Question: Please answer questions 1-5 using the data provided. Please write the answers as clearly as possible. QUESTION 1 Data for Questions 1 through 5 The

Please answer questions 1-5 using the data provided. Please write the answers as clearly as possible.

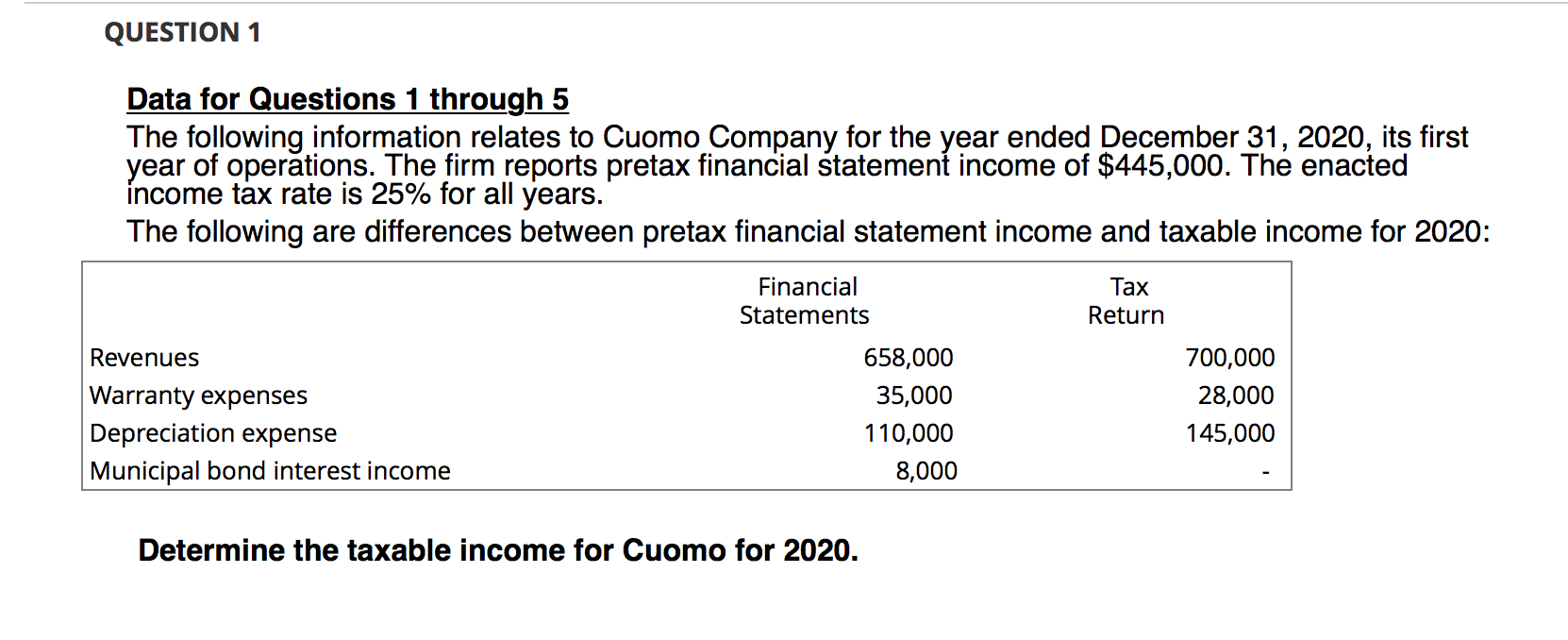

QUESTION 1 Data for Questions 1 through 5 The following information relates to Cuomo Company for the year ended December 31, 2020, its first year of operations. The firm reports pretax financial statement income of $445,000. The enacted income tax rate is 25% for all years. The following are differences between pretax financial statement income and taxable income for 2020: Financial Statements Tax Return Revenues Warranty expenses Depreciation expense Municipal bond interest income 658,000 35,000 110,000 8,000 700,000 28,000 145,000 Determine the taxable income for Cuomo for 2020. QUESTION 2 Prepare the journal entry to record income tax expense, deferred taxes, and the income taxes payable for 2020. TTT Arial 3 (12pt) A T - 3 - E - S oc's Path:p Words:0 QUESTION 3 Determine the effective tax rate for Cuomo in 2020. QUESTION 4 Why is the effective rate different from the statutory, enacted rate of 25%? TT T Arial 3 (12pt) A T-5 - E - S O 's Path:p Words:0 QUESTION 5 How much net income will Cuomo report for 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts