Question: please answer the 2 questions below: Question 15 (Mandatory) (2.5 points) True or false: The Black-Scholes Model assumes volatility remains constant. True False Question 16

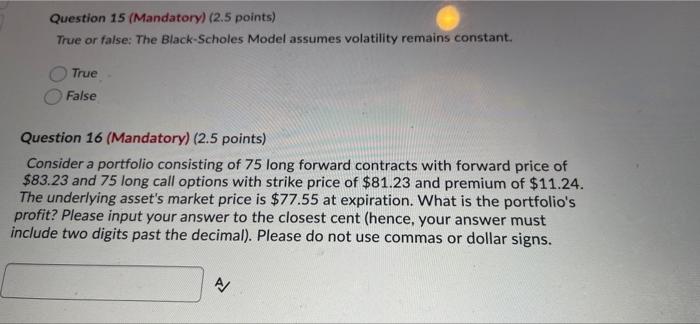

Question 15 (Mandatory) (2.5 points) True or false: The Black-Scholes Model assumes volatility remains constant. True False Question 16 (Mandatory) (2.5 points) Consider a portfolio consisting of 75 long forward contracts with forward price of $83.23 and 75 long call options with strike price of $81.23 and premium of $11.24. The underlying asset's market price is $77.55 at expiration. What is the portfolio's profit? Please input your answer to the closest cent (hence, your answer must include two digits past the decimal). Please do not use commas or dollar signs. A/

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts