Question: PLEASE ANSWER QUESTION PARTS A ,B , C, D, E, AND F PLEASE LABEL EACH ANSWER !! SHOW ALL WORK!!! #4. Conner Corporation reported revenues

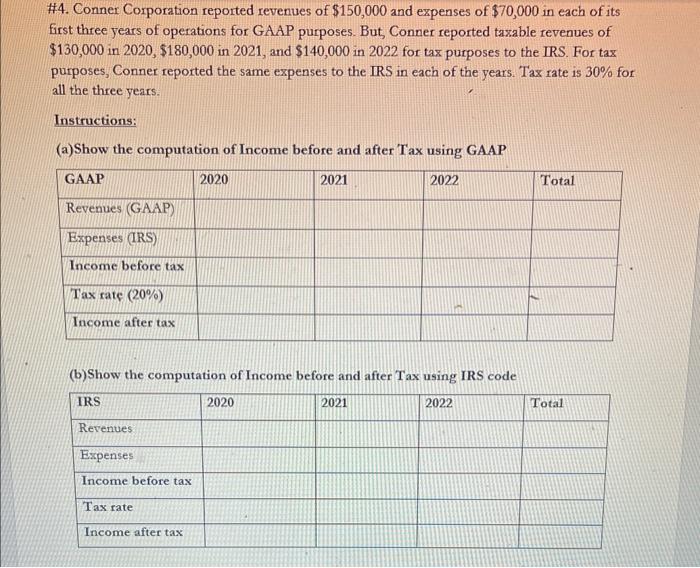

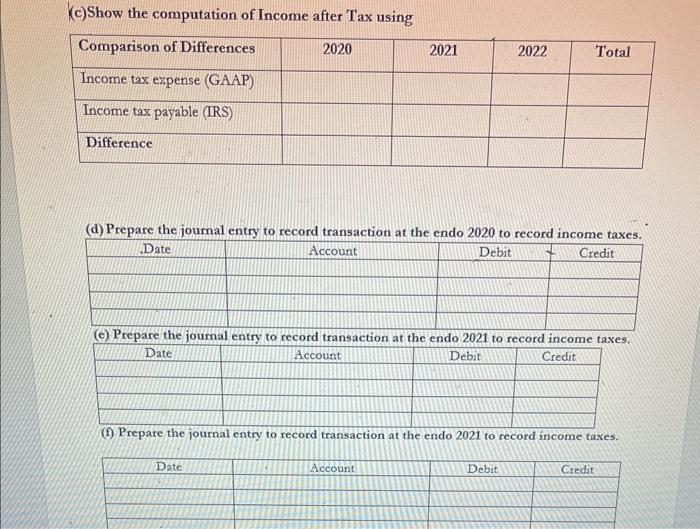

\#4. Conner Corporation reported revenues of $150,000 and expenses of $70,000 in each of its first three years of operations for GAAP purposes. But, Conner reported taxable revenues of $130,000 in 2020,$180,000 in 2021 , and $140,000 in 2022 for tax purposes to the IRS. For tax purposes, Conner reported the same expenses to the IRS in each of the years. Tax rate is 30% for all the three years. Instructions: (a)Show the computation of Income before and after Tax using GAAP (b) Show the computation of Income before and after Tax using IRS code (c)Show the computation of Income after Tax using (d) Prepare the journal entry to record transaction at the endo 2020 to record income taxes. (e) rrepare the journal entry to record transaction at the endo 2021 to record income taxes. (f) Prepare the journal entry to record transaction at the endo 2021 to record income taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts