Question: Please show step by step for calculations. Question 20 4 pts You were hired as a consultant to ABC Company, whose target capital structure is

Please show step by step for calculations.

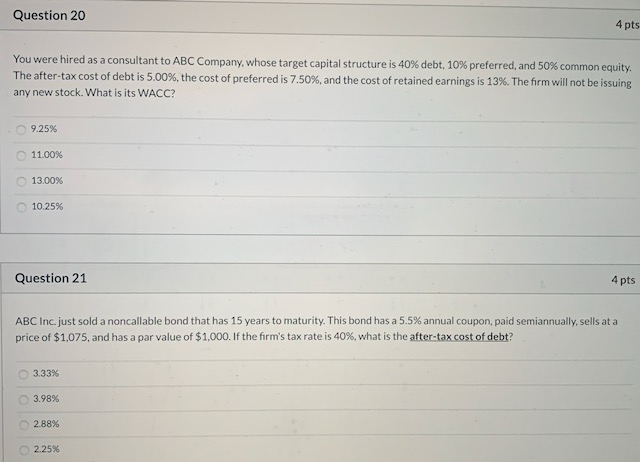

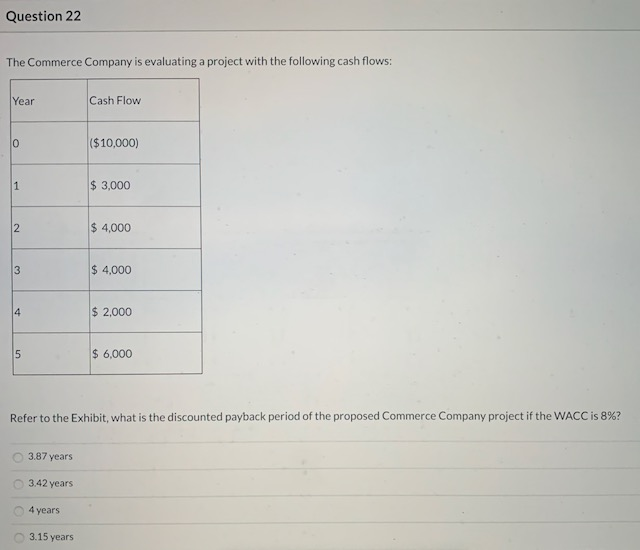

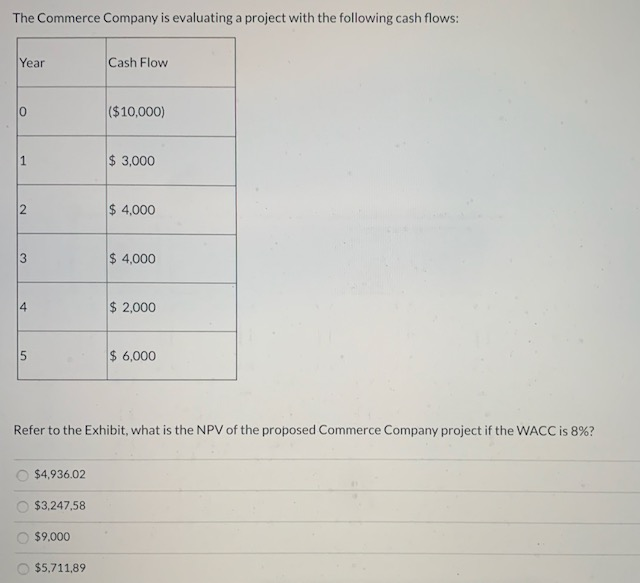

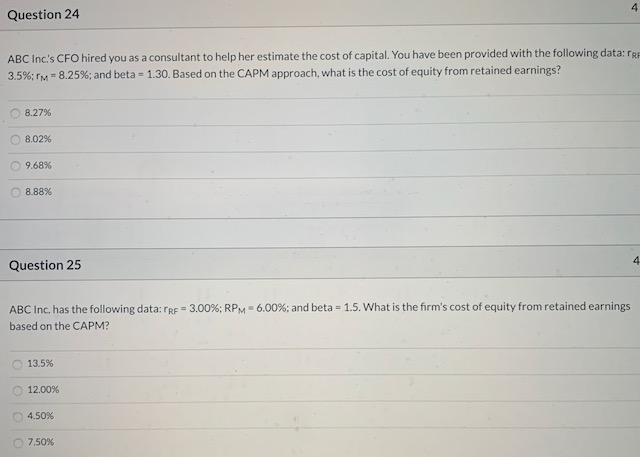

Question 20 4 pts You were hired as a consultant to ABC Company, whose target capital structure is 40% debt, 10% preferred, and 50% common equity. The after-tax cost of debt is 5.00%, the cost of preferred is 7.50%, and the cost of retained earnings is 13%. The firm will not be issuing any new stock. What is its WACC? 9.25% 11.00% 13.00% 10.25% Question 21 4 pts ABC Inc, just sold a noncallable bond that has 15 years to maturity. This bond has a 5.5% annual coupon, paid semiannually sells at a price of $1,075, and has a par value of $1,000. If the firm's tax rate is 40%, what is the after-tax cost of debt? 3.33% 3.98% 2.88% 2.25% Question 22 The Commerce Company is evaluating a project with the following cash flows: Year Cash Flow ($10,000) $ 3,000 $ 4,000 $ 4,000 $ 2,000 $ 6,000 Refer to the Exhibit, what is the discounted payback period of the proposed Commerce Company project if the WACC is 8%? 3.87 years 3.42 years 4 years 3.15 years The Commerce Company is evaluating a project with the following cash flows: Year Cash Flow ($10,000) $ 3,000 $ 4,000 $ 4,000 $ 2,000 $ 6,000 Refer to the Exhibit, what is the NPV of the proposed Commerce Company project if the WACC is 8%? $4,936.02 $3,247,58 $9.000 $5,711,89 Question 24 ABC Inc's CFO hired you as a consultant to help her estimate the cost of capital. You have been provided with the following data: 3.5%; M = 8.25%; and beta = 1.30. Based on the CAPM approach, what is the cost of equity from retained earnings? 8.27% 8.02% 9.68% 8.88% Question 25 ABC Inc. has the following data:rre - 3.00%; RPM - 6.00%; and beta - 1.5. What is the firm's cost of equity from retained earnings based on the CAPM? 13.5% 12.00% 4.50% 7.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts