Question: please answer soon and read questions carefully please I will give thumbs up. Suppose you are the money manager of a 58 million investment fund.

please answer soon and read questions carefully please I will give thumbs up.

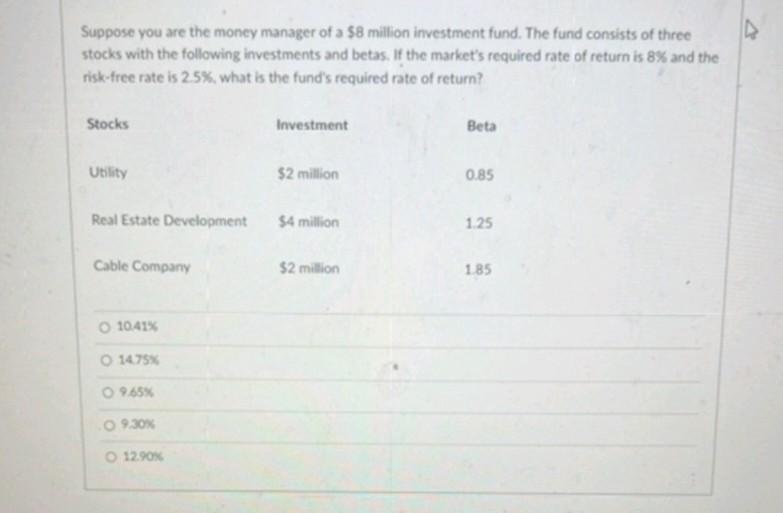

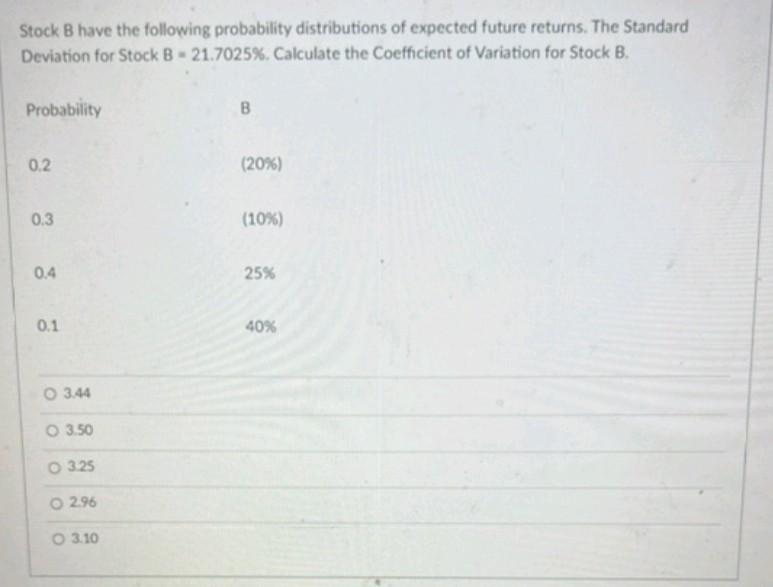

Suppose you are the money manager of a 58 million investment fund. The fund consists of three stocks with the following investments and betas. If the market's required rate of return is 8% and the risk-free rate is 2.5% what is the fund's required rate of return? Stocks Investment Beta Utility $2 million 0.85 Real Estate Development $4 million 1.25 Cable Company $2 million 185 10.41% 1475 9,65% 930% 12.90 Stock B have the following probability distributions of expected future returns. The Standard Deviation for Stock B - 21.7025%. Calculate the Coefficient of Variation for Stock B. Probability B 0.2 (20%) 0.3 (10%) 0.4 25% 0.1 40% O 3.44 O 3.50 O 3.25 O 2.96 03.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts