Question: please answer the 2 questions below: Question 27 (2.5 points) Consider the following short put option: Years to expiration - 4.21 Risk-free rate 1.54% Volatility

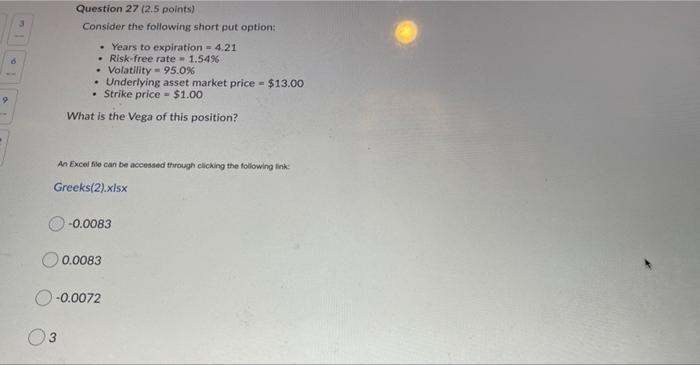

Question 27 (2.5 points) Consider the following short put option: Years to expiration - 4.21 Risk-free rate 1.54% Volatility - 95.0% Underlying asset market price - $13.00 Strike price - $1.00 What is the Vega of this position? 9 An Excel file can be accessed through clicking the following link Greeks(2).xlsx -0.0083 0.0083 -0.0072 3 Question 28 (Mandatory) (2.5 points) The strike price is determined at contract initiation and changes during the life of an option contract True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts