Question: Please Answer Max and Sarah Smith are a married couple. They are both 30 years old and they have a 3 year old girl. Max

Please Answer

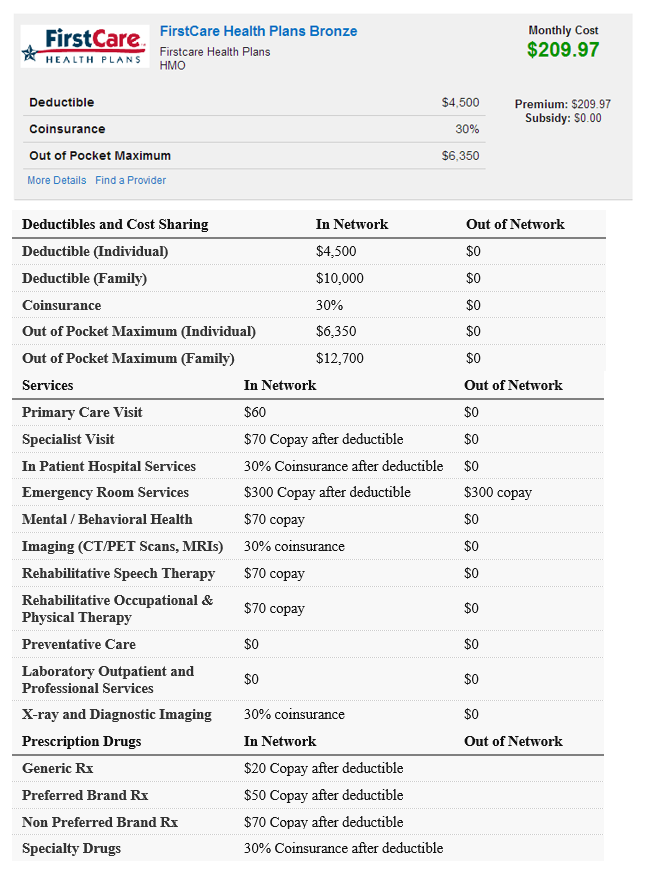

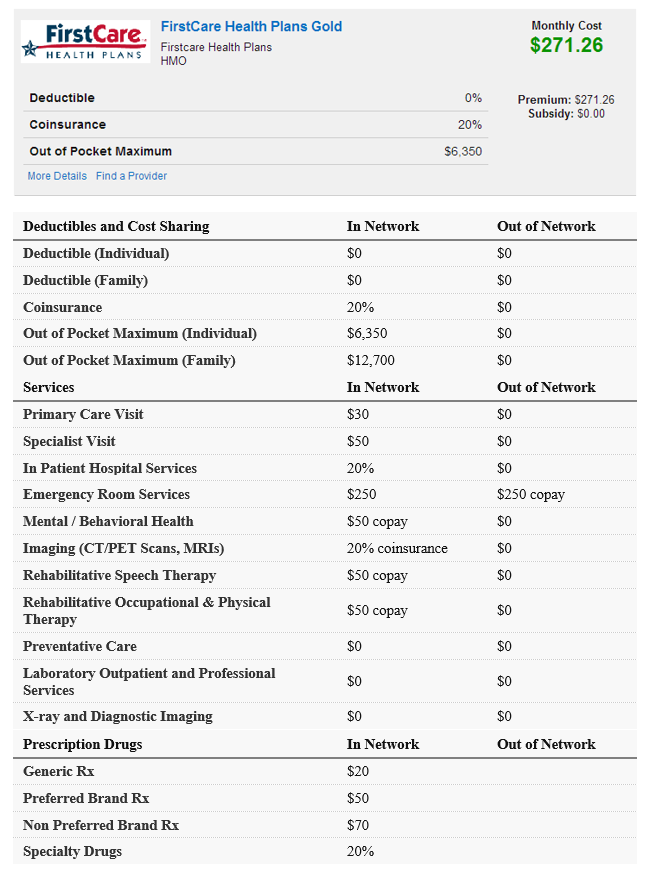

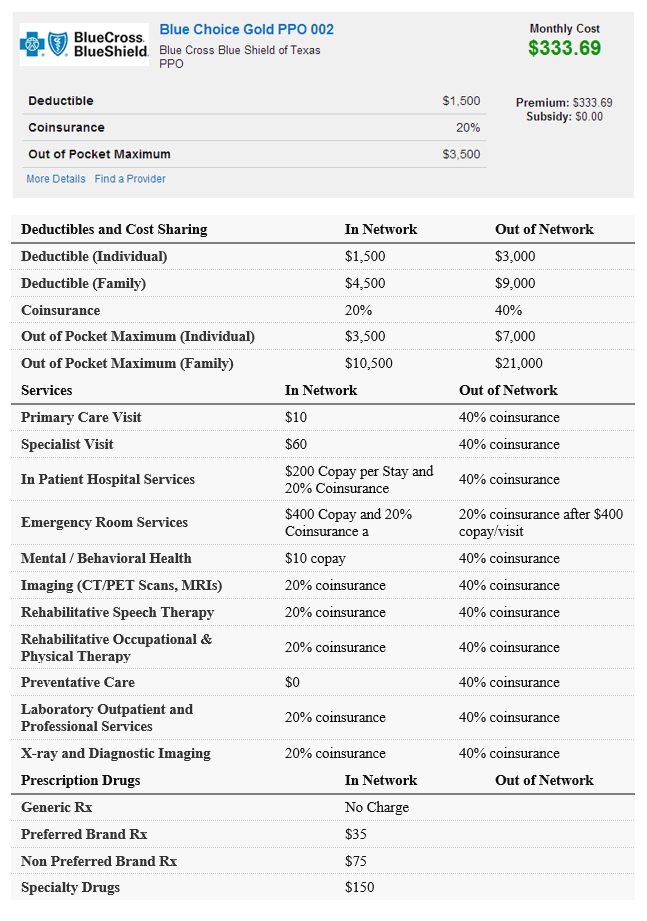

Max and Sarah Smith are a married couple. They are both 30 years old and they have a 3 year old girl. Max is a loan officer and earns $55.000 a year. Sarah works as a retail store manager and earns $50,000 a year. Max's life expectancy is 80 years and Sarah's is 82. They plan on retiring when they are 65. There are three health insurance policies that they could choose from (see page 3-5). No 4. Long-Term Care Insurance: a. Should the Smiths get long-term care insurance? Yes b. Explain your reasoning with evidence from the course materials: FirstCare Health Plans Bronze FirstCare Firstcare Health Plans HEALTH PLANS HMO Monthly Cost $209.97 $4,500 30% Premium: $209.97 Subsidy: $0.00 Deductible Coinsurance Out of Pocket Maximum More Details Find a Provider $6,350 Out of Network $0 $0 $0 $0 $0 Out of Network $0 $0 $0 $300 copay $0 Deductibles and Cost Sharing In Network Deductible (Individual) $4,500 Deductible (Family) $10,000 Coinsurance 30% Out of Pocket Maximum (Individual) $6,350 Out of Pocket Maximum (Family) $12,700 Services In Network Primary Care Visit $60 Specialist Visit $70 Copay after deductible In Patient Hospital Services 30% Coinsurance after deductible Emergency Room Services $300 Copay after deductible Mental / Behavioral Health $70 copay Imaging (CT/PET Scans, MRIS) 30% coinsurance Rehabilitative Speech Therapy $70 copay Rehabilitative Occupational & Physical Therapy Preventative Care $0 Laboratory Outpatient and $0 Professional Services X-ray and Diagnostic Imaging 30% coinsurance Prescription Drugs In Network Generic Rx $20 Copay after deductible Preferred Brand Rx $50 Copay after deductible Non Preferred Brand Rx $70 Copay after deductible Specialty Drugs 30% Coinsurance after deductible $0 $0 $70 copay $0 $0 $0 $0 Out of Network FirstCare Health Plans Gold FirstCare Firstcare Health Plans HEALTH PLANS HMO Monthly Cost $271.26 0% Premium: $271.26 Subsidy: $0.00 Deductible Coinsurance Out of Pocket Maximum More Details Find a Provider 20% $6,350 In Network $0 Out of Network $0 $0 $0 20% $0 $6,350 $0 $0 $12,700 In Network $30 Out of Network $0 $50 $0 20% $0 $250 $250 copay $0 Deductibles and Cost Sharing Deductible (Individual) Deductible (Family) Coinsurance Out of Pocket Maximum (Individual) Out of Pocket Maximum (Family) Services Primary Care Visit Specialist Visit In Patient Hospital Services Emergency Room Services Mental / Behavioral Health Imaging (CT/PET Scans, MRIS) Rehabilitative Speech Therapy Rehabilitative Occupational & Physical Therapy Preventative Care Laboratory Outpatient and Professional Services X-ray and Diagnostic Imaging Prescription Drugs Generic Rx Preferred Brand Rs Non Preferred Brand Rx Specialty Drugs $50 copay 20% coinsurance $50 copay $0 $0 $50 copay $0 $0 $0 $0 $0 $0 $0 In Network Out of Network $20 $50 $70 20% Max and Sarah Smith are a married couple. They are both 30 years old and they have a 3 year old girl. Max is a loan officer and earns $55.000 a year. Sarah works as a retail store manager and earns $50,000 a year. Max's life expectancy is 80 years and Sarah's is 82. They plan on retiring when they are 65. There are three health insurance policies that they could choose from (see page 3-5). No 4. Long-Term Care Insurance: a. Should the Smiths get long-term care insurance? Yes b. Explain your reasoning with evidence from the course materials: FirstCare Health Plans Bronze FirstCare Firstcare Health Plans HEALTH PLANS HMO Monthly Cost $209.97 $4,500 30% Premium: $209.97 Subsidy: $0.00 Deductible Coinsurance Out of Pocket Maximum More Details Find a Provider $6,350 Out of Network $0 $0 $0 $0 $0 Out of Network $0 $0 $0 $300 copay $0 Deductibles and Cost Sharing In Network Deductible (Individual) $4,500 Deductible (Family) $10,000 Coinsurance 30% Out of Pocket Maximum (Individual) $6,350 Out of Pocket Maximum (Family) $12,700 Services In Network Primary Care Visit $60 Specialist Visit $70 Copay after deductible In Patient Hospital Services 30% Coinsurance after deductible Emergency Room Services $300 Copay after deductible Mental / Behavioral Health $70 copay Imaging (CT/PET Scans, MRIS) 30% coinsurance Rehabilitative Speech Therapy $70 copay Rehabilitative Occupational & Physical Therapy Preventative Care $0 Laboratory Outpatient and $0 Professional Services X-ray and Diagnostic Imaging 30% coinsurance Prescription Drugs In Network Generic Rx $20 Copay after deductible Preferred Brand Rx $50 Copay after deductible Non Preferred Brand Rx $70 Copay after deductible Specialty Drugs 30% Coinsurance after deductible $0 $0 $70 copay $0 $0 $0 $0 Out of Network FirstCare Health Plans Gold FirstCare Firstcare Health Plans HEALTH PLANS HMO Monthly Cost $271.26 0% Premium: $271.26 Subsidy: $0.00 Deductible Coinsurance Out of Pocket Maximum More Details Find a Provider 20% $6,350 In Network $0 Out of Network $0 $0 $0 20% $0 $6,350 $0 $0 $12,700 In Network $30 Out of Network $0 $50 $0 20% $0 $250 $250 copay $0 Deductibles and Cost Sharing Deductible (Individual) Deductible (Family) Coinsurance Out of Pocket Maximum (Individual) Out of Pocket Maximum (Family) Services Primary Care Visit Specialist Visit In Patient Hospital Services Emergency Room Services Mental / Behavioral Health Imaging (CT/PET Scans, MRIS) Rehabilitative Speech Therapy Rehabilitative Occupational & Physical Therapy Preventative Care Laboratory Outpatient and Professional Services X-ray and Diagnostic Imaging Prescription Drugs Generic Rx Preferred Brand Rs Non Preferred Brand Rx Specialty Drugs $50 copay 20% coinsurance $50 copay $0 $0 $50 copay $0 $0 $0 $0 $0 $0 $0 In Network Out of Network $20 $50 $70 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts