Question: Please answer question 2 in multiple sentences using the above passage. Thanks! Mini-Case Sony's Dilemma, Matching Strategy and Structure Launched in 1946 in Japan, Sony

Please answer question 2 in multiple sentences using the above passage. Thanks!

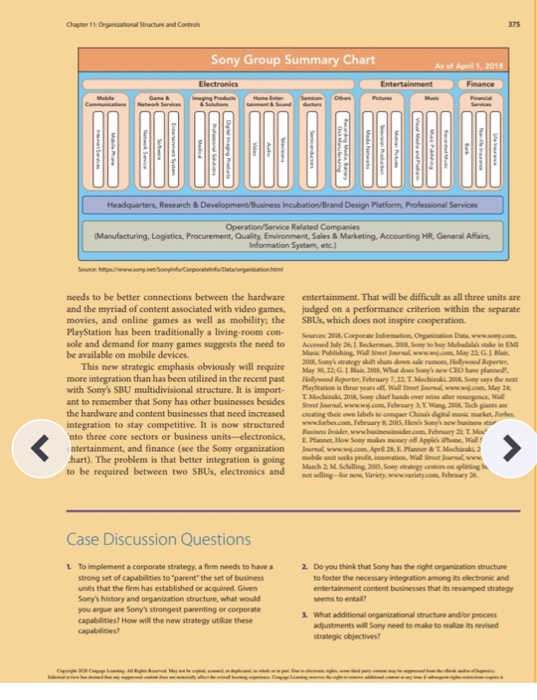

Mini-Case Sony's Dilemma, Matching Strategy and Structure Launched in 1946 in Japan, Sony gained a reputation for producing innovative products that were sold through out the world. In fact, the firm's success was instrumen tal to Japan's development as a powerful caporter during the 1960s, 1970s and 1980s. Sony was sometimes first to market" with an innovative product, while sometimes being able to rapidly enhance a product's capabilities by innovating. Introduced in 1979, the Sony Walkman which was a personal stereotape deck, is an example of a "first to market product from Sony. On the other hand, Sony innovated the transistor radio--initially developed by Regency Electronics and Texas Instruments--in a way that made the product commercially viable. Regardless of the type, innovation has been critical to how Sony competes in multiple product areas. Realizing the value that could be gained by sharing resources, capabilities, and core competencies across types of businesses, Sony's success for many decades was a product of its commitment to convergence, which the firm operationalized by linking its activi- ties across businesses such as film, music, and digital electronics. In essence, Sony was successful for many years as a result of being able to effectively implement the related constrained strategy. But as we noted in the chapter when discussing the related constrained strategy and the structure needed to implement it, an inability to efficiently process information and coordi nate an array of integrated activities between units are problems that may surface when using the cooperative form of the multidivisional structure. This appears to be the case for Sony. In response to performance prob- lems that have plagued the form for over a decade, Sony put into place significant structural changes in October 2015, intended to be the foundation for improve ments to Sony's ability to create value for customers and enhance wealth for shareholders. At the core of the structural changes are efforts to group the firm's businesses in ways that allow Sony's upper-level lead ers to more effectively allocate financial capital. A key objective is to allocate capital to the businesses with the strongest potential not just to grow, but to grow profit ably. In essence, the new structure is an cuample of the SBU form of the multidivisional structure However, in 2018, with new CEO Kenichiro Yoshida (formerly the CFO). Sony is again making a strate gic shift. Yoshida laid out a strategy shift away from hardware and toward content in outlining a three-year business plan. This is not a shock, Sony sold sl million electronic devices in 2011, but only half that volume in 2017. This plan also dispels rumors that Yoshida would dl Sony Pictures, which had successes in a remake of Jumanji, and continued production of the Spiderman movie series. In fostering this shift, Sony recently bol stered its entertainment assets by buying the majority of shares it did not own in EMI Music from Mubadala Lavestment Co The problem is that cooperation among the busi- ness units is going to be more salient. One of its cen- tral competitors, Disney has been very successful in integrating its content businesses such that its mov- ies and TV show characters feed well into its theme parks and retail sales of cartoon and action figures (see the Mini-case at the end of Chapter 6). However, Sony has not been very successful at such integration attempts. For example, Sony's attempt to build a global content-delivery platform via the PlayStation gaming console has not been very fruitful. As Media Partners Asia executive director Vivek Couto suggested, "the company has missed an opportunity to leverage IP from PlayStation games for movies and TV." Sony also comes off poorly in utilizing properties across divisions that integration needs to happen." Sony's new strategy is playing out in video game controllers.currently in its PlayStation 4 console. "Sony has been shifting its PlayStation focus from hardware to online subscription services, including a $60 annual package that includes games and multiplayer features that service, PlayStation Plus, had 34 million users as of March 2018, fitting the new CEO's goal of add ing reven sources that are more stable than volatile hardware and software sales. The leader of this busi- mess unit. Tsuyoshi Kodera, has noted that Sony will take its time in coming out with the fifth generation PlayStation console: "We're no longer in a time when you can think just about the console or just about the network like they're two different things. Thus, there and Control Sony Group Summary Chart Headquarters, Research & Development Business Incubation Brand Design Platform, Professional Services Operation Service Related Companies Manufacturing, Logistics, Procurement, Quality, Environment, Sales & Marketing, Accounting HR. General Affairs, Information System, etc.) needs to be better connections between the hardware and the myriad of content associated with video games, movies, and online games as well as mobility: the PlayStation has been traditionally a living room con sole and demand for many games suggests the need to be available on mobile devices. This new strategic emphasis obviously will require more integration than has been utilized in the recent past with Sony's SBU multidivisional structure. It is import- ant to remember that Sony has other businesses besides the hardware and content businesses that need increased integration to stay competitive. It is now structured into three core sectors or business units-electronics, ntertainment, and finance (see the Sony organization chart). The problem is that better integration is going to be required between two SBUs, electronics and entertainment. That will be difficult as all three units are judged on a performance criterion within the separate SBUS, which does not inspire cooperation Source: 2011. Corporate imati n a www . Acceed July 1 Beckerman , Sony to by l o take in Music Publishing. W w w My 2005. Som strategis down l oad Report May G. 20, What does Soy who he planned olywood Reporter, February 7,22 T Media Soys the Payton is the year w w .May I Medink 2018, Sachid hand over her e Stora www.com.brary W . Tech ating their own labels to con d u tores www. bes.com February 2015. Hende s Busin e , www.business.com E Panne How makes www Bobek po www Mand M illing 2015, Case Discussion Questions 1 To implement a corporate strategy, a firm needs to have a strong set of capabilities to parent the set of business is that the firm has established or acquired Given Sony history and organization structure, what would you argue are Sony's strongest parenting or corporate ca s ? How will the new strategy these 2 Do you think that Sony has the right organization structure to foster the necessary integration among its electronic and entertainment content businesses that is reaped strategy Whatalogo cuando djustments will Sony need to make to strategic objectives? revised Mini-Case Sony's Dilemma, Matching Strategy and Structure Launched in 1946 in Japan, Sony gained a reputation for producing innovative products that were sold through out the world. In fact, the firm's success was instrumen tal to Japan's development as a powerful caporter during the 1960s, 1970s and 1980s. Sony was sometimes first to market" with an innovative product, while sometimes being able to rapidly enhance a product's capabilities by innovating. Introduced in 1979, the Sony Walkman which was a personal stereotape deck, is an example of a "first to market product from Sony. On the other hand, Sony innovated the transistor radio--initially developed by Regency Electronics and Texas Instruments--in a way that made the product commercially viable. Regardless of the type, innovation has been critical to how Sony competes in multiple product areas. Realizing the value that could be gained by sharing resources, capabilities, and core competencies across types of businesses, Sony's success for many decades was a product of its commitment to convergence, which the firm operationalized by linking its activi- ties across businesses such as film, music, and digital electronics. In essence, Sony was successful for many years as a result of being able to effectively implement the related constrained strategy. But as we noted in the chapter when discussing the related constrained strategy and the structure needed to implement it, an inability to efficiently process information and coordi nate an array of integrated activities between units are problems that may surface when using the cooperative form of the multidivisional structure. This appears to be the case for Sony. In response to performance prob- lems that have plagued the form for over a decade, Sony put into place significant structural changes in October 2015, intended to be the foundation for improve ments to Sony's ability to create value for customers and enhance wealth for shareholders. At the core of the structural changes are efforts to group the firm's businesses in ways that allow Sony's upper-level lead ers to more effectively allocate financial capital. A key objective is to allocate capital to the businesses with the strongest potential not just to grow, but to grow profit ably. In essence, the new structure is an cuample of the SBU form of the multidivisional structure However, in 2018, with new CEO Kenichiro Yoshida (formerly the CFO). Sony is again making a strate gic shift. Yoshida laid out a strategy shift away from hardware and toward content in outlining a three-year business plan. This is not a shock, Sony sold sl million electronic devices in 2011, but only half that volume in 2017. This plan also dispels rumors that Yoshida would dl Sony Pictures, which had successes in a remake of Jumanji, and continued production of the Spiderman movie series. In fostering this shift, Sony recently bol stered its entertainment assets by buying the majority of shares it did not own in EMI Music from Mubadala Lavestment Co The problem is that cooperation among the busi- ness units is going to be more salient. One of its cen- tral competitors, Disney has been very successful in integrating its content businesses such that its mov- ies and TV show characters feed well into its theme parks and retail sales of cartoon and action figures (see the Mini-case at the end of Chapter 6). However, Sony has not been very successful at such integration attempts. For example, Sony's attempt to build a global content-delivery platform via the PlayStation gaming console has not been very fruitful. As Media Partners Asia executive director Vivek Couto suggested, "the company has missed an opportunity to leverage IP from PlayStation games for movies and TV." Sony also comes off poorly in utilizing properties across divisions that integration needs to happen." Sony's new strategy is playing out in video game controllers.currently in its PlayStation 4 console. "Sony has been shifting its PlayStation focus from hardware to online subscription services, including a $60 annual package that includes games and multiplayer features that service, PlayStation Plus, had 34 million users as of March 2018, fitting the new CEO's goal of add ing reven sources that are more stable than volatile hardware and software sales. The leader of this busi- mess unit. Tsuyoshi Kodera, has noted that Sony will take its time in coming out with the fifth generation PlayStation console: "We're no longer in a time when you can think just about the console or just about the network like they're two different things. Thus, there and Control Sony Group Summary Chart Headquarters, Research & Development Business Incubation Brand Design Platform, Professional Services Operation Service Related Companies Manufacturing, Logistics, Procurement, Quality, Environment, Sales & Marketing, Accounting HR. General Affairs, Information System, etc.) needs to be better connections between the hardware and the myriad of content associated with video games, movies, and online games as well as mobility: the PlayStation has been traditionally a living room con sole and demand for many games suggests the need to be available on mobile devices. This new strategic emphasis obviously will require more integration than has been utilized in the recent past with Sony's SBU multidivisional structure. It is import- ant to remember that Sony has other businesses besides the hardware and content businesses that need increased integration to stay competitive. It is now structured into three core sectors or business units-electronics, ntertainment, and finance (see the Sony organization chart). The problem is that better integration is going to be required between two SBUs, electronics and entertainment. That will be difficult as all three units are judged on a performance criterion within the separate SBUS, which does not inspire cooperation Source: 2011. Corporate imati n a www . Acceed July 1 Beckerman , Sony to by l o take in Music Publishing. W w w My 2005. Som strategis down l oad Report May G. 20, What does Soy who he planned olywood Reporter, February 7,22 T Media Soys the Payton is the year w w .May I Medink 2018, Sachid hand over her e Stora www.com.brary W . Tech ating their own labels to con d u tores www. bes.com February 2015. Hende s Busin e , www.business.com E Panne How makes www Bobek po www Mand M illing 2015, Case Discussion Questions 1 To implement a corporate strategy, a firm needs to have a strong set of capabilities to parent the set of business is that the firm has established or acquired Given Sony history and organization structure, what would you argue are Sony's strongest parenting or corporate ca s ? How will the new strategy these 2 Do you think that Sony has the right organization structure to foster the necessary integration among its electronic and entertainment content businesses that is reaped strategy Whatalogo cuando djustments will Sony need to make to strategic objectives? revised