Question: Please answer part 4 and 5. Please do it asap.Thank you very much 1) You have three European 3-Month XYZ calls with exercise prices 100,

Please answer part 4 and 5. Please do it asap.Thank you very much

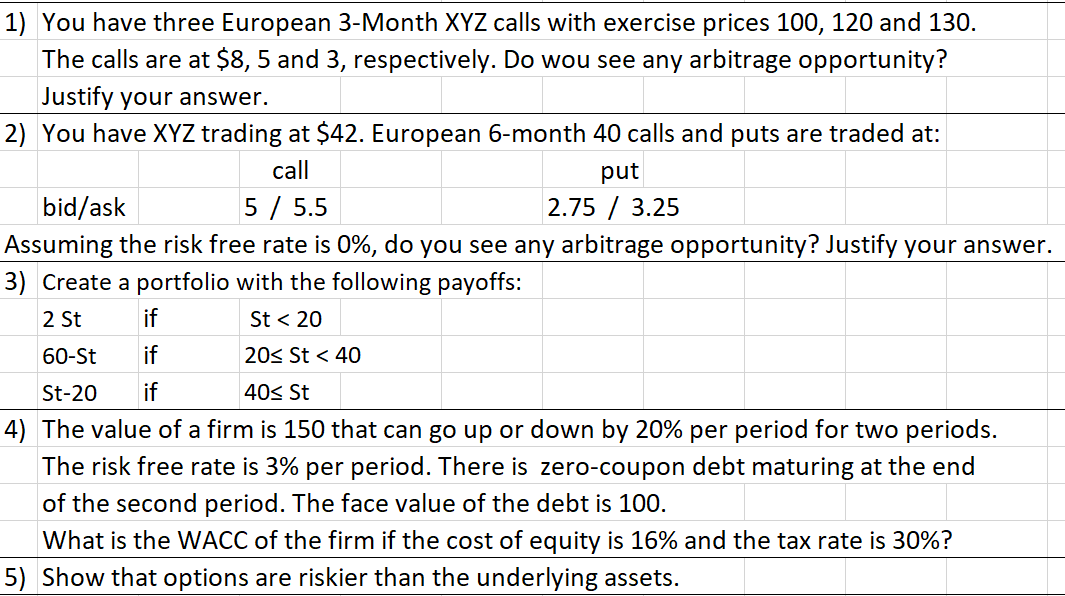

1) You have three European 3-Month XYZ calls with exercise prices 100, 120 and 130. The calls are at $8,5 and 3, respectively. Do wou see any arbitrage opportunity? Justify your answer. 2) You have XYZ trading at $42. European 6-month 40 calls and puts are traded at: call put bid/ask 5 / 5.5 2.75 / 3.25 Assuming the risk free rate is 0%, do you see any arbitrage opportunity? Justify your answer. 3) Create a portfolio with the following payoffs: 2 St if St

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts