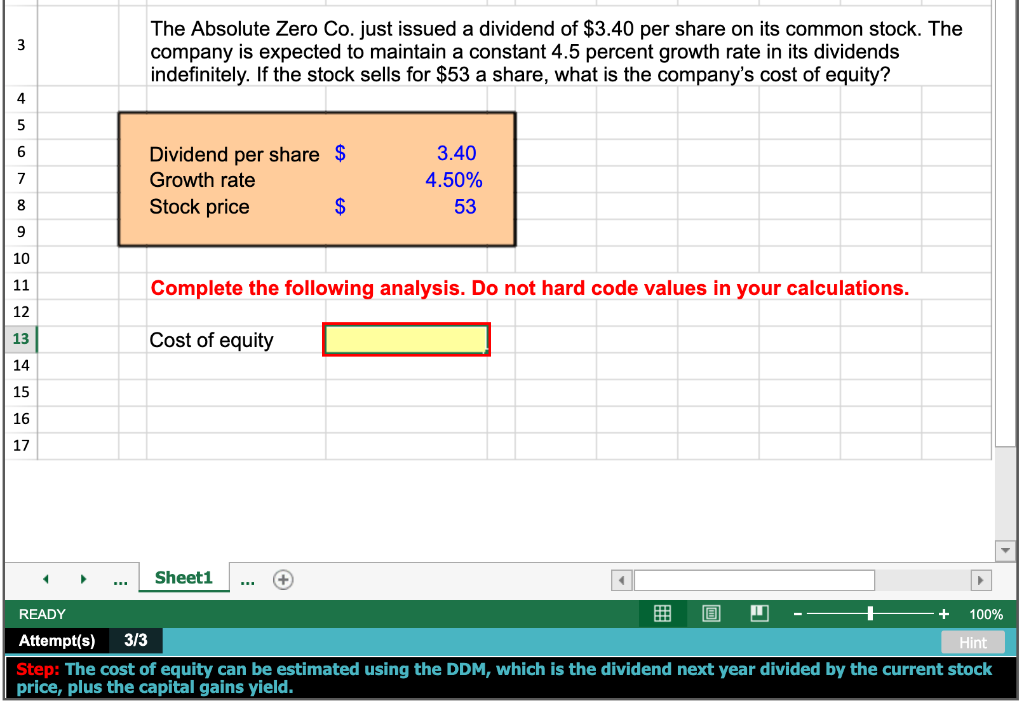

Question: PLEASE ANSWER IN EXCEL FORM WITH THE CELL FORMULAS USED TO SOLVE YELLOW BOX. I NEED TO KNOW HOW THE YELLOW BOX IS CALCULATED. The

PLEASE ANSWER IN EXCEL FORM WITH THE CELL FORMULAS USED TO SOLVE YELLOW BOX. I NEED TO KNOW HOW THE YELLOW BOX IS CALCULATED.

The Absolute Zero Co. just issued a dividend of $3.40 per share on its common stock. The company is expected to maintain a constant 4.5 percent growth rate in its dividends indefinitely. If the stock sells for $53 a share, what is the company's cost of equity? Dividend per share $ Growth rate Stock price 3.40 4.50% 53 Complete the following analysis. Do not hard code values in your calculations. Cost of equity Sheet1 READY O 0 -- + 100% Attempt(s) 3/3 Hint Step: The cost of equity can be estimated using the DDM, which is the dividend next year divided by the current stock price, plus the capital gains yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts