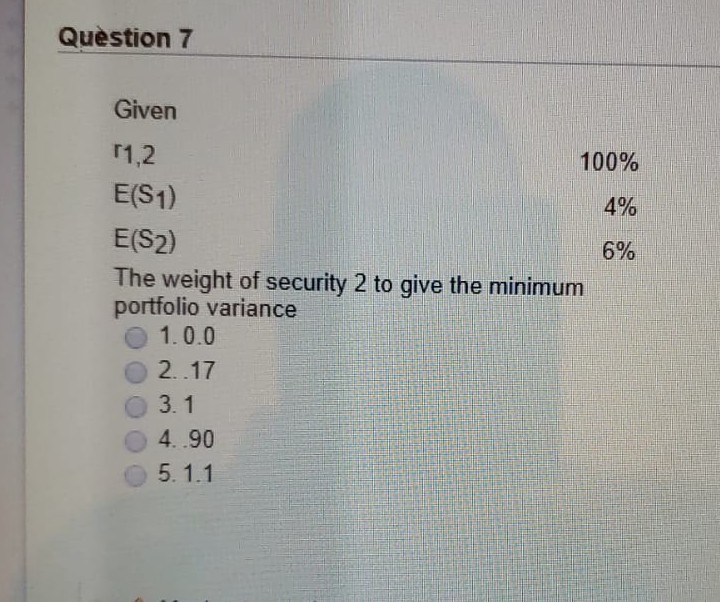

Question: please answer question 7 Question 7 Given 4% 11,2 100% E(S1) E(S2) 6% The weight of security 2 to give the minimum portfolio variance 1.0.0

please answer question 7

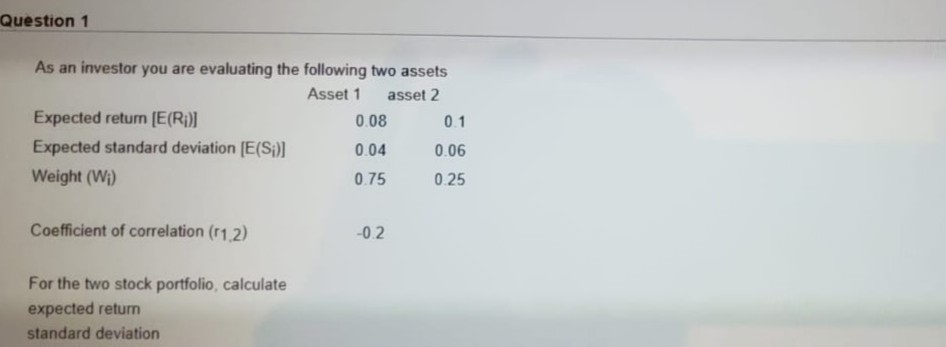

Question 7 Given 4% 11,2 100% E(S1) E(S2) 6% The weight of security 2 to give the minimum portfolio variance 1.0.0 2.17 0 3.1 4.90 5.1.1 Question 1 As an investor you are evaluating the following two assets Asset 1 asset 2 Expected return (E(R)] 0.08 0.1 Expected standard deviation (E(S)] 0.04 0.06 Weight (W) 0.75 0.25 Coefficient of correlation (11.2) -0.2 For the two stock portfolio, calculate expected return standard deviation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock