Question: please answer the 2 questions below: Question 31 (Mandatory) (2.5 points) True or false: You've entered into a long position in a forward contract. The

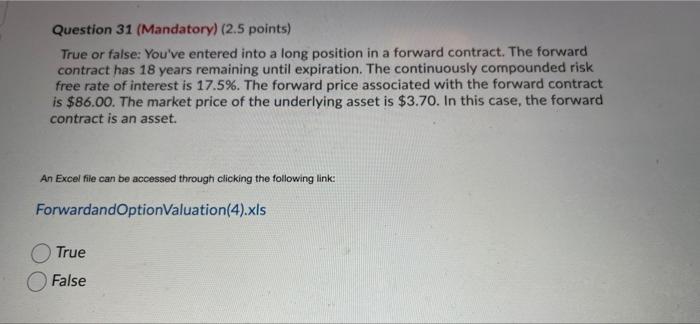

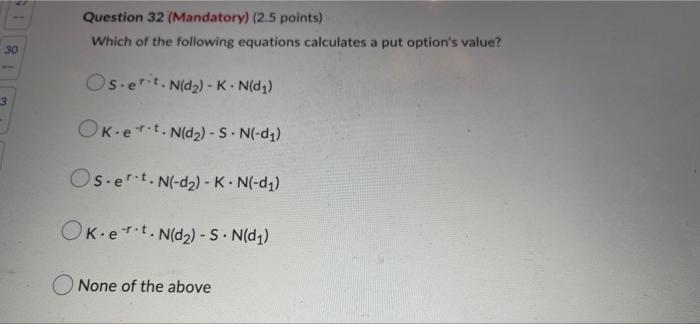

Question 31 (Mandatory) (2.5 points) True or false: You've entered into a long position in a forward contract. The forward contract has 18 years remaining until expiration. The continuously compounded risk free rate of interest is 17.5%. The forward price associated with the forward contract is $86.00. The market price of the underlying asset is $3.70. In this case, the forward contract is an asset. An Excel file can be accessed through clicking the following link: ForwardandOptionValuation(4).xls True False Question 32 (Mandatory) (2.5 points) Which of the following equations calculates a put option's value? 30 Os.erit. Nda) - K.N(dz) 3 OK.erit.N(dz) - S.N(-da) Oset. Nl-d2) - K. N(-dy) OK.e.t.N(D2) - S.N(da) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts