Question: Please answer questions 28 & 29 and show your work. Thank you Given the summarized financial information below, calculate the Net Operating Profit After Taxes

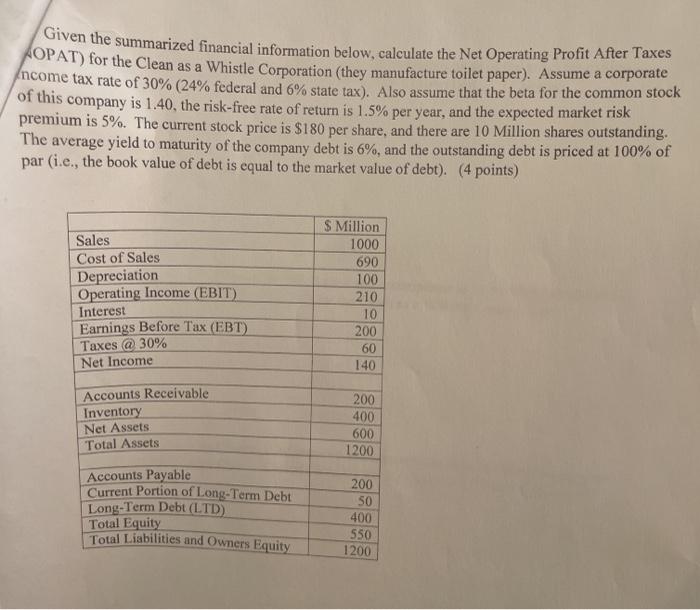

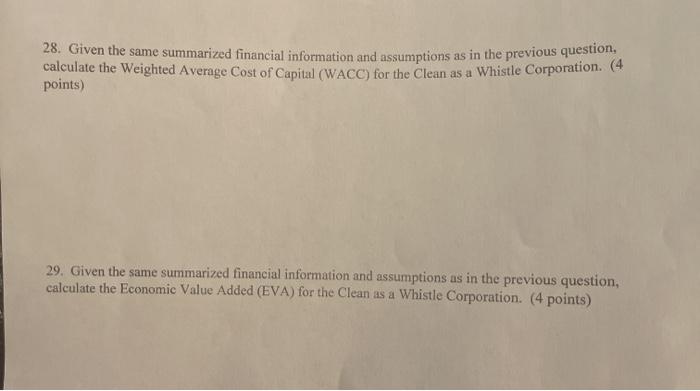

Given the summarized financial information below, calculate the Net Operating Profit After Taxes AOPAT) for the Clean as a Whistle Corporation (they manufacture toilet paper). Assume a corporate {ncome tax rate of 30% (24% federal and 6% state tax). Also assume that the beta for the common stock of this company is 1.40, the risk-free rate of return is 1.5% per year, and the expected market risk premium is 5%. The current stock price is $180 per share, and there are 10 Million shares outstanding. The average yield to maturity of the company debt is 6%, and the outstanding debt is priced at 100% of par (i.e., the book value of debt is equal to the market value of debt). (4 points) Sales Cost of Sales Depreciation Operating Income (EBIT) Interest Earnings Before Tax (EBT) Taxes @ 30% Net Income $ Million 1000 690 100 210 10 200 60 140 Accounts Receivable Inventory Net Assets Total Assets 200 400 600 1200 Accounts Payable Current Portion of Long-Term Debt Long-Term Debt (LTD) Total Equity Total Liabilities and Owners Equity 200 SO 400 550 1200 28. Given the same summarized financial information and assumptions as in the previous question, calculate the Weighted Average Cost of Capital (WACC) for the Clean as a Whistle Corporation. (4 points) 29. Given the same summarized financial information and assumptions as in the previous question, calculate the Economic Value Added (EVA) for the Clean as a Whistle Corporation. (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts