Question: please answer question 21. i will give a guaranteed thumps up/ upvote for working and correct answer. thank you. For Q.20) to Q.21), please refer

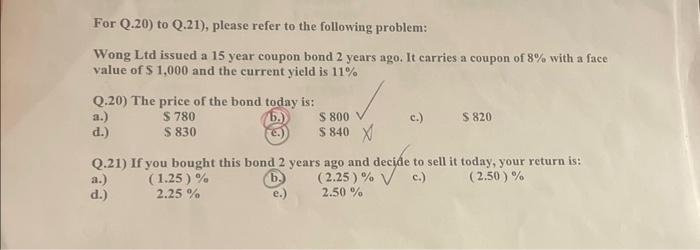

For Q.20) to Q.21), please refer to the following problem: Wong Ltd issued a 15 year coupon bond 2 years ago. It carries a coupon of \8 with a face value of \\( \\$ 1,000 \\) and the current yield is \11 Q.20) The price of the bond today is: a.) \\( \\quad \\$ 780 \\) d.) \\( \\$ 830 \\) b.) \\( \\$ 800 \\) c.) \\( \\$ 820 \\) Q.21) If you bought this bond 2 years ago and decie to sell it today, your return is: a.) (1.25) \\% (b.) \(2.25) c.) \(2.50) d.) \2.25 e.) \2.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts