Question: please answer in details, the final answer is given below 1. K.Z. Moley purchased a small retail restaurant business and opened on July, 2008. At

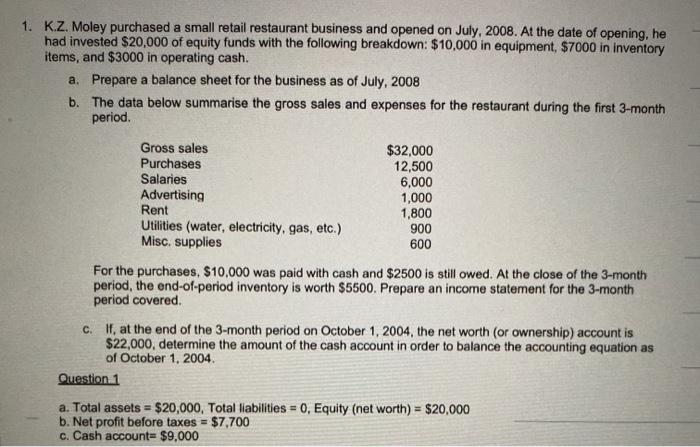

1. K.Z. Moley purchased a small retail restaurant business and opened on July, 2008. At the date of opening, he had invested $20,000 of equity funds with the following breakdown: $10,000 in equipment, $7000 in inventory items, and $3000 in operating cash. a. Prepare a balance sheet for the business as of July, 2008 b. The data below summarise the gross sales and expenses for the restaurant during the first 3-month period. Gross sales $32,000 Purchases 12,500 Salaries 6,000 Advertising 1,000 Rent 1,800 Utilities (water, electricity, gas, etc.) 900 Misc. supplies 600 For the purchases $10,000 was paid with cash and $2500 is still owed. At the close of the 3-month period, the end-of-period inventory is worth $5500. Prepare an income statement for the 3-month period covered. c. If, at the end of the 3-month period on October 1, 2004, the net worth (or ownership) account is $22,000, determine the amount of the cash account in order to balance the accounting equation as of October 1, 2004 Question 1 a. Total assets = $20,000, Total liabilities = 0, Equity (net worth) = $20,000 b. Net profit before taxes = $7,700 c. Cash account=$9,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts