Question: Please answer questions in the Excel sheet format below. All calculations have to include cell references and formulas to be condsidered for full credit. You

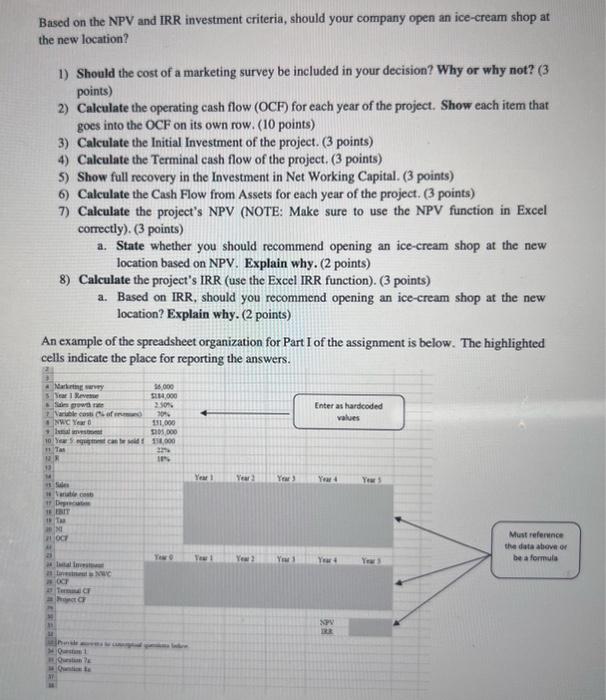

You are working part-time at a local ice-cream shop that operates in multiple locations in the Philadelphia area. The management is considering opening an ice-cream store in a new location, and they asked you to help out with the capital budgeting analysis. Three months ago, the company spent $6,000 on a marketing survey to learn whether opening an ice-cream shop at the selected location is viable. If the new shop opens, the management estimates the incremental revenue in Year 1 at $184,000, and the sales are forecasted to grow at a rate of 2.50% per year. The incremental variable costs are expected to be 70% of incremental revenues. The net working capital in Year 0 is expected to be $31,000 with a full recovery at the end of the project. This project requires an immediate investment of $105,000 in equipment. The equipment is to be depreciated over 10 years on a straight-line basis to zero value. After five years, the management plans to close the shop at this location and seek regional alternatives. At the end of this project, the equipment will be sold for $58,000. The tax rate is 22%, and the required rate of return is 18%. Based on the NPV and IRR investment criteria, should your company open an ice-cream shop at the new location? 1) Should the cost of a marketing survey be included in your decision? Why or why not? (3 points) 2) Calculate the operating cash flow (OCF) for each year of the project. Show each item that goes into the OCF on its own row. ( 10 points) 3) Calculate the Initial Investment of the project. (3 points) 4) Calculate the Terminal cash flow of the project. (3 points) 5) Show full recovery in the Investment in Net Working Capital. (3 points) 6) Calculate the Cash Flow from Assets for each year of the project. (3 points) 7) Calculate the project's NPV (NOTE: Make sure to use the NPV function in Excel correctly). ( 3 points) a. State whether you should recommend opening an ice-cream shop at the new location based on NPV. Explain why. (2 points) 8) Calculate the project's IRR (use the Excel IRR function). (3 points) a. Based on IRR, should you recommend opening an ice-cream shop at the new location? Explain why. ( 2 points) An example of the spreadsheet organization for Part I of the assignment is below. The highlighted cells indicate the place for reporting the answers. You are working part-time at a local ice-cream shop that operates in multiple locations in the Philadelphia area. The management is considering opening an ice-cream store in a new location, and they asked you to help out with the capital budgeting analysis. Three months ago, the company spent $6,000 on a marketing survey to learn whether opening an ice-cream shop at the selected location is viable. If the new shop opens, the management estimates the incremental revenue in Year 1 at $184,000, and the sales are forecasted to grow at a rate of 2.50% per year. The incremental variable costs are expected to be 70% of incremental revenues. The net working capital in Year 0 is expected to be $31,000 with a full recovery at the end of the project. This project requires an immediate investment of $105,000 in equipment. The equipment is to be depreciated over 10 years on a straight-line basis to zero value. After five years, the management plans to close the shop at this location and seek regional alternatives. At the end of this project, the equipment will be sold for $58,000. The tax rate is 22%, and the required rate of return is 18%. Based on the NPV and IRR investment criteria, should your company open an ice-cream shop at the new location? 1) Should the cost of a marketing survey be included in your decision? Why or why not? (3 points) 2) Calculate the operating cash flow (OCF) for each year of the project. Show each item that goes into the OCF on its own row. ( 10 points) 3) Calculate the Initial Investment of the project. (3 points) 4) Calculate the Terminal cash flow of the project. (3 points) 5) Show full recovery in the Investment in Net Working Capital. (3 points) 6) Calculate the Cash Flow from Assets for each year of the project. (3 points) 7) Calculate the project's NPV (NOTE: Make sure to use the NPV function in Excel correctly). ( 3 points) a. State whether you should recommend opening an ice-cream shop at the new location based on NPV. Explain why. (2 points) 8) Calculate the project's IRR (use the Excel IRR function). (3 points) a. Based on IRR, should you recommend opening an ice-cream shop at the new location? Explain why. ( 2 points) An example of the spreadsheet organization for Part I of the assignment is below. The highlighted cells indicate the place for reporting the answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts