Question: PLEASE ANSWER IN EXCEL FORM WITH THE CELL FORMULAS USED TO SOLVE YELLOW BOX. I NEED TO KNOW HOW THE YELLOW BOX IS CALCULATED. Mullineaux

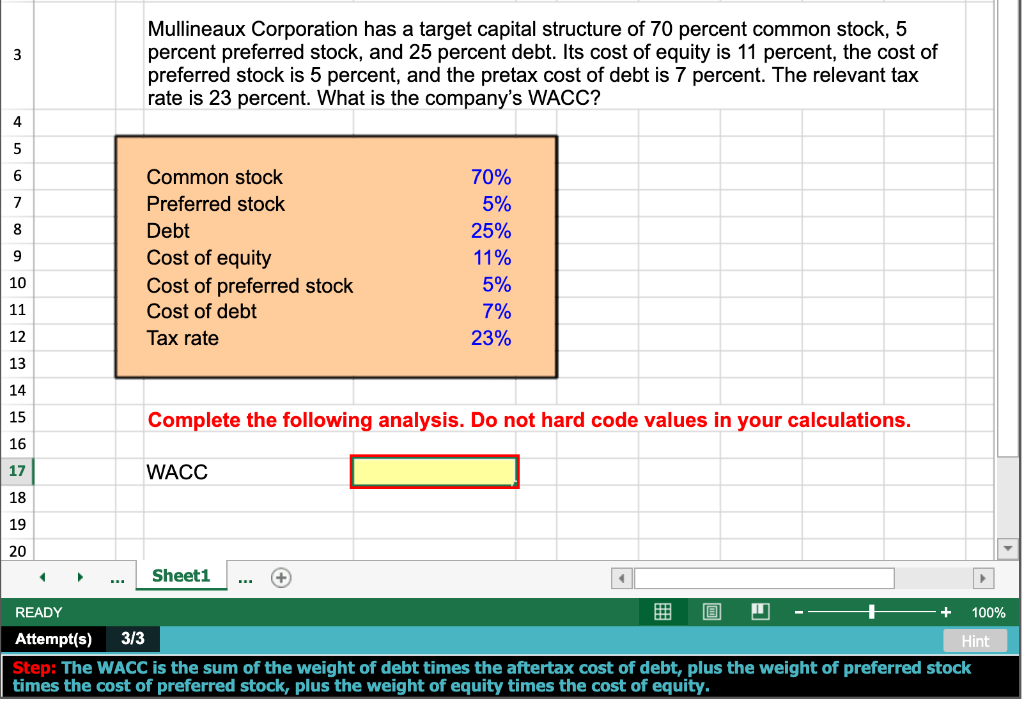

PLEASE ANSWER IN EXCEL FORM WITH THE CELL FORMULAS USED TO SOLVE YELLOW BOX. I NEED TO KNOW HOW THE YELLOW BOX IS CALCULATED.

Mullineaux Corporation has a target capital structure of 70 percent common stock, 5 percent preferred stock, and 25 percent debt. Its cost of equity is 11 percent, the cost of preferred stock is 5 percent, and the pretax cost of debt is 7 percent. The relevant tax rate is 23 percent. What is the company's WACC? Common stock Preferred stock Debt Cost of equity Cost of preferred stock Cost of debt Tax rate 70% 5% 25% 11% 5% 7% 23% Complete the following analysis. Do not hard code values in your calculations. WACC ... Sheet1 ... + READY @ U -- + 100% Attempt(s) 3/3 Hint Step: The WACC is the sum of the weight of debt times the aftertax cost of debt, plus the weight of preferred stock times the cost of preferred stock, plus the weight of equity times the cost of equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts