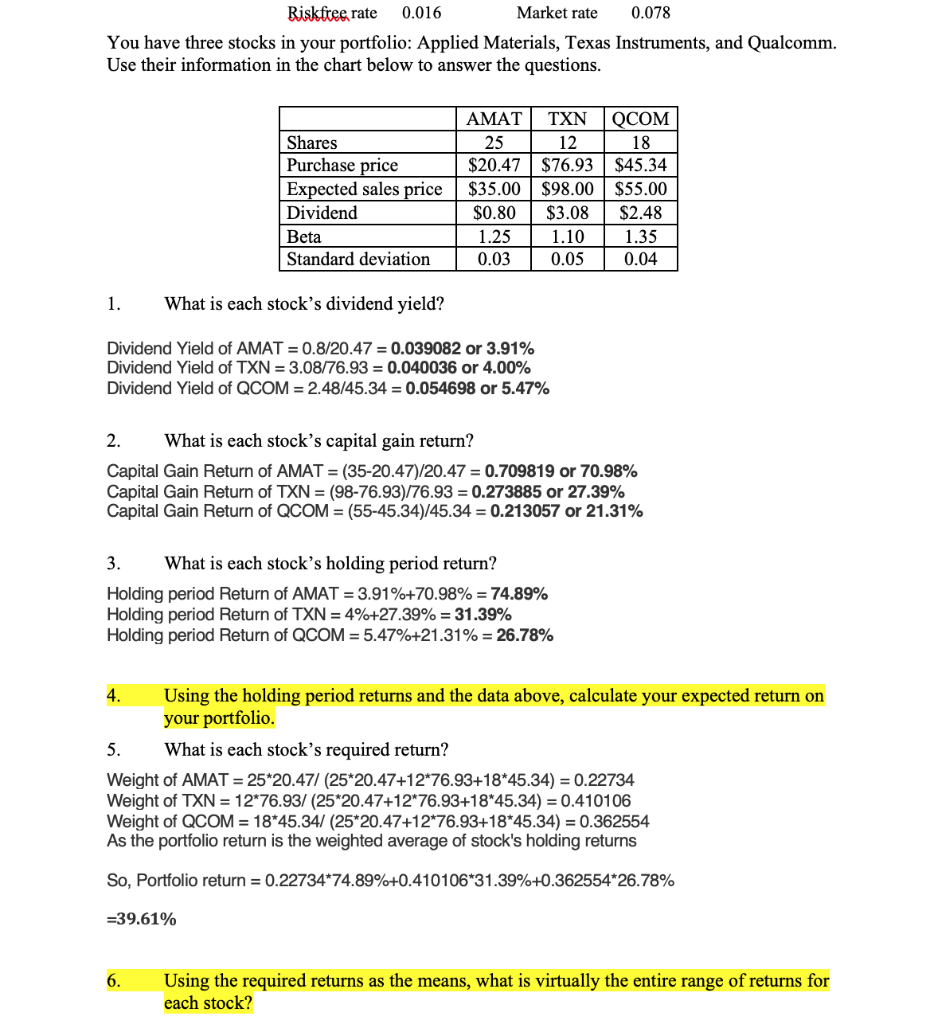

Riskfree rate 0.016 Market rate 0.078 You have three stocks in your portfolio: Applied Materials, Texas Instruments, and Qualcomm. Use their information in the chart below to answer the questions. Shares Purchase price Expected sales price Dividend Beta Standard deviation AMAT 25 $20.47 $35.00 $0.80 1.25 0.03 TXN 12 $76.93 $98.00 $3.08 1.10 0.05 QCOM 18 $45.34 $55.00 $2.48 1.35 0.04 1. What is each stock's dividend yield? Dividend Yield of AMAT = 0.8/20.47 = 0.039082 or 3.91% Dividend Yield of TXN = 3.08/76.93 = 0.040036 or 4.00% Dividend Yield of QCOM = 2.48/45.34 = 0.054698 or 5.47% 2. What is each stock's capital gain return? Capital Gain Return of AMAT = (35-20.47)/20.47 = 0.709819 or 70.98% Capital Gain Return of TXN = (98-76.93)/76.93 = 0.273885 or 27.39% Capital Gain Return of QCOM = (55-45.34)/45.34 = 0.213057 or 21.31% 3. What is each stock's holding period return? Holding period Return of AMAT = 3.91%+70.98% = 74.89% Holding period Return of TXN = 4%+27.39% = 31.39% Holding period Return of QCOM = 5.47%+21.31% = 26.78% 4. Using the holding period returns and the data above, calculate your expected return on your portfolio. 5. What is each stock's required return? Weight of AMAT = 25*20.471 (25*20.47+12*76.93+18*45.34) = 0.22734 Weight of TXN = 12*76.93/ (25*20.47+12*76.93+18*45.34) = 0.410106 Weight of QCOM = 18*45.34/ (25*20.47+12*76.93+18*45.34) = 0.362554 As the portfolio return is the weighted average of stock's holding returns So, Portfolio return = 0.22734*74.89%+0.410106*31.39%+0.362554*26.78% =39.61% 6. Using the required returns as the means, what is virtually the entire range of returns for each stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts