Question: please answer part A & B Optimistic-NOI will be $200,000 the first year and increase 3 percent per year over a five-year holding period. The

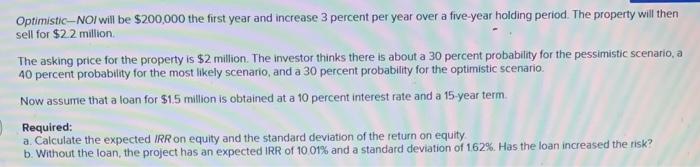

Optimistic-NOI will be $200,000 the first year and increase 3 percent per year over a five-year holding period. The property will then sell for $22 million. The asking price for the property is $2 million. The investor thinks there is about a 30 percent probability for the pessimistic scenario, a 40 percent probability for the most likely scenario, and a 30 percent probability for the optimistic scenario. Now assume that a loan for $1.5 million is obtained at a 10 percent interest rate and a 15 -year term. Required: a. Calculate the expected IRR on equity and the standard deviation of the return on equity b. Without the loan, the project has an expected IRR of 10.01% and a standard deviation of 162%. Has the loan increased the risk? Optimistic-NOI will be $200,000 the first year and increase 3 percent per year over a five-year holding period. The property will then sell for $22 million. The asking price for the property is $2 million. The investor thinks there is about a 30 percent probability for the pessimistic scenario, a 40 percent probability for the most likely scenario, and a 30 percent probability for the optimistic scenario. Now assume that a loan for $1.5 million is obtained at a 10 percent interest rate and a 15 -year term. Required: a. Calculate the expected IRR on equity and the standard deviation of the return on equity b. Without the loan, the project has an expected IRR of 10.01% and a standard deviation of 162%. Has the loan increased the risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts