Question: Please Answer Question 2,3 and 4 2. A Fortune 500 company is tracking revenues versus cash flow for recent years, and the data is shown

Please Answer Question 2,3 and 4

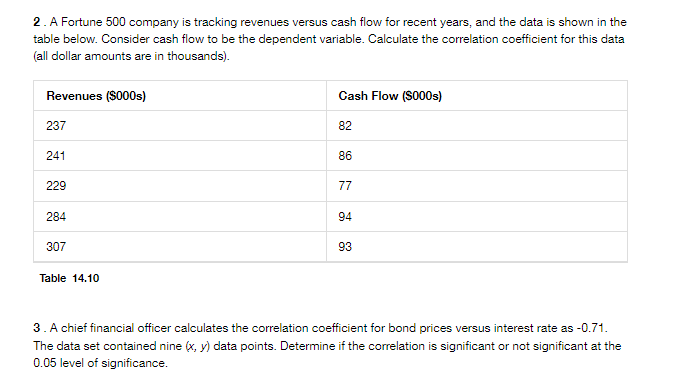

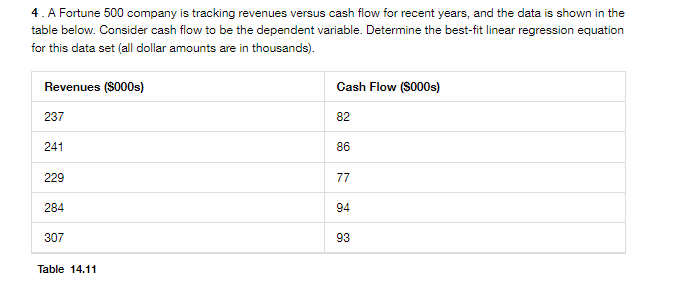

2. A Fortune 500 company is tracking revenues versus cash flow for recent years, and the data is shown in the table below. Consider cash flow to be the dependent variable. Calculate the correlation coefficient for this data (all dollar amounts are in thousands). Table 14.10 3. A chief financial officer calculates the correlation coefficient for bond prices versus interest rate as -0.71 . The data set contained nine (x,y) data points. Determine if the correlation is significant or not significant at the 0.05 level of significance. 4. A Fortune 500 company is tracking revenues versus cash flow for recent years, and the data is shown in the table below. Consider cash flow to be the dependent variable. Determine the best-fit linear regression equation for this data set (all dollar amounts are in thousands). Table 14.11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts