Question: Please Answer Question 15A and 15B. Question 14 only included to provide information necessary to answer 15. thank you! 4. The Budvar Company sells parts

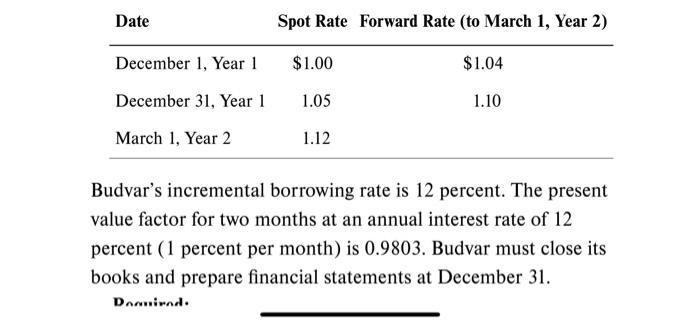

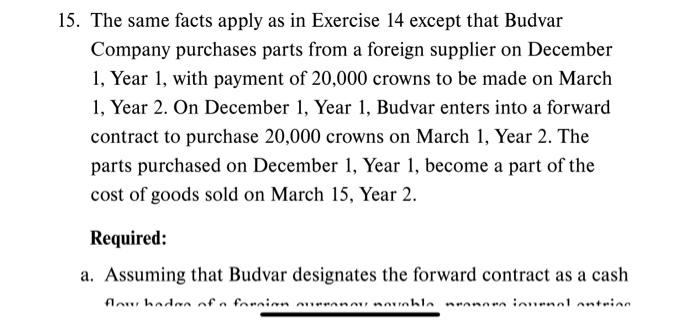

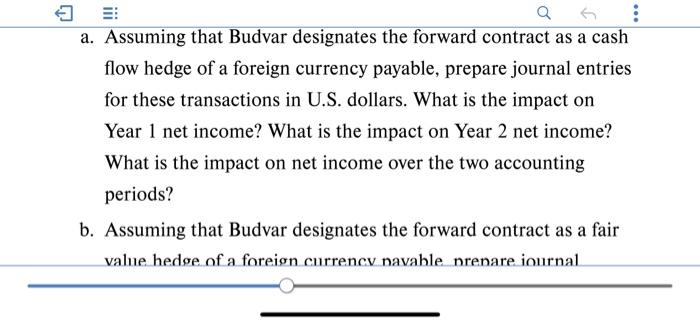

4. The Budvar Company sells parts to a foreign customer on December 1, Year 1, with payment of 20,000 crowns to be received on March 1, Year 2. Budvar enters into a forward contract on December 1, Year 1, to sell 20,000 crowns on March 1, Year 2. Relevant exchange rates for the crown on various dates are as follows: Budvar's incremental borrowing rate is 12 percent. The present value factor for two months at an annual interest rate of 12 percent ( 1 percent per month) is 0.9803. Budvar must close its books and prepare financial statements at December 31 . Donuimad. 15. The same facts apply as in Exercise 14 except that Budvar Company purchases parts from a foreign supplier on December 1, Year 1, with payment of 20,000 crowns to be made on March 1, Year 2. On December 1, Year 1, Budvar enters into a forward contract to purchase 20,000 crowns on March 1, Year 2. The parts purchased on December 1, Year 1, become a part of the cost of goods sold on March 15, Year 2. Required: a. Assuming that Budvar designates the forward contract as a cash a. Assuming that Budvar designates the forward contract as a cash flow hedge of a foreign currency payable, prepare journal entries for these transactions in U.S. dollars. What is the impact on Year 1 net income? What is the impact on Year 2 net income? What is the impact on net income over the two accounting periods? b. Assuming that Budvar designates the forward contract as a fair value hedge of a foreion currency navable nrenare inurnal b. Assuming that Budvar designates the forward contract as a fair value hedge of a foreign currency payable, prepare journal entries for these transactions in U.S. dollars. What is the impact on Year 1 net income? What is the impact on Year 2 net income? What is the impact on net income over the two accounting periods? 4. The Budvar Company sells parts to a foreign customer on December 1, Year 1, with payment of 20,000 crowns to be received on March 1, Year 2. Budvar enters into a forward contract on December 1, Year 1, to sell 20,000 crowns on March 1, Year 2. Relevant exchange rates for the crown on various dates are as follows: Budvar's incremental borrowing rate is 12 percent. The present value factor for two months at an annual interest rate of 12 percent ( 1 percent per month) is 0.9803. Budvar must close its books and prepare financial statements at December 31 . Donuimad. 15. The same facts apply as in Exercise 14 except that Budvar Company purchases parts from a foreign supplier on December 1, Year 1, with payment of 20,000 crowns to be made on March 1, Year 2. On December 1, Year 1, Budvar enters into a forward contract to purchase 20,000 crowns on March 1, Year 2. The parts purchased on December 1, Year 1, become a part of the cost of goods sold on March 15, Year 2. Required: a. Assuming that Budvar designates the forward contract as a cash a. Assuming that Budvar designates the forward contract as a cash flow hedge of a foreign currency payable, prepare journal entries for these transactions in U.S. dollars. What is the impact on Year 1 net income? What is the impact on Year 2 net income? What is the impact on net income over the two accounting periods? b. Assuming that Budvar designates the forward contract as a fair value hedge of a foreion currency navable nrenare inurnal b. Assuming that Budvar designates the forward contract as a fair value hedge of a foreign currency payable, prepare journal entries for these transactions in U.S. dollars. What is the impact on Year 1 net income? What is the impact on Year 2 net income? What is the impact on net income over the two accounting periods

Step by Step Solution

There are 3 Steps involved in it

Question 15 Analysis and Journal Entries Scenario Recap Budvar purchases parts from a foreign supplier on December 1 Year 1 Payment of 20000 crowns is due on March 1 Year 2 Enters into a forward contr... View full answer

Get step-by-step solutions from verified subject matter experts