Question: Please answer part a Compute and Interpret Liquidity, Solvency and Coverage Ratios Selected balance sheet and income statement information for Calpine Corporation for 2004 and

Please answer part a

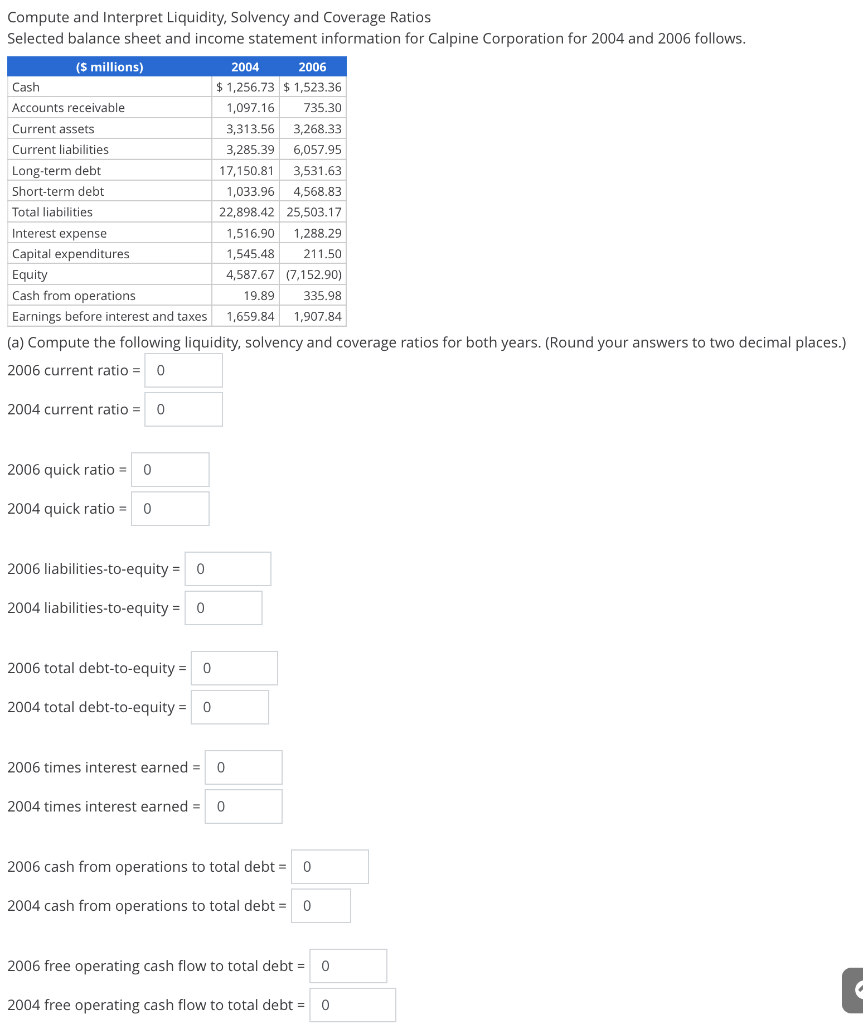

Compute and Interpret Liquidity, Solvency and Coverage Ratios Selected balance sheet and income statement information for Calpine Corporation for 2004 and 2006 follows. ($ millions) 2004 2006 Cash $ 1,256.73 $ 1,523.36 Accounts receivable 1,097.16 735.30 Current assets 3,313.56 3,268.33 Current liabilities 3,285.39 6,057.95 Long-term debt 17,150.81 3,531.63 Short-term debt 1,033.96 4,568.83 Total liabilities 22,898.42 25,503.17 Interest expense 1,516.90 1,288.29 Capital expenditures 1,545.48 211.50 Equity 4,587.67 (7,152.90) Cash from operations 19.89 335.98 Earnings before interest and taxes 1,659.84 1,907.84 (a) Compute the following liquidity, solvency and coverage ratios for both years. (Round your answers to two decimal places.) 2006 current ratio = 0 2004 current ratio = 0 2006 quick ratio = 0 2004 quick ratio = 0 2006 liabilities-to-equity 0 2004 liabilities-to-equity = 0 2006 total debt-to-equity = 0 2004 total debt-to-equity = 0 2006 times interest earned = 0 2004 times interest earned = 0 2006 cash from operations to total debt = 0 2004 cash from operations to total debt = 0 2006 free operating cash flow to total debt = 0 2004 free operating cash flow to total debt = 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts