Question: Please answer Questions 2 and 4 Question 2 10 pts You were hired as a consultant to Louisiana Blue Ocean Company, whose target capital structure

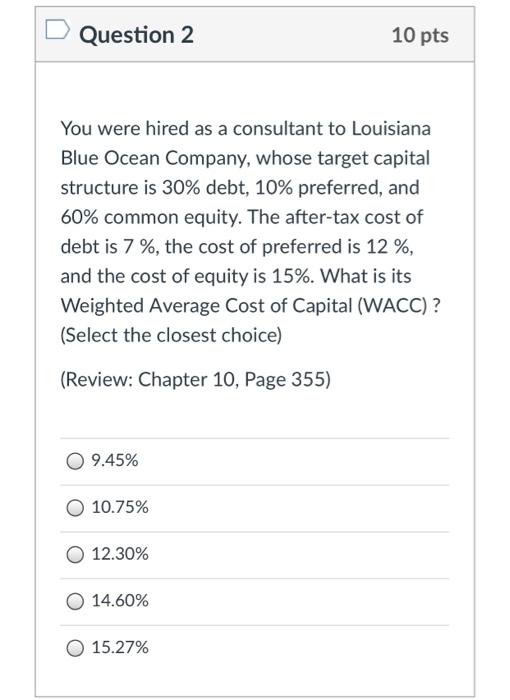

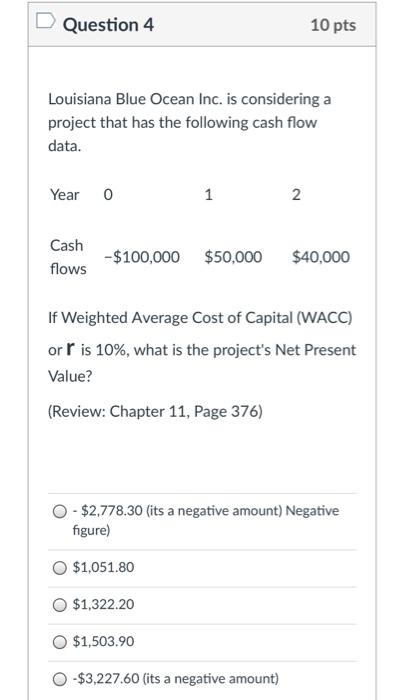

Question 2 10 pts You were hired as a consultant to Louisiana Blue Ocean Company, whose target capital structure is 30% debt, 10% preferred, and 60% common equity. The after-tax cost of debt is 7%, the cost of preferred is 12 %, and the cost of equity is 15%. What is its Weighted Average Cost of Capital (WACC)? (Select the closest choice) (Review: Chapter 10, Page 355) 9.45% 10.75% 12.30% 14.60% 15.27% Question 4 10 pts Louisiana Blue Ocean Inc. is considering a project that has the following cash flow data. Year 0 1 2 Cash flows -$100,000 $50,000 $40,000 If Weighted Average Cost of Capital (WACC) or r is 10%, what is the project's Net Present Value? (Review: Chapter 11, Page 376) - $2,778.30 (its a negative amount) Negative figure) $1,051.80 $1,322.20 $1,503.90 0-$3,227.60 (its a negative amount)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts