Question: Please Answer the Bonus Question in Question 3 as well Thank you QUESTION 3 3 points Save Answer A bond has a face value of

Please Answer the Bonus Question in Question 3 as well

Thank you

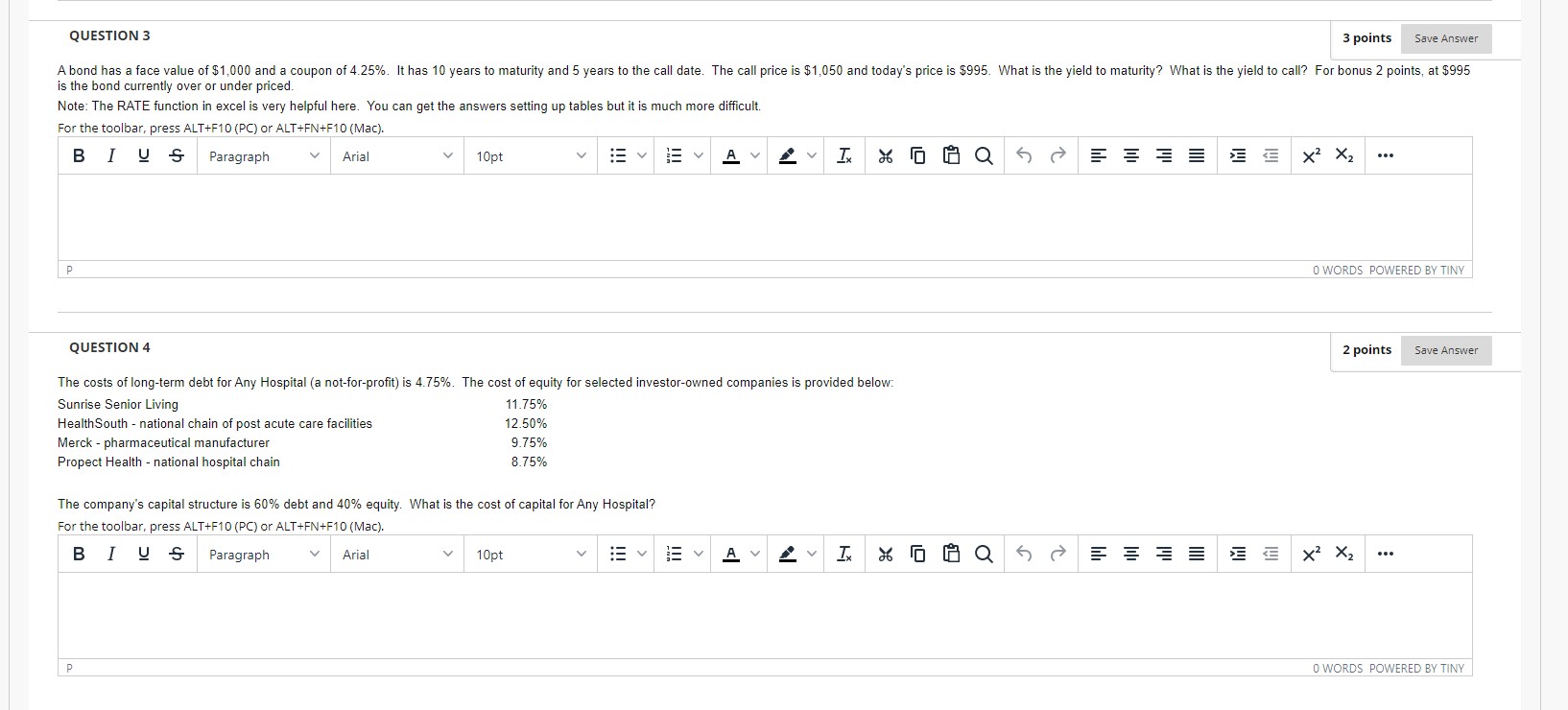

QUESTION 3 3 points Save Answer A bond has a face value of $1,000 and a coupon of 4.25%. It has 10 years to maturity and 5 years to the call date. The call price is $1,050 and today's price is $995. What is the yield to maturity? What is the yield to call? For bonus 2 points, at $995 is the bond currently over or under priced. Note: The RATE function in excel is very helpful here. You can get the answers setting up tables but it is much more difficult. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Arial 10pt Ev A v TX E X2 X2 ... P O WORDS POWERED BY TINY QUESTION 4 2 points Save Answer The costs of long-term debt for Any Hospital (a not-for-profit) is 4.75%. The cost of equity for selected investor-owned companies is provided below: Sunrise Senior Living 11.75% HealthSouth - national chain of post acute care facilities 12.50% Merck - pharmaceutical manufacturer 9.75% Propect Health - national hospital chain 8.75% The company's capital structure is 60% debt and 40% equity. What is the cost of capital for Any Hospital? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Arial 10pt iEv Ev Av SIX EE x2 X2 ... P 0 WORDS POWERED BY TINY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts