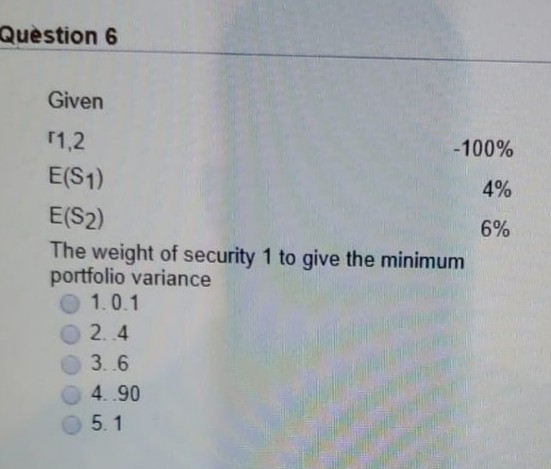

Question: please answer question 6 Question 6 Given r1,2 -100% E(S1) 4% E(S2) 6% The weight of security 1 to give the minimum portfolio variance 1.0.1

please answer question 6

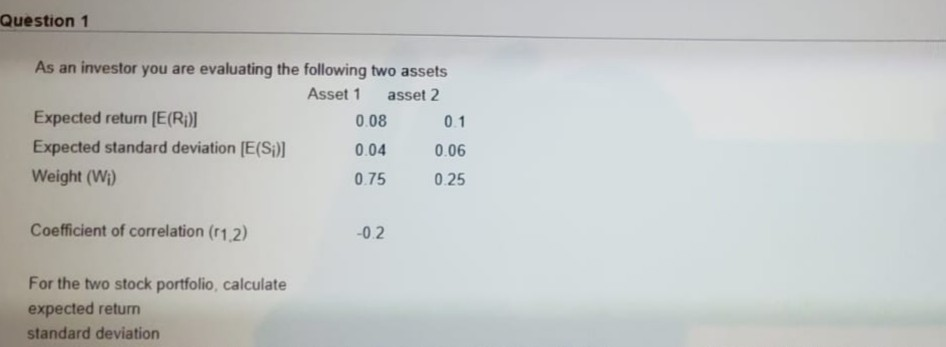

Question 6 Given r1,2 -100% E(S1) 4% E(S2) 6% The weight of security 1 to give the minimum portfolio variance 1.0.1 2 4 3. 6 4..90 5.1 Question 1 As an investor you are evaluating the following two assets Asset 1 asset 2 Expected return (E(Ri) 0.08 0.1 Expected standard deviation [E(Si)] 0.04 0.06 Weight (Wi 0.75 0.25 Coefficient of correlation (r1 2) -0.2 For the two stock portfolio, calculate expected return standard deviation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock