Question: Please answer the # 28-30 multiple choice questions: Textbook: Federal Income Taxation of Corporations and Shareholders, 7th Edition Course: Taxation of Reorganizations & Liquidations 28.

Please answer the # 28-30 multiple choice questions:

Textbook: Federal Income Taxation of Corporations and Shareholders, 7th Edition

Course: Taxation of Reorganizations & Liquidations

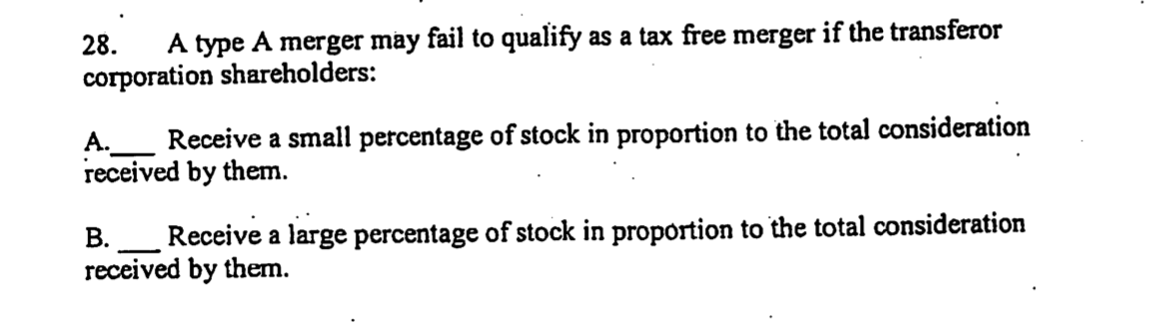

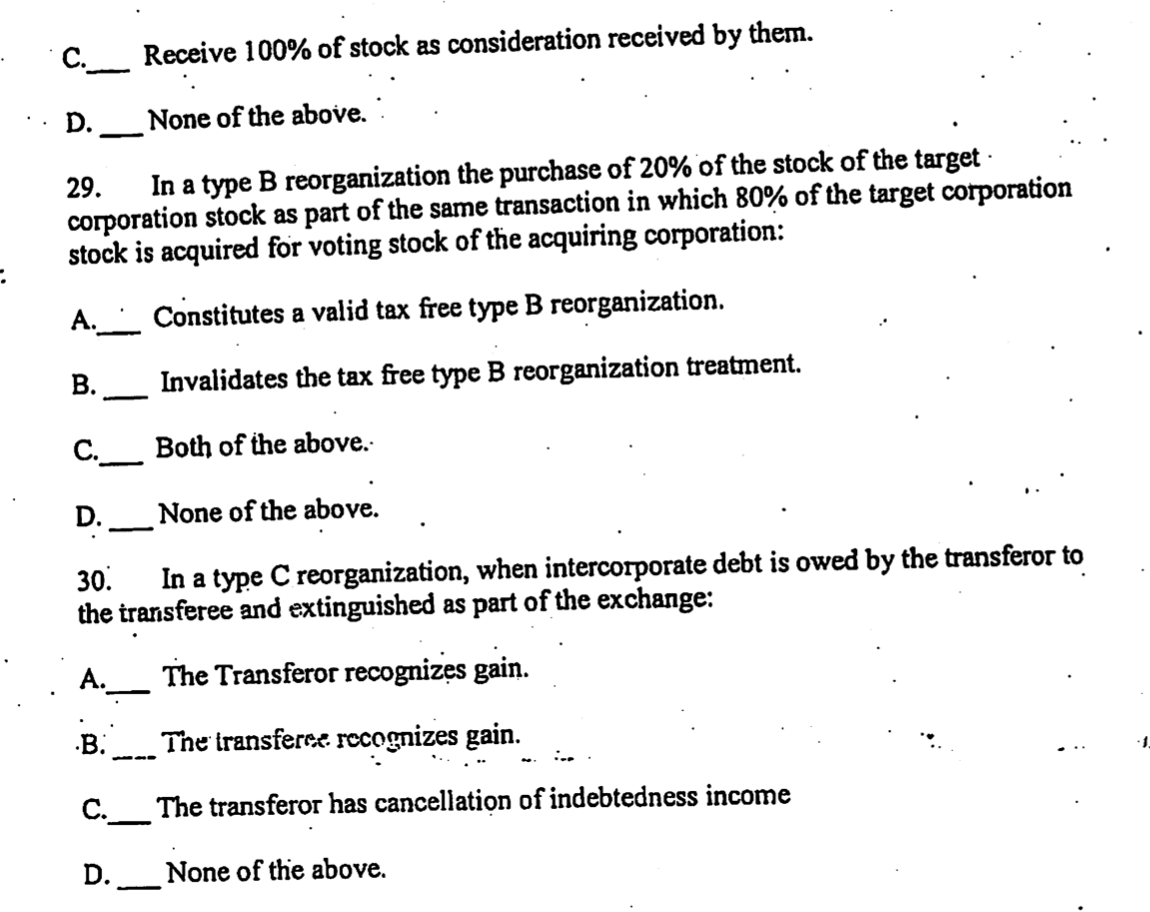

28. A type A merger may fail to qualify as a tax free merger if the transferor corporation shareholders: A. _ Receive a small percentage of stock in proportion to the total consideration received by them. B. _ Receive a large percentage of stock in proportion to the total consideration received by them. . C. Receive 100% of stock as consideration received by them. . D. _ None of the above. 29. In a type B reorganization the purchase of 20% of the stock of the target corporation stock as part of the same transaction in which 80% of the target corporation stock is acquired for voting stock of the acquiring corporation: A._ Constitutes a valid tax free type B reorganization. B. _ Invalidates the tax free type B reorganization treatment. C._ Both of the above. D. _ None of the above. 30. In a type C reorganization, when intercorporate debt is owed by the transferor to the transferee and extinguished as part of the exchange: A. _ The Transferor recognizes gain. B: _ The transferce recognizes gain. .. C. __ The transferor has cancellation of indebtedness income D. _ None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts