Question: Please answer questions 12-15 using the data provided. Please write the answers as clearly as possible. QUESTION 12 Data for Questions 12 through 15 In

Please answer questions 12-15 using the data provided. Please write the answers as clearly as possible.

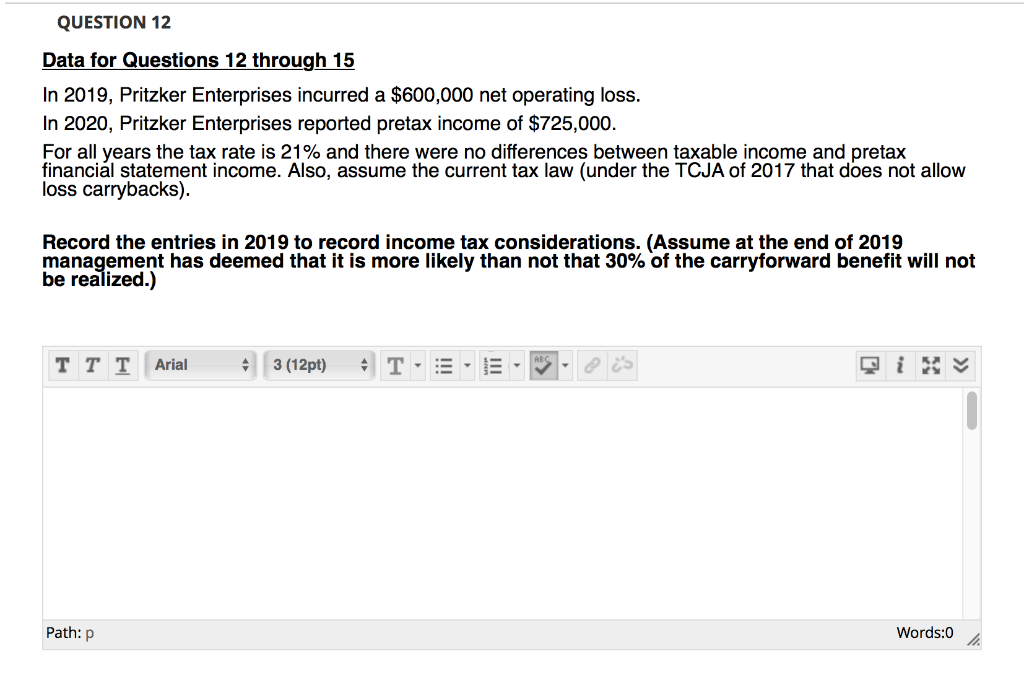

QUESTION 12 Data for Questions 12 through 15 In 2019, Pritzker Enterprises incurred a $600,000 net operating loss. In 2020, Pritzker Enterprises reported pretax income of $725,000. For all years the tax rate is 21% and there were no differences between taxable income and pretax financial statement income. Also, assume the current tax law (under the TCJA of 2017 that does not allow loss carrybacks). Record the entries in 2019 to record income tax considerations. (Assume at the end of 2019 management has deemed that it is more likely than not that 30% of the carryforward benefit will not be realized.) TTT Arial 3 (12pt) T- : - E - S oos Path:p Words:0 QUESTION 13 What is the net tax expense/benefit that Pritzker should report on the 2019 income statement? QUESTION 14 Record the entries in 2020 to reflect all income tax considerations. TT T Arial 3 (12pt) T- - E - S O 's Path: p Words:0 QUESTION 15 What is the net tax expense/benefit that Pritzker should report on the 2020 income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts