Question: Please answer on paper no excel and show steps. The answer of the first question is necessary for the second. The duration = 1.9723, and

Please answer on paper no excel and show steps. The answer of the first question is necessary for the second. The duration = 1.9723, and the convexity = .044946.

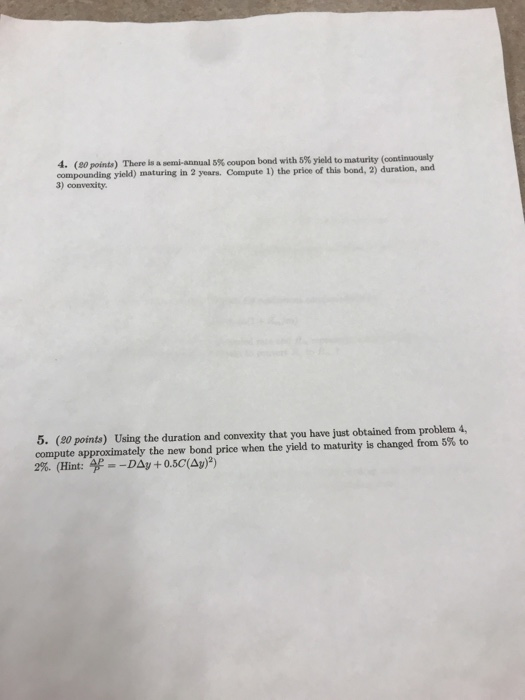

Please answer on paper no excel and show steps. The answer of the first question is necessary for the second. The duration = 1.9723, and the convexity = .044946. 4. 5% coupon bond with 5% yield to maturity (continuou!y conpounding yiel)maturing in 2 years Compute 1) the price of this bond, 2) duration, and (00 points) There is a semi-annual 3) convexity. 5. (20 points) Using the duration and convexity that you have just obtained from problem 4, compute approximately the new bond price when the yield to maturity is changed from 5% 2%. (Hint: --DAy + 0.5C(Ay)2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts