Question: please answer question B According to the Front Page, FRONT PAGE Joe Camel Acquires Newport In a widely anticipoted movo, Reynolds American, producer of best-selling

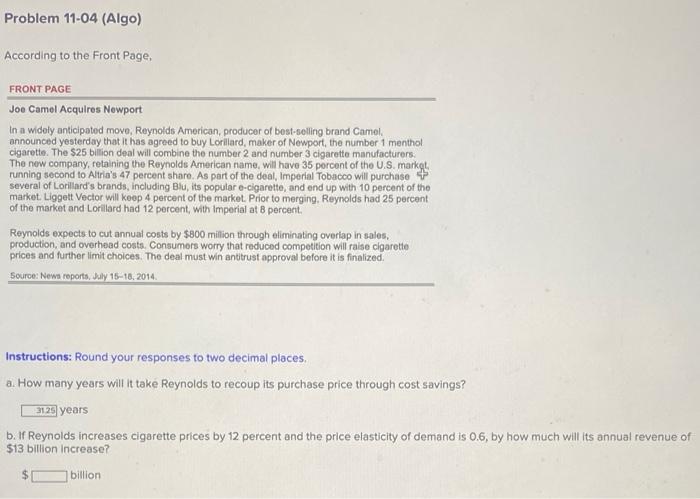

According to the Front Page, FRONT PAGE Joe Camel Acquires Newport In a widely anticipoted movo, Reynolds American, producer of best-selling brand Camel, announced yesterday that it has agreed to buy Lorilard, maker of Newport, the number 1 menthol cigarette. The $25 biltion deal will combine the number 2 and number 3 cigarette manufacturers. The new company, retaining the Reynolds American name, will have 35 porcent of the U.S. market, running second to Aliria's 47 percent share. As part of the deal, Imperial Tobscco will purchaso \&s several of Lorillard's brands, including Blu, its popular e-cigarette, and end up with 10 percent of the market. Liggett Vector will keop 4 percent of the market. Prior to merging. Reynolds had 25 percent of the market and Lorillard had 12 percent, With Imperial at B percent. Reynolds expects to cut annual costs by $800 milfion through eliminating overiap in sales, production, and overhead costs. Consumers worry that reduced competition will raise cigarette prices and further limit choices. The deal must win antitrust approval before it is finalized. Sources Newa reports, Jaly 15-18, 2014. Instructions: Round your responses to two decimal places. a. How many years will it take Reynolds to recoup its purchase price through cost savings? years b. If Reynolds increases cigarette prices by 12 percent and the price elasticity of demand is 0.6, by how much will its annual revenue of 513 billion increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts