Question: PLEASE ANSWER PART B Note: You can right-click the image then open in a new tab to better see the problem Problem 4-1 On January

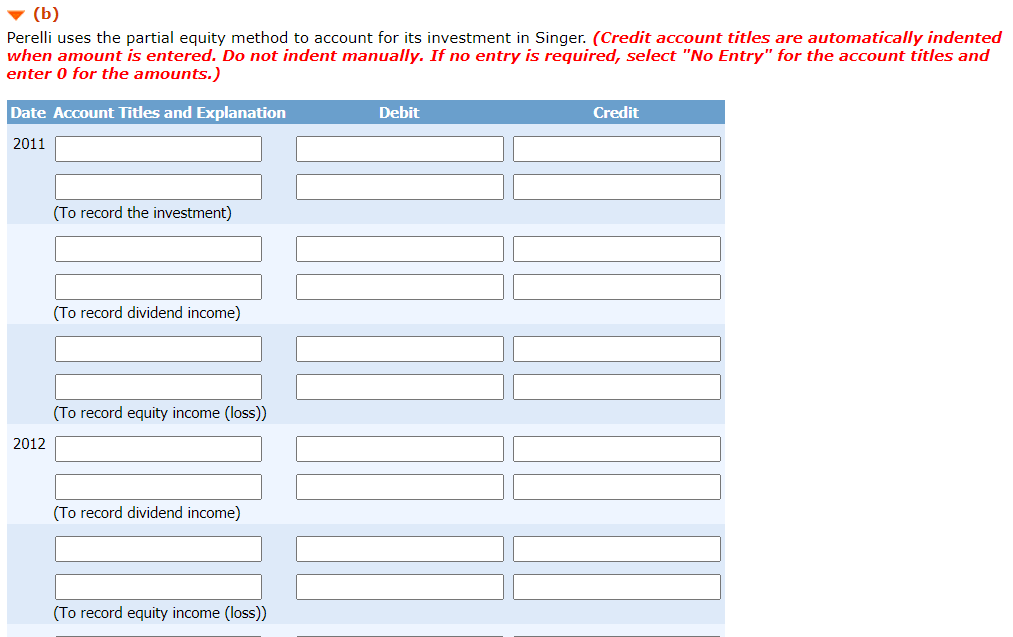

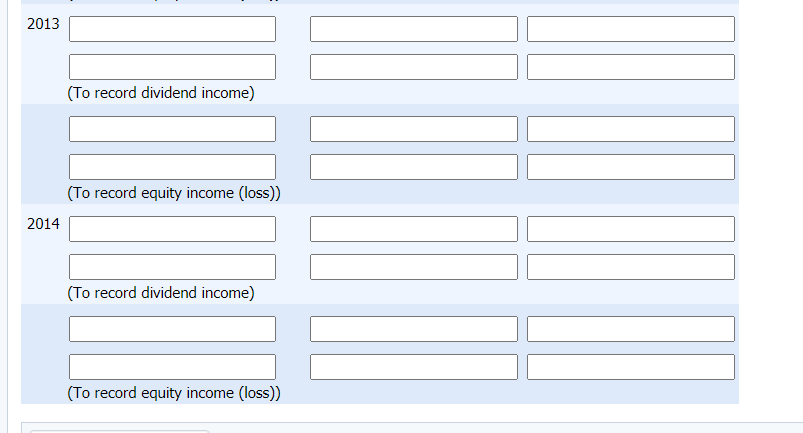

PLEASE ANSWER PART B

Note: You can right-click the image then open in a new tab to better see the problem

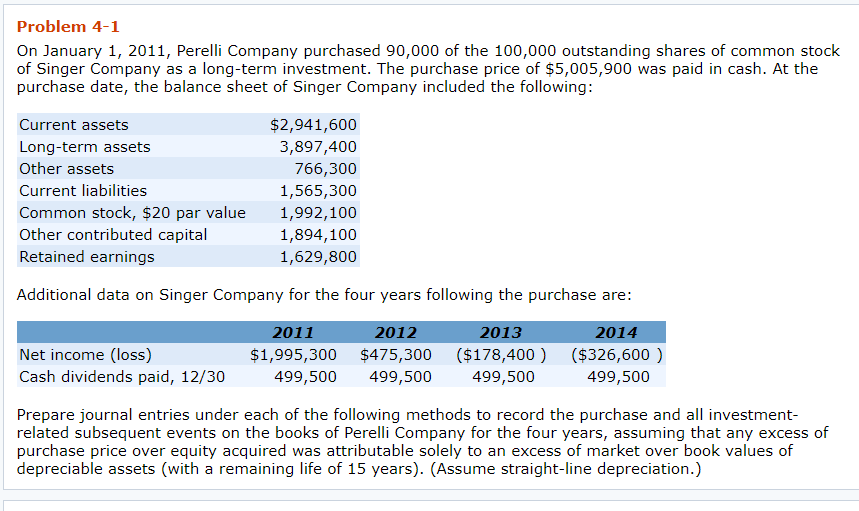

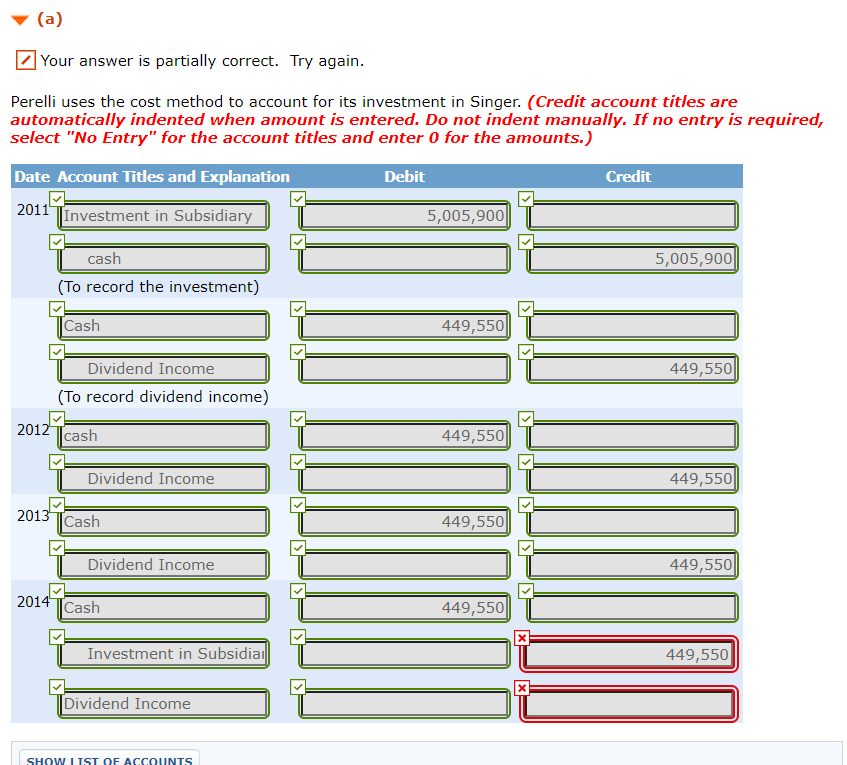

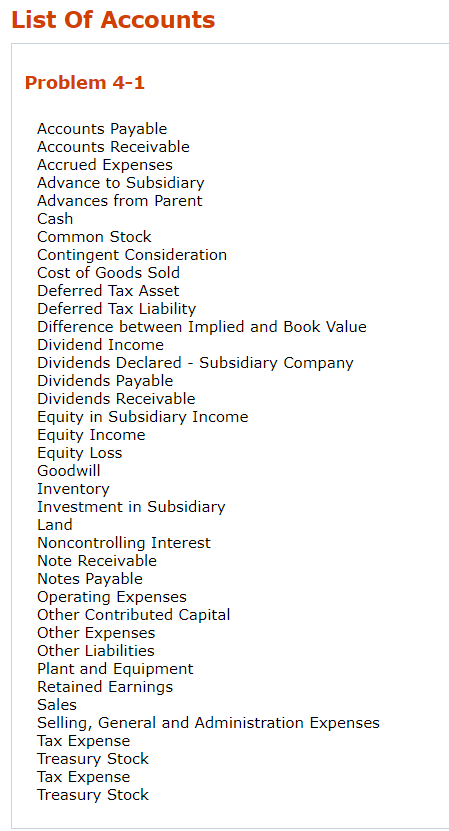

Problem 4-1 On January 1, 2011, Perelli Company purchased 90,000 of the 100,000 outstanding shares of common stock of Singer Company as a long-term investment. The purchase price of $5,005,900 was paid in cash. At the purchase date, the balance sheet of Singer Company included the following: Current assets Long-term assets Other assets Current liabilities Common stock, $20 par value Other contributed capital Retained earnings $2,941,600 3,897,400 766,300 1,565,300 1,992,100 1,894,100 1,629,800 Additional data on Singer Company for the four years following the purchase are: Net income (loss) Cash dividends paid, 12/30 2011 2012 $1,995,300 $475,300 499,500 499,500 2013 ($178,400) 499,500 2014 ($326,600 ) 499,500 Prepare journal entries under each of the following methods to record the purchase and all investment- related subsequent events on the books of Perelli Company for the four years, assuming that any excess of purchase price over equity acquired was attributable solely to an excess of market over book values of depreciable assets (with a remaining life of 15 years). (Assume straight-line depreciation.) (a) Your answer is partially correct. Try again. Perelli uses the cost method to account for its investment in Singer. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Debit Credit Date Account Titles and Explanation 2011 Investment in Subsidiary 5,005,900 5,005,900 cash (To record the investment) Cash 449,550 449,550 Dividend Income (To record dividend income) 2012 Tcash 449,550 Dividend Income 449,550 2013 Cash 449,550 Dividend Income 449,5501 2014 Cash 449,550 X Investment in Subsidiai 449,550 X Dividend Income SHOW ITST OF ACCOUNTS (b) Perelli uses the partial equity method to account for its investment in Singer. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit 2011 (To record the investment) (To record dividend income) (To record equity income (loss)) 2012 (To record dividend income) (To record equity income (loss)) 2013 (To record dividend income) (To record equity income (loss) 2014 (To record dividend income) (To record equity income (loss)) List Of Accounts Problem 4-1 Accounts Payable Accounts Receivable Accrued Expenses Advance to Subsidiary Advances from Parent Cash Common Stock Contingent Consideration Cost of Goods Sold Deferred Tax Asset Deferred Tax Liability Difference between Implied and Book Value Dividend Income Dividends Declared - Subsidiary Company Dividends Payable Dividends Receivable Equity in Subsidiary Income Equity Income Equity Loss Goodwill Inventory Investment in Subsidiary Land Noncontrolling Interest Note Receivable Notes Payable Operating Expenses Other Contributed Capital Other Expenses Other Liabilities Plant and Equipment Retained Earnings Sales Selling, General and Administration Expenses Tax Expense Treasury Stock Tax Expense Treasury Stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts