Question: Please answer in excel format! You consider buying a investment property in Fayetteville and the expect the value of the property going up 5% every

Please answer in excel format!

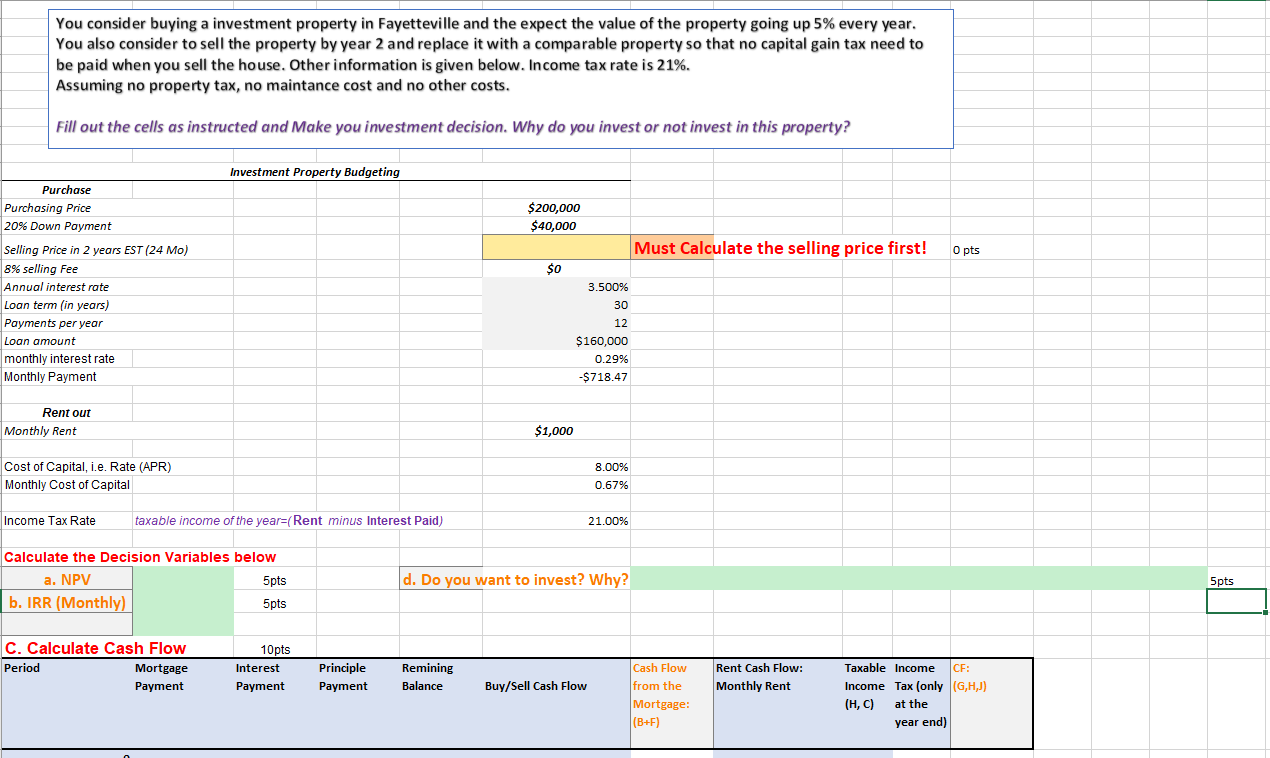

You consider buying a investment property in Fayetteville and the expect the value of the property going up 5% every year. You also consider to sell the property by year 2 and replace it with a comparable property so that no capital gain tax need to be paid when you sell the house. Other information is given below. Income tax rate is 21%. Assuming no property tax, no maintance cost and no other costs. Fill out the cells as instructed and Make you investment decision. Why do you invest or not invest in this property? Investment Property Budgeting $200,000 $40,000 Must Calculate the selling price first! O pts so Purchase Purchasing Price 20% Down Payment Selling Price in 2 years EST (24 Mo) 8% selling Fee Annual interest rate Loan term (in years) Payments per year Loan amount monthly interest rate Monthly Payment 3.500% 30 12 $160,000 0.29% -$718.47 Rent out Monthly Rent $1,000 Cost of Capital, i.e. Rate (APR) Monthly Cost of Capital 8.00% 0.67% Income Tax Rate taxable income of the year=(Rent minus Interest Paid) 21.00% Calculate the Decision Variables below 5pts b. IRR (Monthly) 5pts a. NPV d. Do you want to invest? Why? 5pts C. Calculate Cash Flow Period Mortgage Payment 10pts Interest Payment Principle Payment Remining Balance Rent Cash Flow: Monthly Rent Buy/Sell Cash Flow Cash Flow from the Mortgage: (B+F) Taxable income CE: Income Tax (only G, H,J) (H, C) at the year end)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts