Question: Please answer the 1-4 multiple choice questions: Textbook: Federal Income Taxation of Corporations and Shareholders, 7th Edition Course: Taxation of Reorganizations & Liquidations Multiple choice

Please answer the 1-4 multiple choice questions:

Textbook: Federal Income Taxation of Corporations and Shareholders, 7th Edition

Course: Taxation of Reorganizations & Liquidations

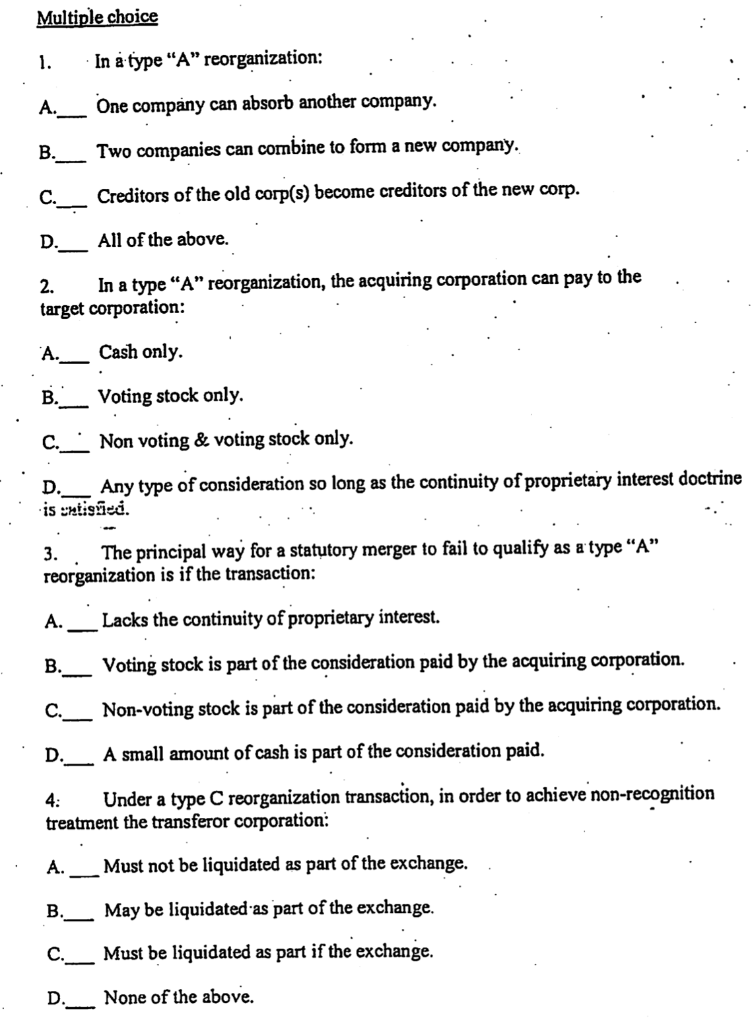

Multiple choice 1. In a type A reorganization: One company can absorb another company. __ Two companies can combine to form a new company. - Creditors of the old corp(s) become creditors of the new corp. D.__ All of the above. 2. In a type A reorganization, the acquiring corporation can pay to the target corporation: . . A._ Cash only. Voting stock only. c. __Non voting & voting stock only. D.__ Any type of consideration so long as the continuity of proprietary interest doctrine is ertiged. 3. The principal way for a statutory merger to fail to qualify as a type "A" reorganization is if the transaction: A. _ Lacks the continuity of proprietary interest. - Voting stock is part of the consideration paid by the acquiring corporation. _Non-voting stock is part of the consideration paid by the acquiring corporation. D._ A small amount of cash is part of the consideration paid. 4: Under a type C reorganization transaction, in order to achieve non-recognition treatment the transferor corporation: A. __ Must not be liquidated as part of the exchange B._ May be liquidated as part of the exchange. Must be liquidated as part of the exchange. D.__ None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts