Question: Please answer questions 19-21 using the data provided. Please write the answers as clearly as possible. QUESTION 19 Data for Questions 19 through 21 Fauci

Please answer questions 19-21 using the data provided. Please write the answers as clearly as possible.

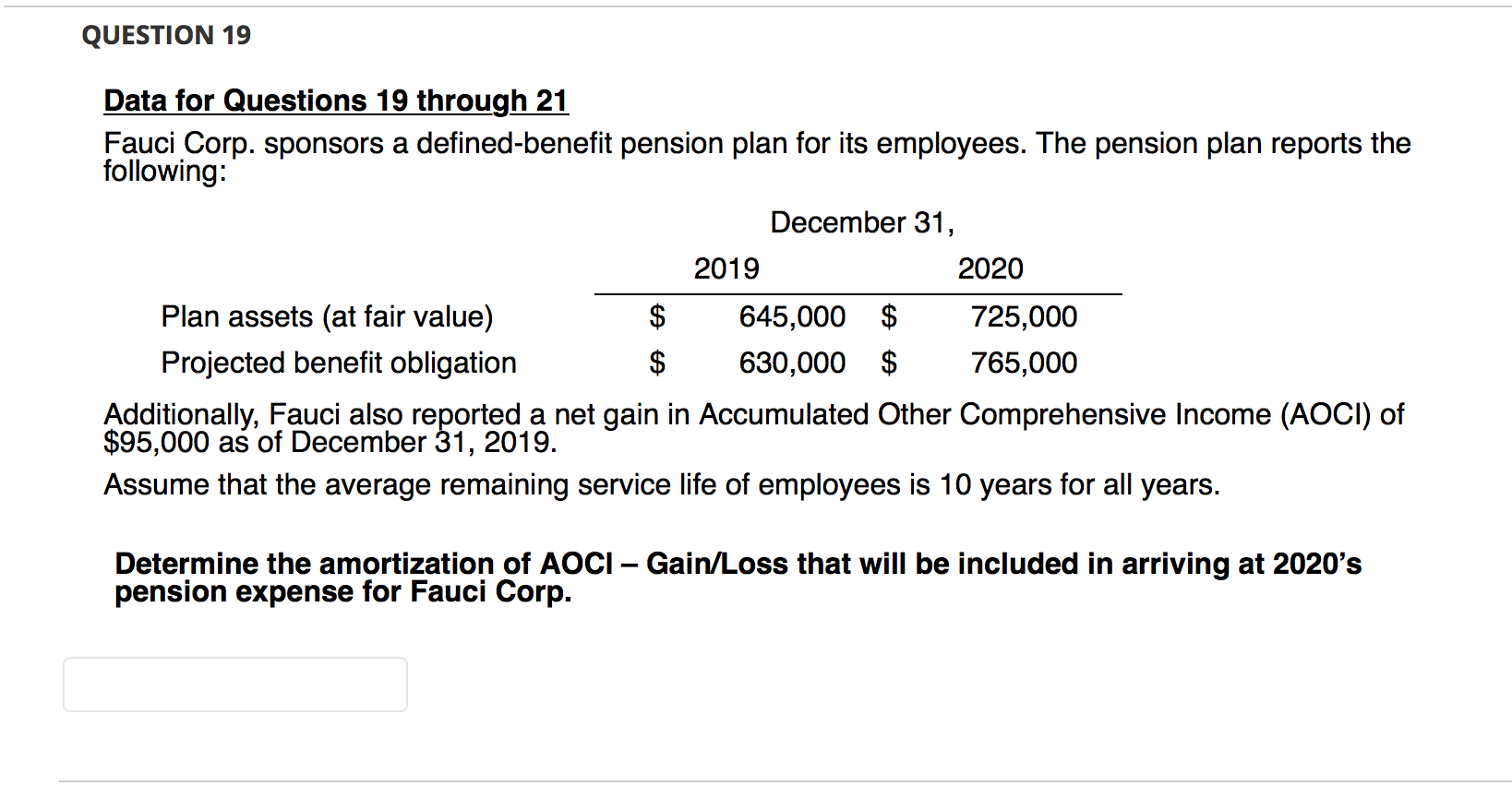

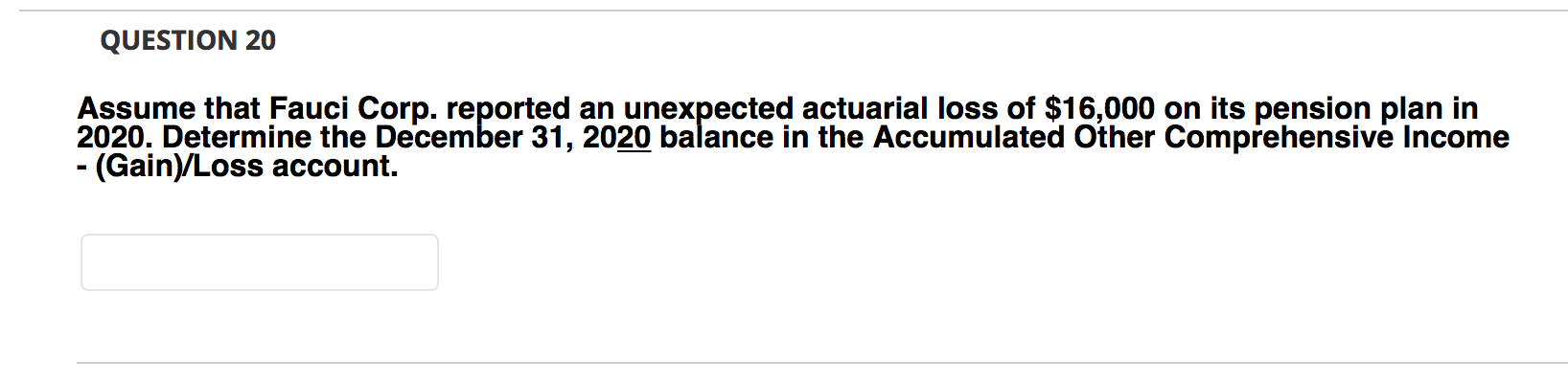

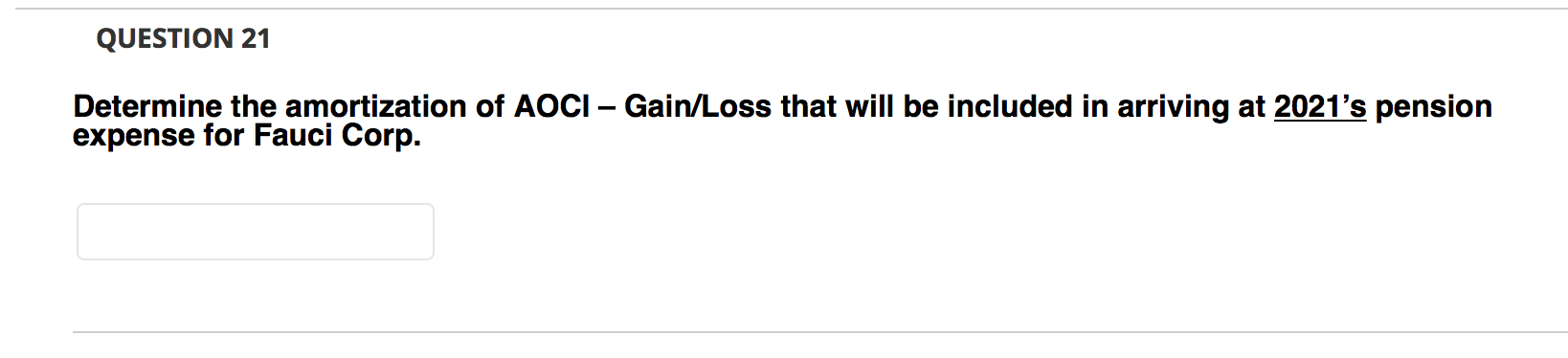

QUESTION 19 Data for Questions 19 through 21 Fauci Corp. sponsors a defined-benefit pension plan for its employees. The pension plan reports the following: December 31, 2019 2020 Plan assets (at fair value) $ 645,000 $ 725,000 Projected benefit obligation 630,000 $ 765,000 Additionally, Fauci also reported a net gain in Accumulated Other Comprehensive Income (AOCI) of $95,000 as of December 31, 2019. Assume that the average remaining service life of employees is 10 years for all years. Determine the amortization of AOCI - Gain/Loss that will be included in arriving at 2020's pension expense for Fauci Corp. QUESTION 20 Assume that Fauci Corp. reported an unexpected actuarial loss of $16,000 on its pension plan in 2020. Determine the December 31, 2020 balance in the Accumulated Other Comprehensive Income - (Gain)/Loss account. QUESTION 21 Determine the amortization of AOCI Gain/Loss that will be included in arriving at 2021's pension expense for Fauci Corp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts