Question: please answer question 24, a guaranteed thumps up for correct answer with working. thank you. For Q 22 to ( Q 24 ), please refer

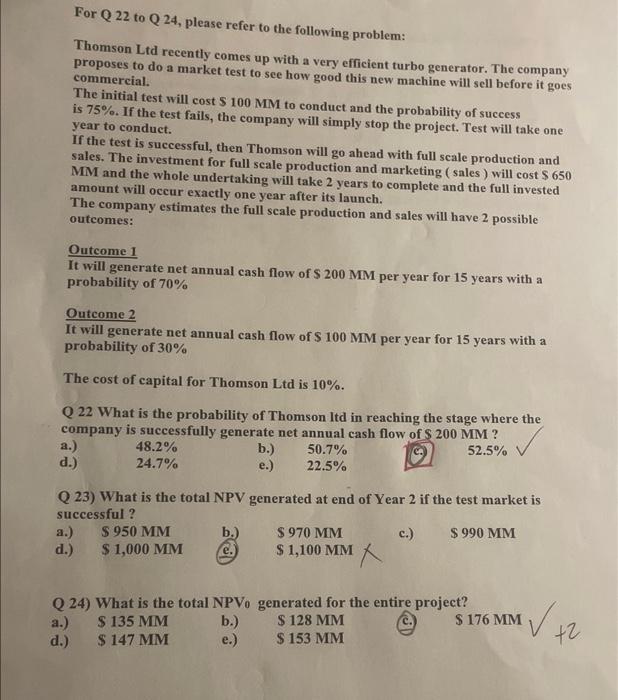

For Q 22 to \\( Q 24 \\), please refer to the following problem: Thomson Ltd recently comes up with a very efficient turbo generator. The company proposes to do a market test to see how good this new machine will sell before it goes commercial. The initial test will cost \\( 5100 \\mathrm{MM} \\) to conduct and the probability of success is \75. If the test fails, the company will simply stop the project. Test will take one year to conduct. If the test is successful, then Thomson will go ahead with full scale production and sales. The investment for full scale production and marketing ( sales) will cost \\$ 650 \\( \\mathrm{MM} \\) and the whole undertaking will take 2 years to complete and the full invested amount will occur exactly one year after its launch. The company estimates the full scale production and sales will have 2 possible outcomes: Outcome 1 It will generate net annual cash flow of \\( \\$ 200 \\mathrm{MM} \\) per year for 15 years with a probability of \70 Outcome 2 It will generate net annual cash flow of \\( \\$ 100 \\mathrm{MM} \\) per year for 15 years with a probability of \30 The cost of capital for Thomson Ltd is \10. Q 22 What is the probability of Thomson Itd in reaching the stage where the company is successfully generate net annual cash flow of \\( \\$ 200 \\mathrm{MM} \\) ? a.) \quad48.2 d.) \quadmathbf24.7 b.) \50.7 e.) \22.5 \52.5 Q 23) What is the total NPV generated at end of Year 2 if the test market is successful ? a.) \\( \\$ 950 \\mathrm{MM} \\) b.) \\( \\$ 970 \\mathrm{MM} \\) c.) \\( \\$ 990 \\mathrm{MM} \\) d.) \\( \\$ 1,000 \\mathrm{MM} \\) e. \\( \\$ 1,100 \\mathrm{MM} \\) Q 24) What is the total \\( N P V_{0} \\) generated for the entire project? a.) \\( \\$ 135 \\mathrm{MM} \\) b.) \\( \\$ 128 \\mathrm{MM} \\) d.) \\( \\$ 147 \\mathrm{MM} \\) e.) \\( \\$ 153 \\mathrm{MM} \\) \\( \\$ 176 \\mathrm{MM} \\) For Q 22 to \\( Q 24 \\), please refer to the following problem: Thomson Ltd recently comes up with a very efficient turbo generator. The company proposes to do a market test to see how good this new machine will sell before it goes commercial. The initial test will cost \\( 5100 \\mathrm{MM} \\) to conduct and the probability of success is \75. If the test fails, the company will simply stop the project. Test will take one year to conduct. If the test is successful, then Thomson will go ahead with full scale production and sales. The investment for full scale production and marketing ( sales) will cost \\$ 650 \\( \\mathrm{MM} \\) and the whole undertaking will take 2 years to complete and the full invested amount will occur exactly one year after its launch. The company estimates the full scale production and sales will have 2 possible outcomes: Outcome 1 It will generate net annual cash flow of \\( \\$ 200 \\mathrm{MM} \\) per year for 15 years with a probability of \70 Outcome 2 It will generate net annual cash flow of \\( \\$ 100 \\mathrm{MM} \\) per year for 15 years with a probability of \30 The cost of capital for Thomson Ltd is \10. Q 22 What is the probability of Thomson Itd in reaching the stage where the company is successfully generate net annual cash flow of \\( \\$ 200 \\mathrm{MM} \\) ? a.) \quad48.2 d.) \quadmathbf24.7 b.) \50.7 e.) \22.5 \52.5 Q 23) What is the total NPV generated at end of Year 2 if the test market is successful ? a.) \\( \\$ 950 \\mathrm{MM} \\) b.) \\( \\$ 970 \\mathrm{MM} \\) c.) \\( \\$ 990 \\mathrm{MM} \\) d.) \\( \\$ 1,000 \\mathrm{MM} \\) e. \\( \\$ 1,100 \\mathrm{MM} \\) Q 24) What is the total \\( N P V_{0} \\) generated for the entire project? a.) \\( \\$ 135 \\mathrm{MM} \\) b.) \\( \\$ 128 \\mathrm{MM} \\) d.) \\( \\$ 147 \\mathrm{MM} \\) e.) \\( \\$ 153 \\mathrm{MM} \\) \\( \\$ 176 \\mathrm{MM} \\)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts