Question: ( Please Answer My Questions 2 sub parts based on Image .... please Answer fast max 30-35 minutes And just send it answer.... i'm very

( Please Answer My Questions 2 sub parts based on Image .... please Answer fast max 30-35 minutes And just send it answer.... i'm very needed thank u )

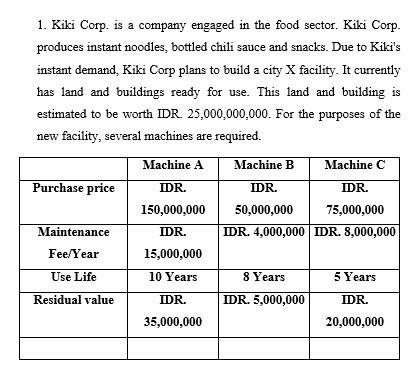

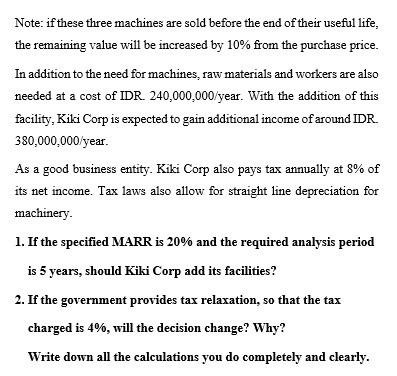

1. Kiki Corp. is a company engaged in the food sector. Kiki Corp. produces instant noodles, bottled chili sauce and snacks. Due to Kiki's instant demand, Kiki Corp plans to build a city X facility. It currently has land and buildings ready for use. This land and building is estimated to be worth IDR 25,000,000,000. For the purposes of the new facility, several machines are required. Machine A Machine B Machine C Purchase price IDR. IDR. IDR. 150,000,000 50,000,000 75,000,000 Maintenance IDR. IDR. 4,000,000 IDR. 8,000,000 Fee/Year 15,000,000 Use Life 10 Years 8 Years 5 Years Residual value IDR. IDR. 5,000,000 IDR. 35,000,000 20,000,000 Note: if these three machines are sold before the end of their useful life, the remaining value will be increased by 10% from the purchase price. In addition to the need for machines, raw materials and workers are also needed at a cost of IDR 240,000,000/year. With the addition of this facility, Kiki Corp is expected to gain additional income of around IDR. 380,000,000/year. As a good business entity. Kiki Corp also pays tax annually at 8% of its net income. Tax laws also allow for straight line depreciation for machinery 1. If the specified MARR is 20% and the required analysis period is 5 years, should Kiki Corp add its facilities? 2. If the government provides tax relaxation, so that the tax charged is 4%, will the decision change? Why? Write down all the calculations you do completely and clearly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts