Question: Please, answer the below question with showing the entire steps very clearly. Company B sells a 10-year fixed rate bond at 8%. At the same

Please, answer the below question with showing the entire steps very clearly.

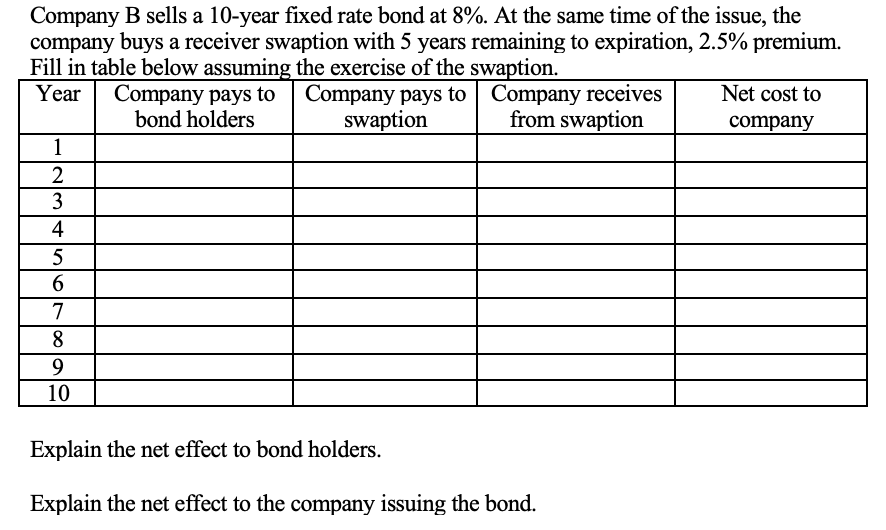

Company B sells a 10-year fixed rate bond at 8%. At the same time of the issue, the company buys a receiver swaption with 5 years remaining to expiration, 2.5% premium. Fill in table below assuming the exercise of the swaption Company receives from swaption Company pays to bond holders Company pays to swaption Net cost to Year company 1 2 3 4 5 6 7 10 Explain the net effect to bond holders. Explain the net effect to the company issuing the bond Company B sells a 10-year fixed rate bond at 8%. At the same time of the issue, the company buys a receiver swaption with 5 years remaining to expiration, 2.5% premium. Fill in table below assuming the exercise of the swaption Company receives from swaption Company pays to bond holders Company pays to swaption Net cost to Year company 1 2 3 4 5 6 7 10 Explain the net effect to bond holders. Explain the net effect to the company issuing the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts